Financial literacy Extra Challenge Money Worksheets for Ages 4-5

3 filtered results

-

From - To

Introduce financial literacy early with our Extra Challenge Money Worksheets for ages 4-5. These engaging, age-appropriate printables from Kids Academy help young learners grasp money concepts through interactive and fun activities. Designed to enhance counting skills and understand the value of different coins, these worksheets are the perfect tool for teaching children how to handle money in a practical, hands-on manner. Boost their confidence and foundation in financial awareness with our thoughtfully structured resources, laying the groundwork for a lifetime of smart money habits. Download and print today to start their financial learning journey!

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is a crucial life skill that sets the foundation for responsible money management. Introducing Extra Challenge Money for ages 4-5 can make a significant difference in a child's development.

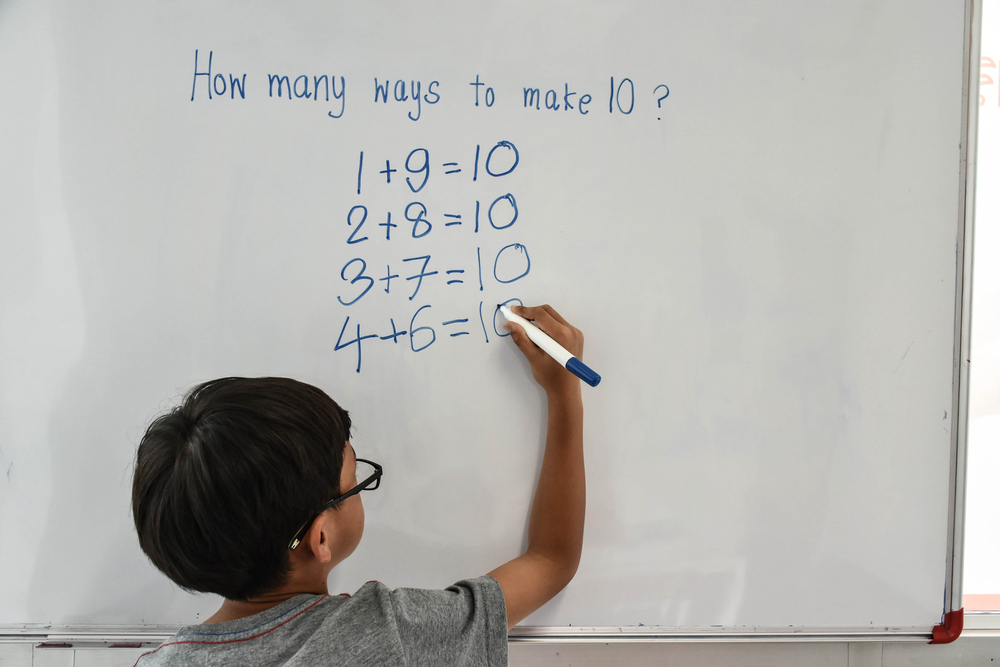

At this young age, children are exceptionally receptive to new concepts, and instiling financial literacy early fosters a healthy relationship with money. These activities can teach fundamental principles such as saving, spending, sharing, and understanding value. For instance, using play money in simple activities can illustrate basic math skills and the idea that money is a finite resource requiring thoughtful use.

Moreover, engaging in financial literacy prepares children to navigate real-world financial situations. Parents and teachers play pivotal roles in shaping their attitudes and behaviors about money. By incorporating these early lessons, adults build a strong foundation that helps prevent future financial challenges.

Additionally, teaching these concepts can encourage critical thinking and decision-making. Children learn to appreciate the consequences of their financial choices, which can lead to more responsible behaviors later in life.

Involving young children in these educational activities can also be a bonding opportunity. It allows parents and teachers to discuss everyday transactions in a way that's fun and understandable, creating an open dialogue about money, which is essential for breaking down the stigma often associated with financial discussions.

Assign to My Students

Assign to My Students