Understanding currency Extra Challenge Money Worksheets for Ages 5-8

3 filtered results

-

From - To

Nurture your child's financial literacy with our "Understanding Currency Extra Challenge Money Worksheets for Ages 5-8". These engaging and educational worksheets are designed to help young learners grasp the concept of money, recognize coins and bills, and solve basic math problems involving currency. Packed with fun activities, they challenge kids to count money, make change, and develop critical thinking skills. Perfect for both classroom and home use, these worksheets provide a solid foundation in financial education, ensuring your child gains practical currency knowledge in an enjoyable way. Equip your child with essential money skills today!

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

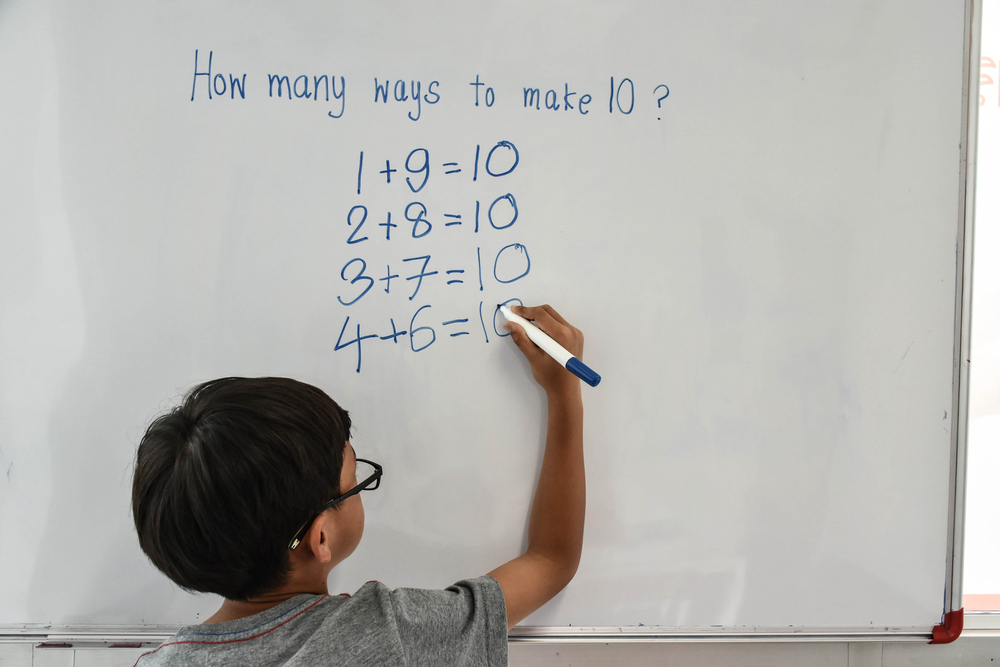

Understanding currency is a vital skill that serves as a critical building block for young children ages 5-8, as it lays the foundation for their overall financial literacy and numeracy skills. Early exposure to money concepts helps children grasp the basics of counting, addition, and subtraction, fostering their mathematical development.

When parents and teachers invest time in teaching about currency, they prepare children for real-world scenarios where they will need to make informed financial decisions. For instance, recognizing different denominations and understanding the value of money empower kids to make simple transactions, like buying a snack or saving pocket money. This hands-on learning can enhance their cognitive abilities and practical life skills.

Moreover, understanding currency can also stimulate a child's curiosity and engagement. Interactive activities, such as play-based learning with toy money or participating in a classroom "market day," make learning enjoyable and relevant. These activities not only reinforce math concepts but also teach kids important lessons about saving, sharing, and decision-making.

Ultimately, by emphasizing early currency education, parents and teachers can nurture financially confident individuals. These foundational skills will prove invaluable as children grow older, helping them navigate more complex financial choices and promoting a lifelong habit of financial responsibility.

Assign to My Students

Assign to My Students