Financial literacy Extra Challenge Math Worksheets for Ages 4-5

3 filtered results

-

From - To

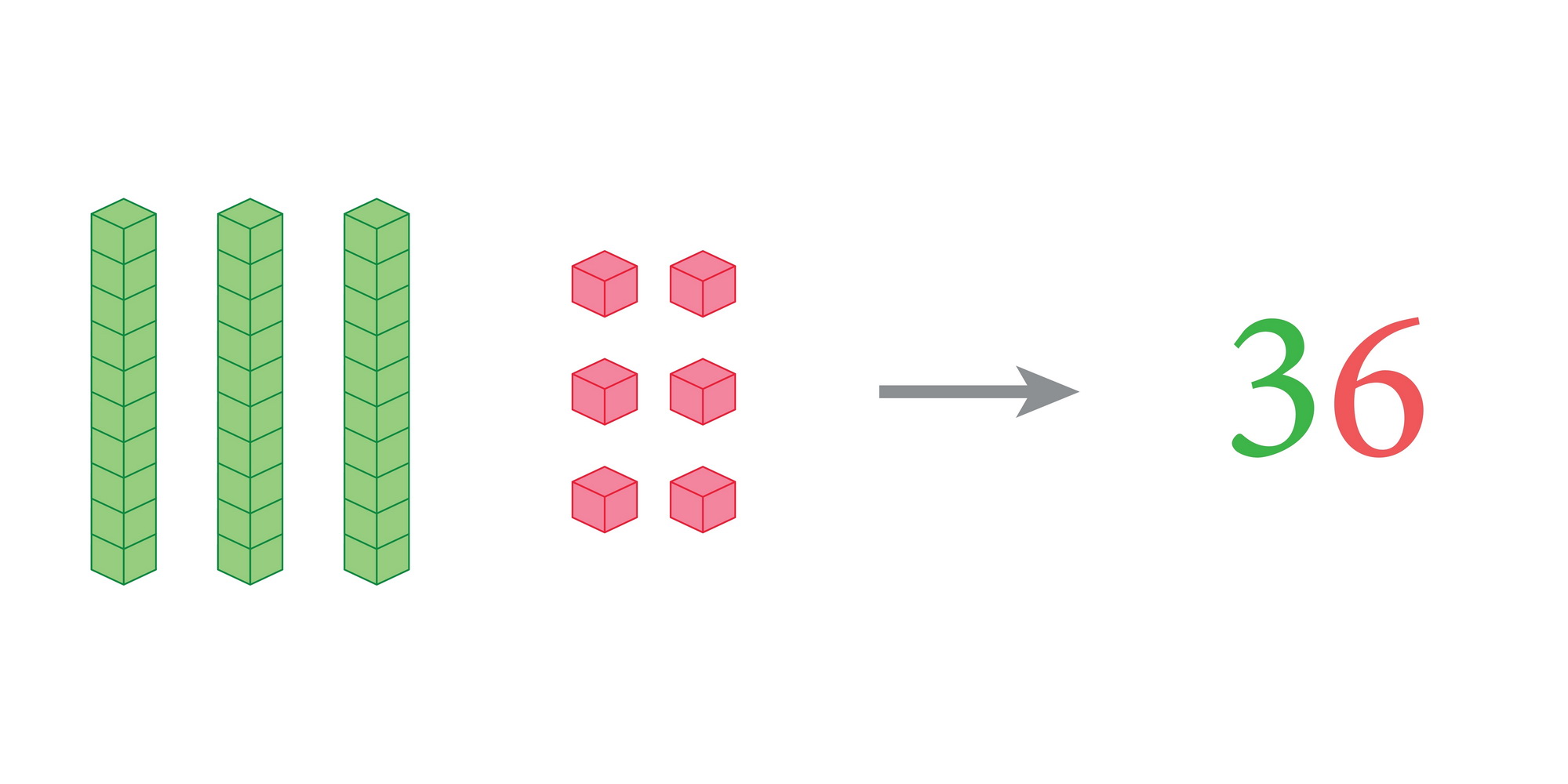

Empower your little learners with our Financial Literacy Extra Challenge Math Worksheets tailored for ages 4-5! Designed to introduce foundational money concepts, these engaging worksheets combine fun illustrations and captivating activities that make learning about finances exciting. Children will explore essential skills such as counting, recognizing coins, and basic budgeting through interactive and age-appropriate challenges. Our resources not only reinforce math skills but also foster a sense of responsibility and understanding about money management from an early age. Perfect for teachers and parents alike, these worksheets offer a valuable addition to any young child’s educational journey! Access them today for optimal learning results!

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is a crucial skill that can set the foundation for a child's future. For children ages 4-5, instilling basic principles of financial literacy through activities like Extra Challenge Math can be both engaging and educational. At this age, children are inherently curious and love to play, which makes teaching concepts like counting, budgeting, and value systems through math games perfectly suited to their developmental stage.

Parents and teachers should care because early exposure to financial concepts can shape children's attitudes towards money and spending habits as they grow. Simple activities like counting coins or sorting bills using extra challenge math encourage problem-solving and critical thinking. These foundational lessons not only promote mathematical skills but also teach young children the value of saving, the significance of making choices, and the importance of responsibility.

Moreover, financial literacy can enhance children's self-esteem as they learn to make informed decisions. By incorporating these lessons into everyday activities or classroom settings, adults can empower children to become confident stewards of their future finances. Ultimately, understanding financial concepts early on can help children navigate more complex financial landscapes as they grow, fostering greater stability and success in adulthood.

Assign to My Students

Assign to My Students