Money management Worksheets for Ages 3-8

4 filtered results

-

From - To

Introduce your little ones to smart financial habits with our Money Management Worksheets for Ages 3-8. Designed to make learning about money fun and interactive, these printables cover essential skills like recognizing coins, understanding value, and basic saving techniques. Perfect for early learners, our worksheets engage kids through colorful activities and simple exercises that lay the foundation for a lifetime of good financial decisions. Whether in a classroom or at home, these resources will help your children become money-smart from an early age. Dive into our collection and start building those foundational money management skills today!

Grocery Store Worksheet

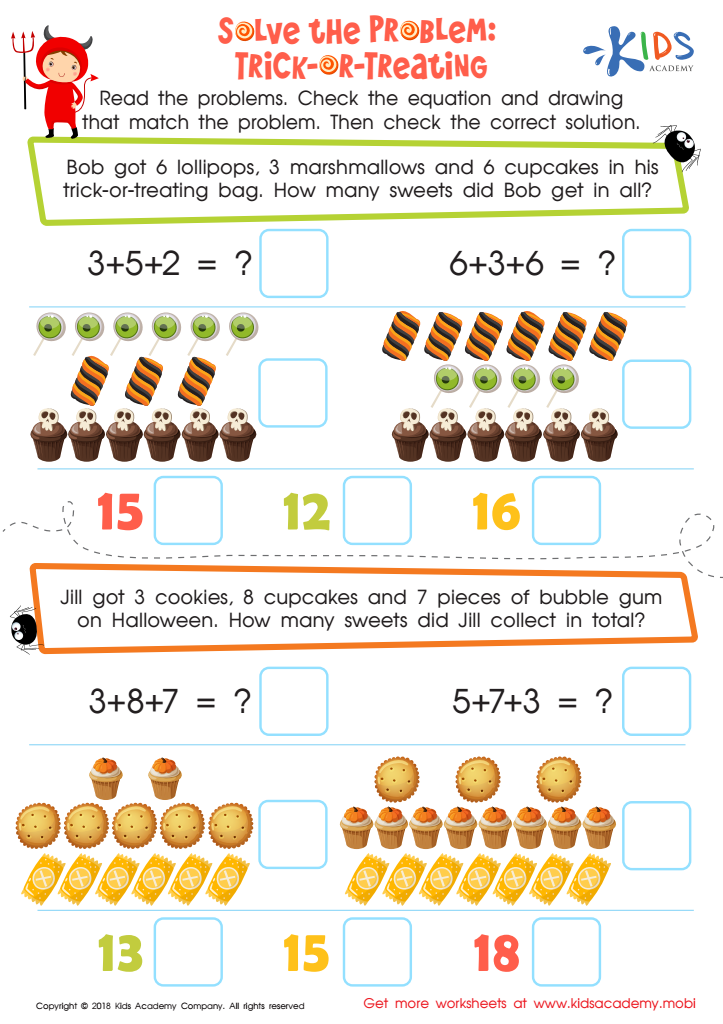

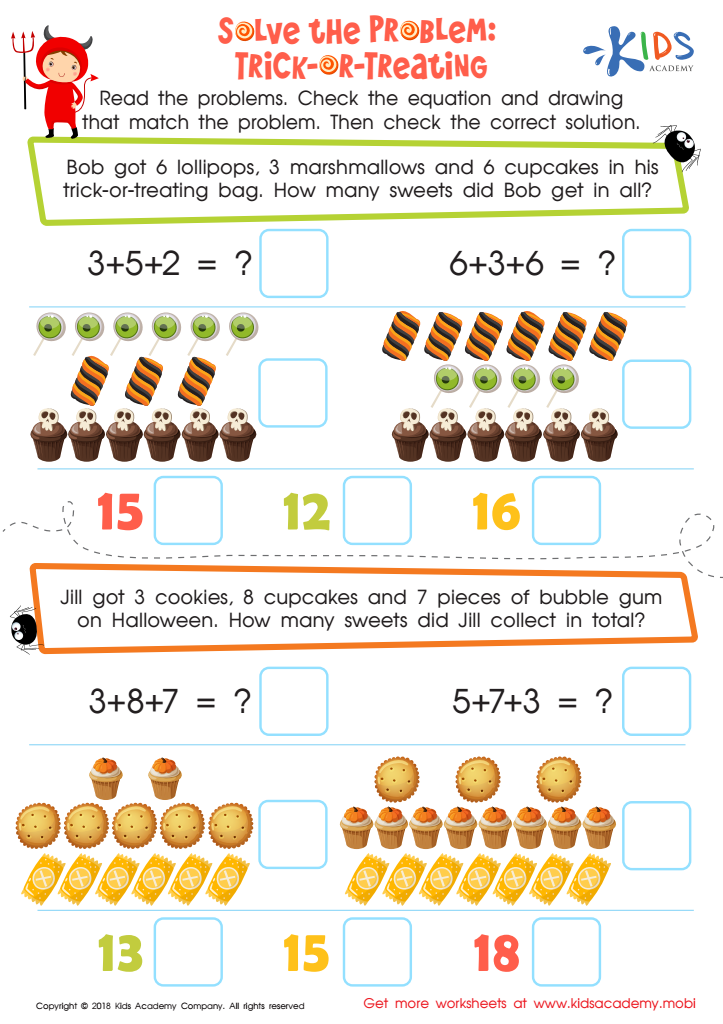

Solve the Problem: Trick–or–treating Worksheet

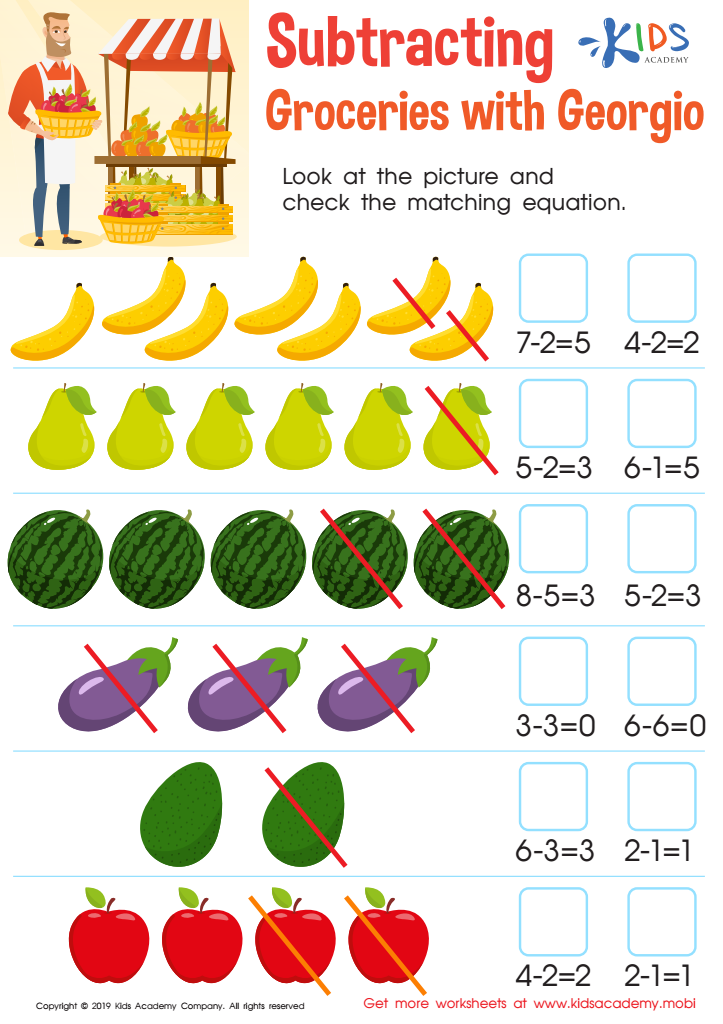

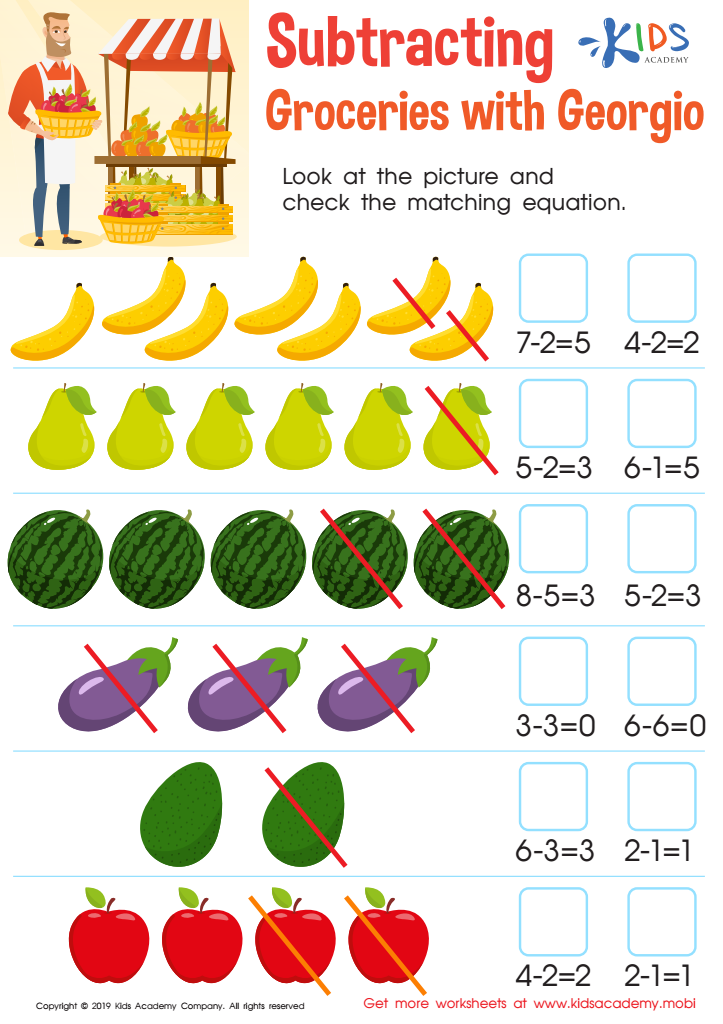

Subtracting: Groceries with Georgio Worksheet

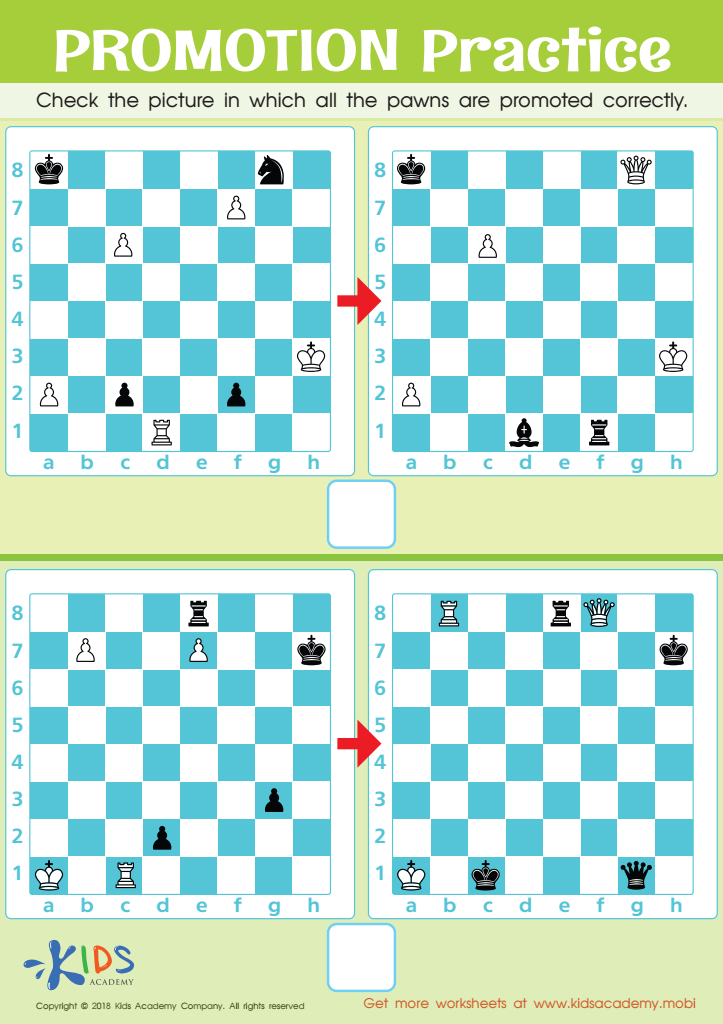

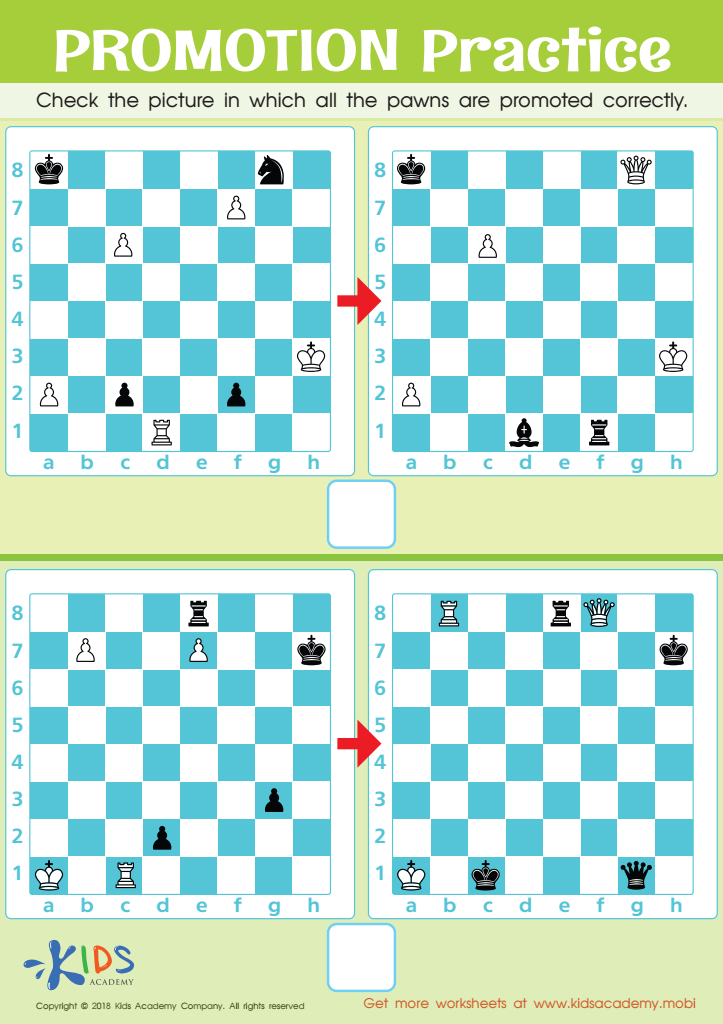

Promotion Practice Worksheet

Teaching money management to children aged 3-8 is crucial for laying the foundation of financial literacy early in life. At this developmental stage, kids are like sponges, absorbing habits and lessons that will shape their future behaviors. By introducing basic concepts of money management, such as saving, spending, and understanding value, parents and teachers can equip children with essential life skills.

First, learning about money helps children develop a sense of responsibility and discipline. Simple chores in exchange for a small allowance can teach them the value of hard work and delayed gratification. Knowing that they have to save up for a desired toy or treat encourages goal-setting and patience.

Secondly, early exposure to money concepts demystifies financial transactions they observe in day-to-day activities. This can prevent misconceptions and foster an understanding of the economic world they live in. They’ll become more aware consumers and can make better choices in the future.

Thirdly, financial literacy fosters independence and confidence. Kids who understand money basics are less likely to feel intimidated or helpless in financial matters as they grow older.

In conclusion, investing time in teaching money management to young children promotes financial competence, ensuring they grow into informed, responsible, and empowered adults.

Assign to My Students

Assign to My Students