Money management Worksheets for Ages 6-8

4 filtered results

-

From - To

Develop vital financial skills with our Money Management Worksheets tailored for ages 6-8. These engaging worksheets from Kids Academy introduce young learners to fundamental concepts like recognizing coins, counting money, and basic budgeting. Through fun and interactive activities, children will learn to differentiate between various denominations, practice simple transactions, and understand the value of saving versus spending. Our expertly designed exercises aim to build a strong foundation in financial literacy, setting the stage for responsible money handling in the future. Make learning about money fun and educational with our printable resources perfect for young minds.

Grocery Store Worksheet

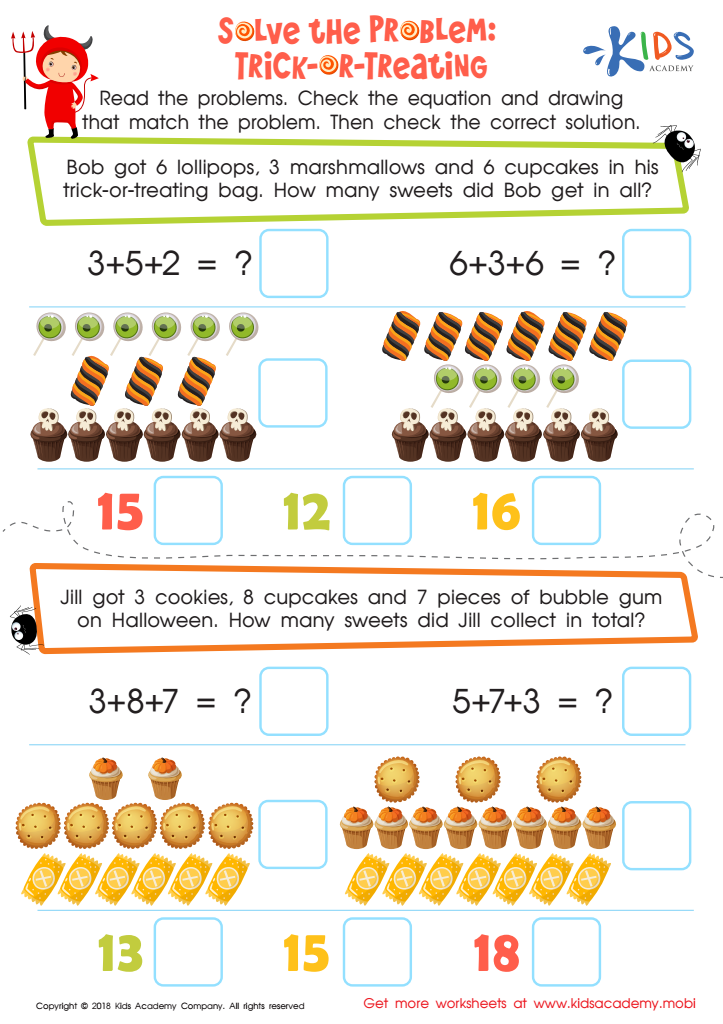

Solve the Problem: Trick–or–treating Worksheet

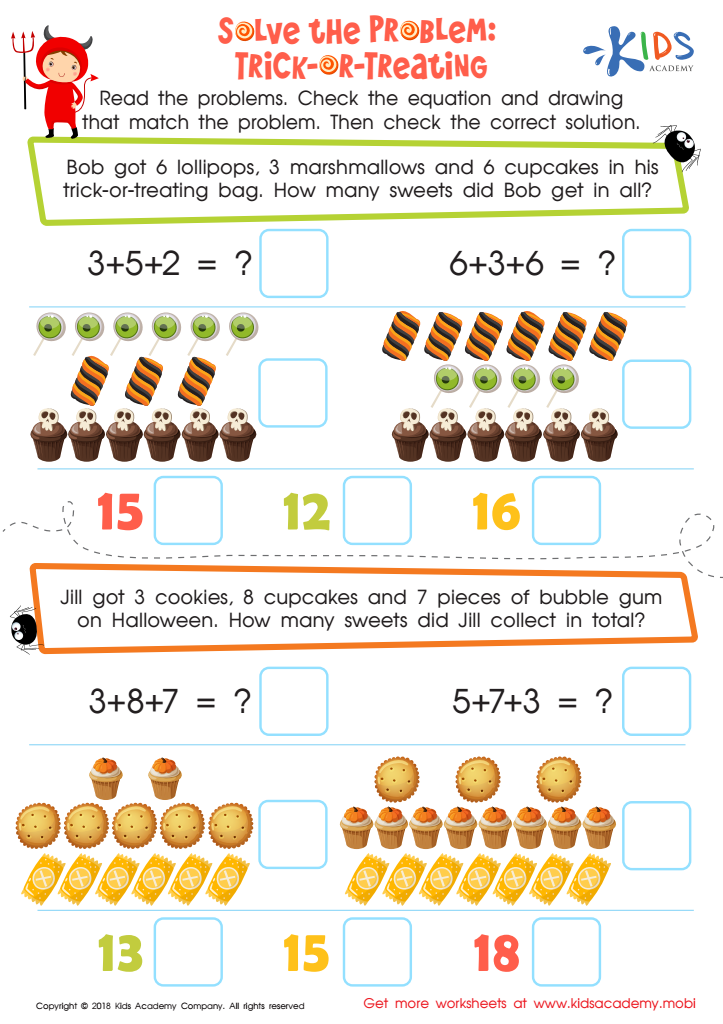

