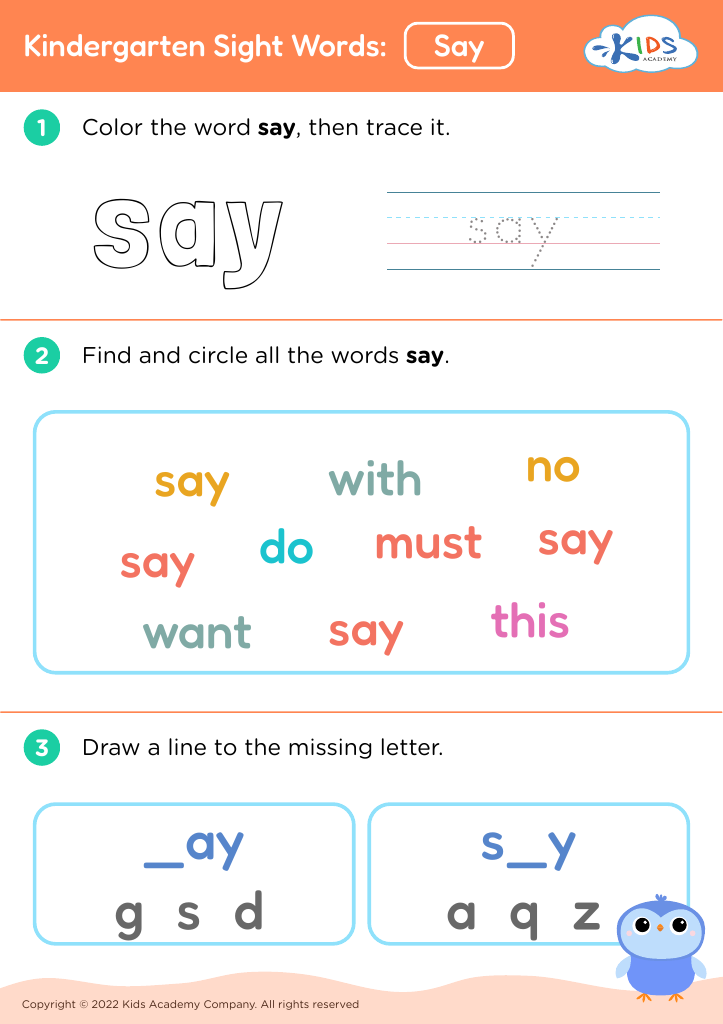

Financial literacy Worksheets for Ages 3-8

6 filtered results

-

From - To

Discover our engaging "Financial Literacy Worksheets for Ages 3-8," designed to introduce young learners to the basics of money management in a fun and interactive way. Our collection features colorful worksheets that teach essential concepts such as saving, spending, and sharing, making financial education accessible and enjoyable for children. Each activity promotes critical thinking and problem-solving skills through relatable scenarios tailored for early learners. Perfect for parents and educators alike, these worksheets encourage financial awareness and responsibility from a young age. Empower your child’s journey to understanding money management with our comprehensive resources, and lay the foundation for a financially savvy future!

Let's Go to the Store! Worksheet

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy for children aged 3-8 sets the foundation for lifelong money management skills. At this formative stage, children begin to develop key concepts about money, value, and resources. Parents and teachers play a crucial role in introducing financial concepts, helping kids understand basic ideas like saving, spending, sharing, and earning.

Early financial literacy encourages children to make informed choices. For example, understanding the difference between needs and wants empowers them to prioritize appropriately. By learning to save a portion of their allowance or birthday money, they grasp delayed gratification—a vital skill in today’s consumer-driven society.

Moreover, teaching financial literacy fosters critical thinking and problem-solving abilities. As children engage in simple budgeting activities or play shop, they practice valuable math and decision-making skills, paving the way for academic success in broader subjects.

Engaging with financial literacy early cultivates a positive attitude toward money. It helps demystify financial concepts and alleviates anxiety in older age. As these children grow, they’ll be better equipped to manage their finances wisely, avoid unhealthy financial habits, and contribute positively to their community. Ultimately, prioritizing financial literacy at a young age can lead to a more financially responsible and empowered generation.

