Money management skills Math Worksheets for 5-Year-Olds

3 filtered results

-

From - To

Our Money Management Skills Math Worksheets for 5-Year-Olds offer a fun, engaging way to introduce young learners to basic financial concepts. Designed with colorful illustrations and interactive activities, these worksheets help kids recognize different coins and bills, understand their values, and learn simple counting and addition. By incorporating real-life scenarios, children will develop essential money management skills at an early age, setting the foundation for future financial literacy. Perfect for parents and educators, these worksheets make learning about money simple, enjoyable, and educational for your 5-year-olds.

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

Introducing money management skills to 5-year-olds is crucial as it lays a foundation for their financial literacy and responsibility in the future. Early exposure to math and money concepts helps children develop a solid understanding of the value of money, which is essential in recognizing the importance of saving, spending wisely, and budgeting.

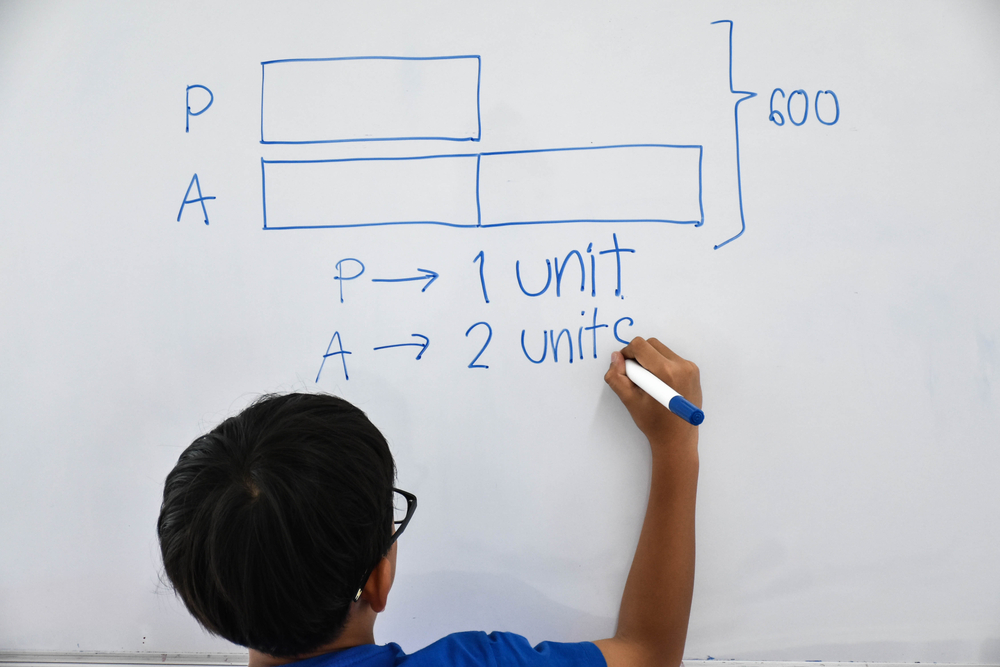

When parents and teachers introduce basic math skills like counting, addition, and subtraction using money, children become more comfortable and adept with numerical figures. For example, using play money to count change during imaginary store transactions fosters practical problem-solving and critical thinking skills. This kind of early practice not only builds their confidence in math but also integrates a tangible context that's relatable and engaging.

Moreover, teaching money management encourages goal-setting and planning, fundamental skills that influence children's decision-making abilities throughout life. Understanding the concept of saving for something special teaches patience and delayed gratification. Simultaneously, discussing financial choices, such as distinguishing between needs and wants, can instill prudent spending habits early on.

As 5-year-olds are impressionable and naturally curious, parents and teachers have a unique opportunity to cultivate healthy financial habits and a positive attitude toward math. This proactive approach helps ensure children grow up equipped to navigate life's financial challenges more adeptly.

Assign to My Students

Assign to My Students