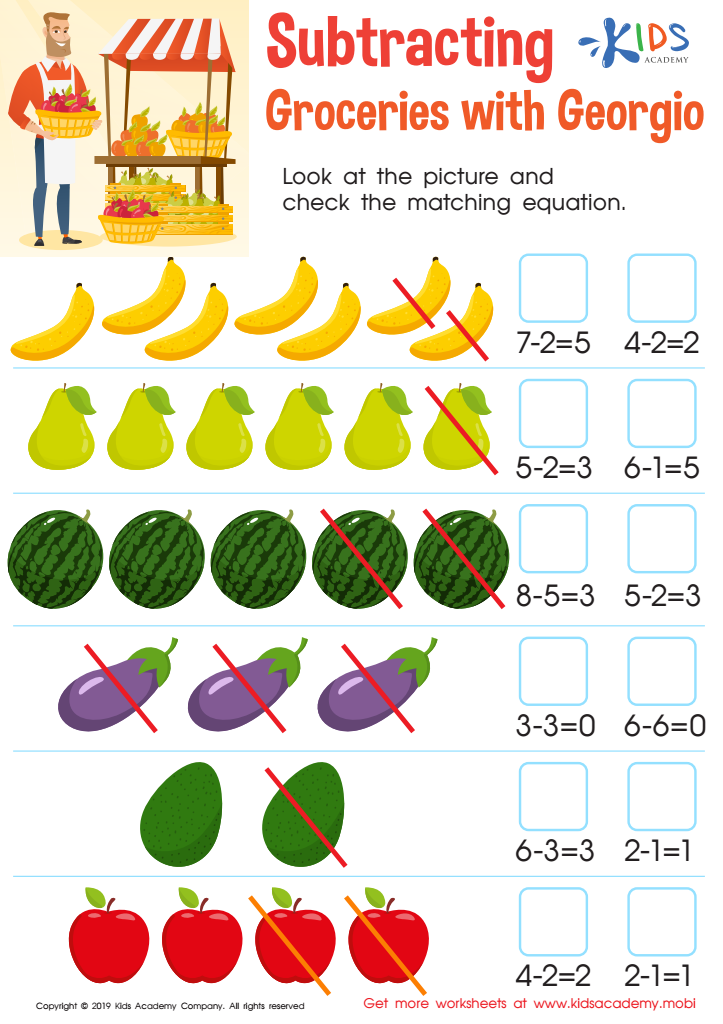

Subtracting: Groceries with Georgio Worksheet

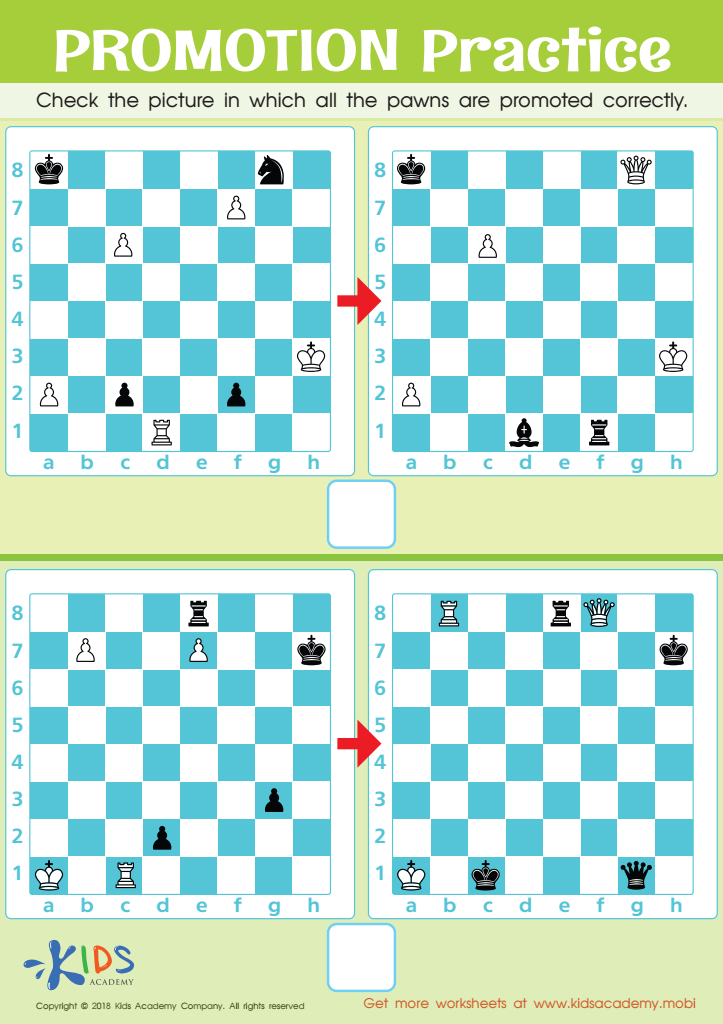

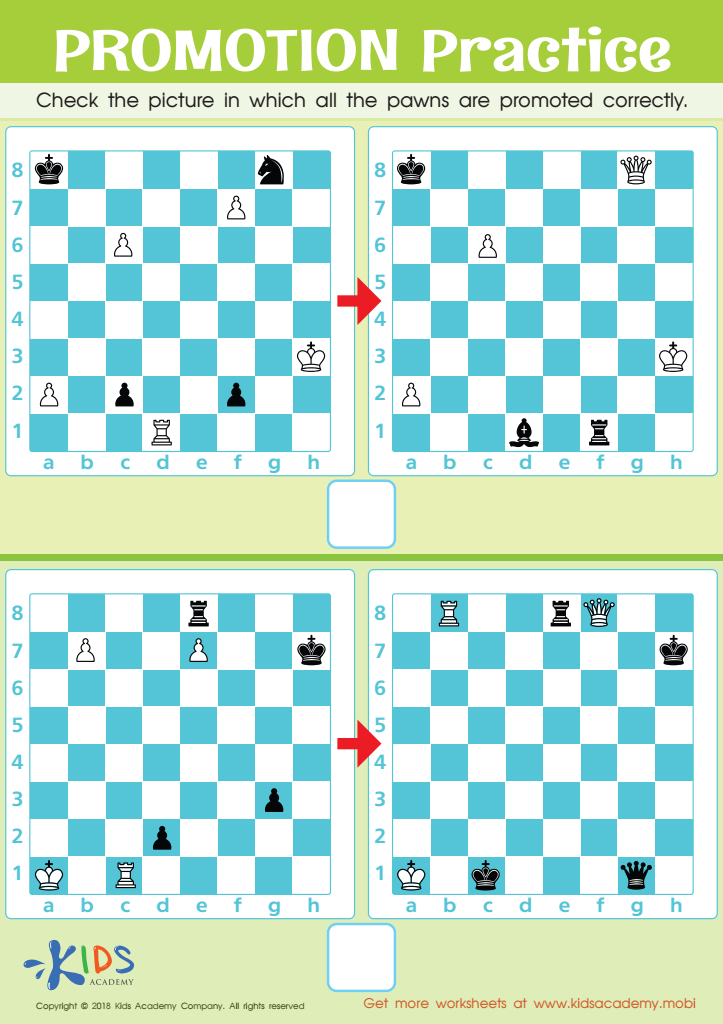

Promotion Practice Worksheet

Teaching money management to children aged 6-8 is essential as it lays a solid foundation for their financial future. At this developmental stage, kids grasp basic concepts quickly and form foundational habits. Introducing them to money management early helps cultivate responsible behaviors like saving, budgeting, and making informed spending decisions.

Firstly, early financial education demystifies the concept of money, allowing kids to understand its value. When children comprehend that items cost money, they begin to appreciate the hard work that goes into earning it. This awareness fosters respect for money and can curb impulsive spending habits from forming later in life.

Additionally, teaching children about money management encourages mathematical and critical thinking skills. Counting coins, understanding price tags, and making change all require math, while deciding between wants and needs improves decision-making abilities.

Financial literacy also promotes independence and confidence. When kids learn to save money for something they want, they experience a sense of accomplishment and control. They realize that they can set and achieve goals through dedication and patience.

Lastly, lessons in money management build a basis for more complex financial concepts later, such as investing, debt management, and financial planning. By partnering with parents and teachers to educate young children about money, we empower the next generation with the skills they need for a financially responsible and secure future.

Assign to My Students

Assign to My Students

.jpg)