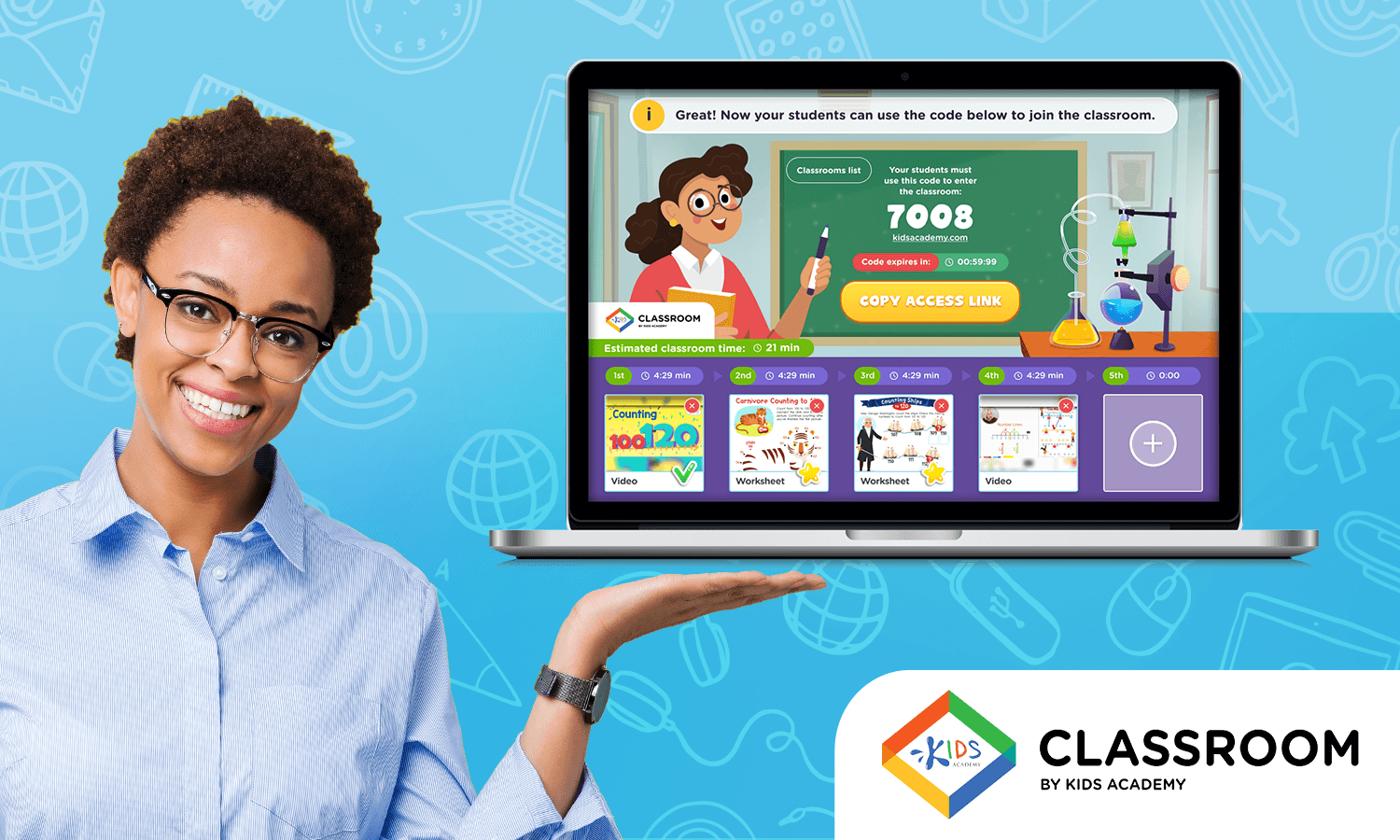

Assign to My Students

Assign to My Students