Money Worksheets Activities With Answers for 8-Year-Olds

1 filtered results

-

From - To

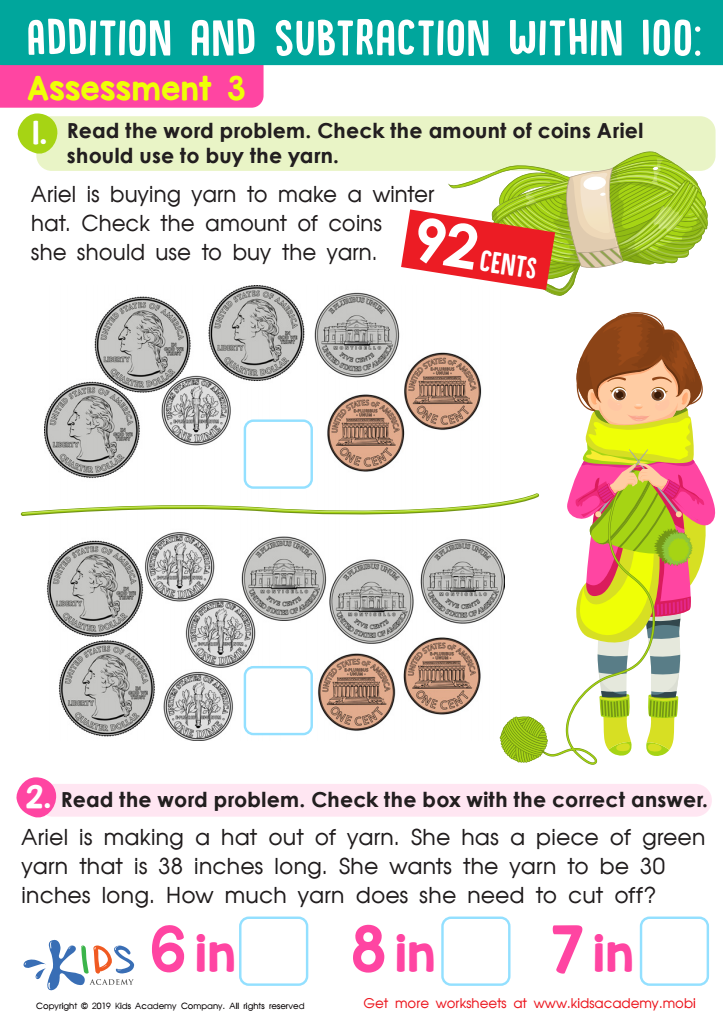

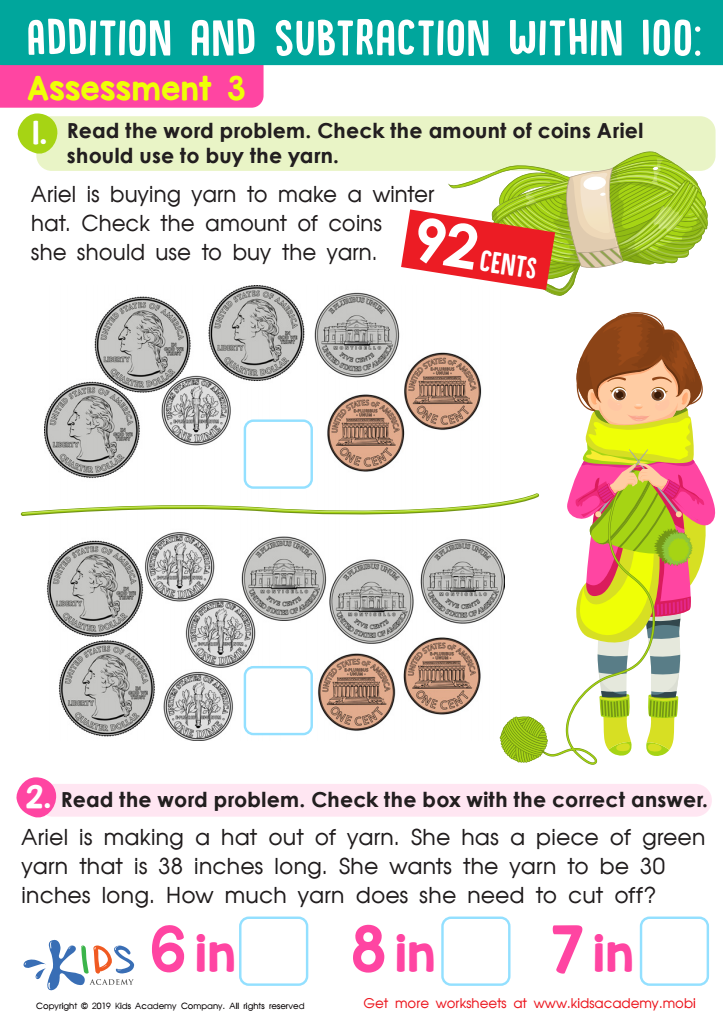

Assessment 3 Math Worksheet

Money Worksheets Activities with Answers are an indispensable resource for both educators and students aiming to master the essential skill of money management. These activities not only make the subject of financial literacy more accessible but also more engaging. By incorporating real-world applications, students can see the immediate relevance of what they're learning, making the lessons more memorable and the knowledge more durable.

Firstly, these worksheets serve as a practical approach to understanding the complexities of money. They cover a broad range of topics, from identifying coins and bills to advanced concepts like budgeting, saving, and investing. This wide spectrum ensures that learners of all ages and levels can find materials suited to their needs and progress at their own pace.

Moreover, Money Worksheets Activities with Answers provide immediate feedback, a crucial component in the learning process. This opportunity for self-assessment helps students identify areas of strength and those needing improvement without the pressure of a classroom setting. It fosters a growth mindset, encouraging learners to see mistakes as opportunities to learn rather than failures.

The inclusion of answers also facilitates independent learning. Students can engage with the material outside of classroom hours, allowing for extra practice that is self-directed and thus more personalized. This autonomy in learning not only reinforces the subject matter but also builds confidence and self-reliance, skills that are invaluable in financial decision-making.

In addition, these worksheets can help demystify the concept of money for young learners. By breaking down financial concepts into digestible, manageable exercises, children can develop a healthy relationship with money from an early age. They learn the value of money, the importance of saving, and the basics of budgeting, setting a solid foundation for future financial competence.

In summary, Money Worksheets Activities with Answers are a vital tool in the journey towards financial literacy. They provide a structured yet flexible approach to learning that is both informative and empowering, equipping learners with the knowledge and confidence to make sound financial decisions in the future.

Assign to My Students

Assign to My Students