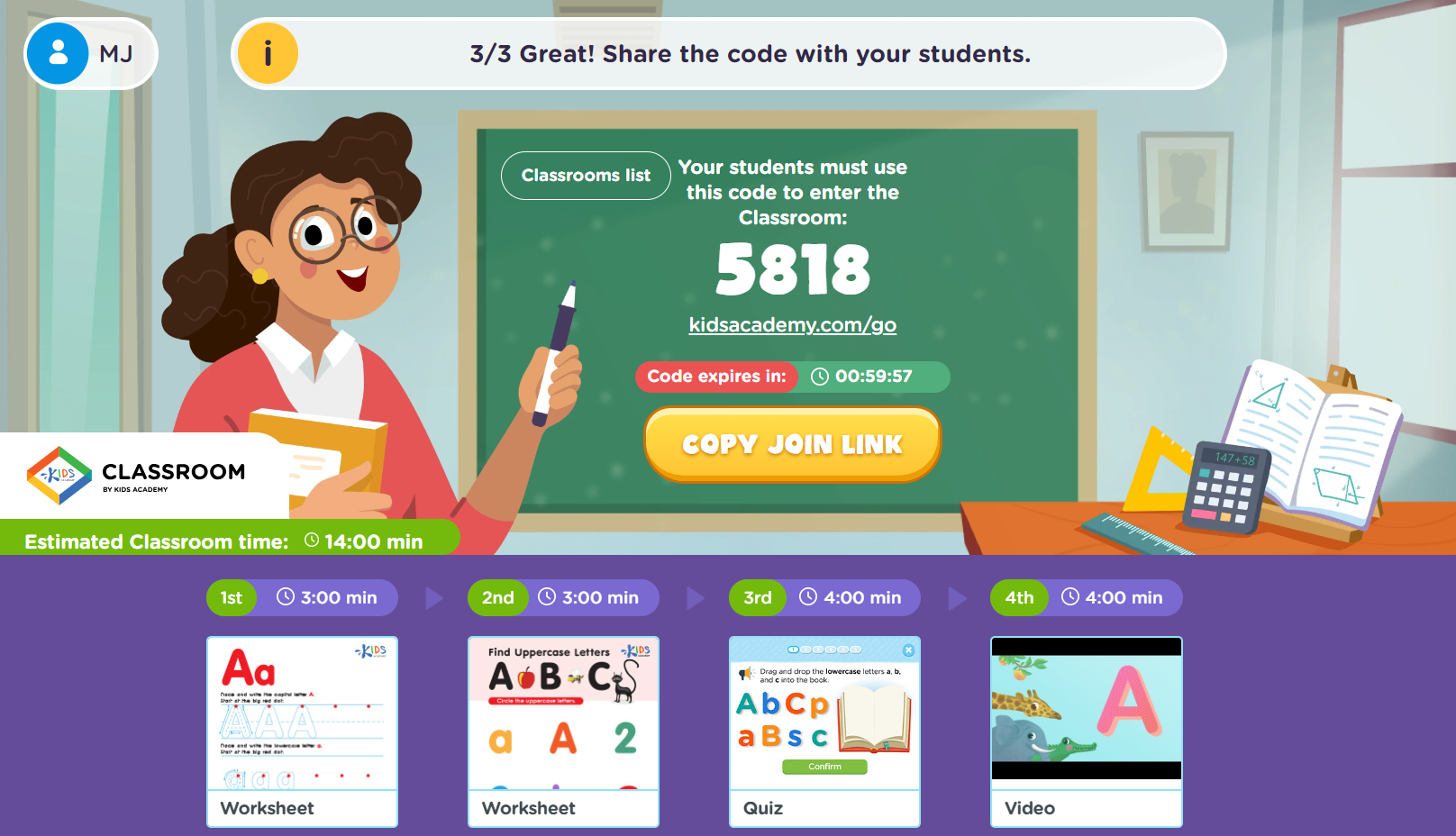

Understanding currency Grade 3 Math Worksheets

3 filtered results

-

From - To

Enhance your third grader's math skills with our "Understanding Currency" worksheets! These engaging and printable resources are designed to introduce young learners to the world of money. Through fun activities, your child will explore various denominations, learn to identify coins and bills, and practice basic addition and subtraction involving currency. Each worksheet encourages hands-on learning, promotes critical thinking, and builds confidence in financial literacy. Perfect for classroom use or home instruction, these worksheets make learning about currency enjoyable and accessible. Help your child develop essential math skills while fostering an understanding of money management with our high-quality worksheets!

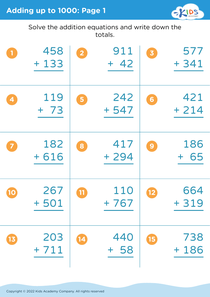

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

Understanding currency is a fundamental aspect of Grade 3 math that teachers and parents should prioritize for several reasons. Firstly, grasping the concept of money helps children develop essential mathematical skills, such as addition, subtraction, multiplication, and division. Students learn to count various denominations, which enhances their ability to perform basic arithmetic operations in real-life situations.

Furthermore, understanding currency equips children with critical life skills. As they navigate everyday tasks, such as shopping, saving, and budgeting, children develop a sense of financial responsibility. This foundation prepares them for future financial literacy, essential in today's consumer-driven society.

Moreover, learning about currency fosters problem-solving and critical-thinking skills. When children engage in activities like making change or figuring out how much money they need for a desired item, they enhance their reasoning abilities.

Finally, discussions about money can spark conversations about mathematical concepts such as value, transactions, and economic principles, making learning more engaging and relevant. By emphasizing the importance of understanding currency, parents and teachers can ensure that students are not only proficient in math but are also prepared for the real world, promoting confidence and autonomy in financial matters.

Assign to My Students

Assign to My Students