Understanding money Worksheets for 5-Year-Olds

3 filtered results

-

From - To

Our "Understanding Money Worksheets for 5-Year-Olds" are designed to introduce young learners to the concepts of money through engaging, age-appropriate activities. These printable worksheets feature fun exercises that teach kids how to recognize different coins, understand their values, and practice simple addition and subtraction with money. Our resources aim to build a solid foundation for financial literacy, help develop math skills, and support hands-on learning. Perfect for both classroom settings and at-home education, these worksheets not only make learning about money enjoyable but also help children gain confidence in managing money-related tasks.

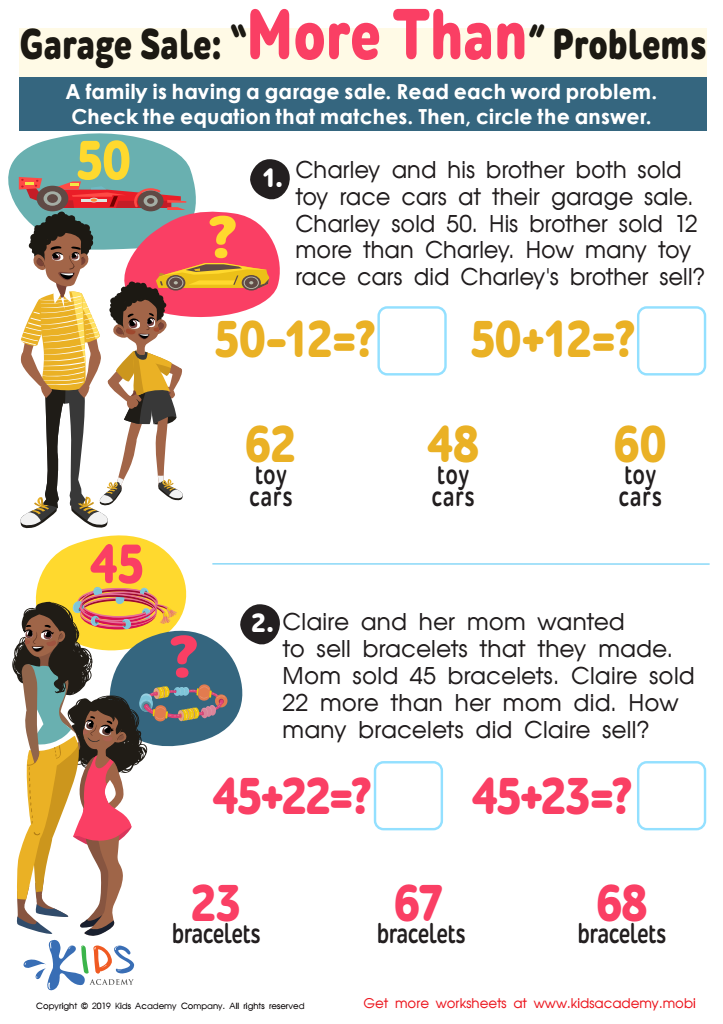

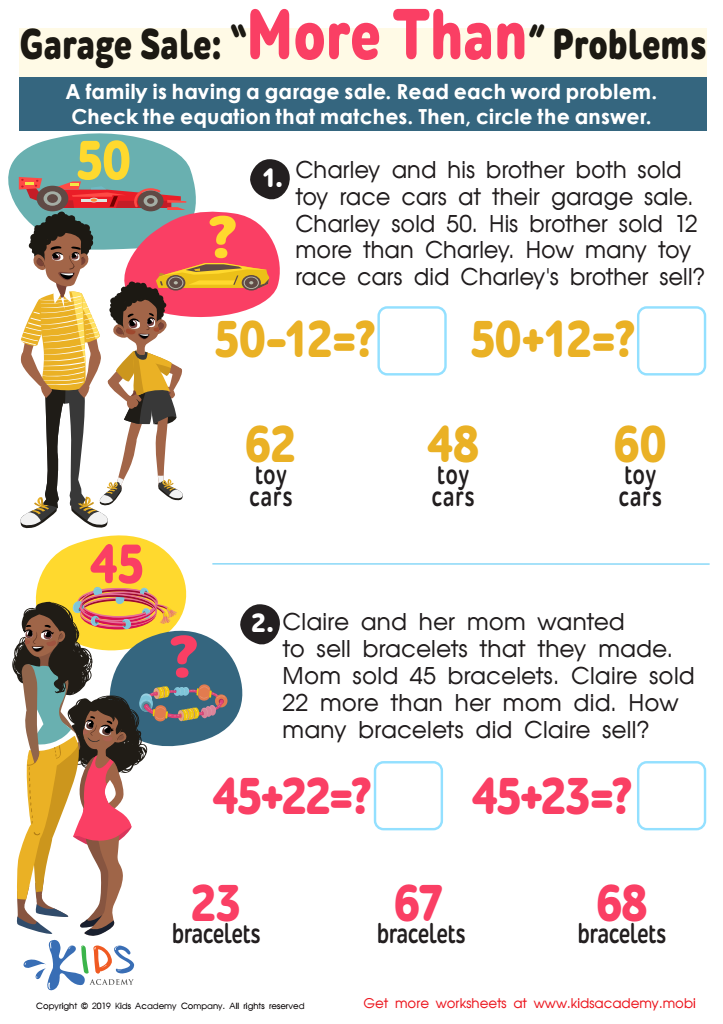

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

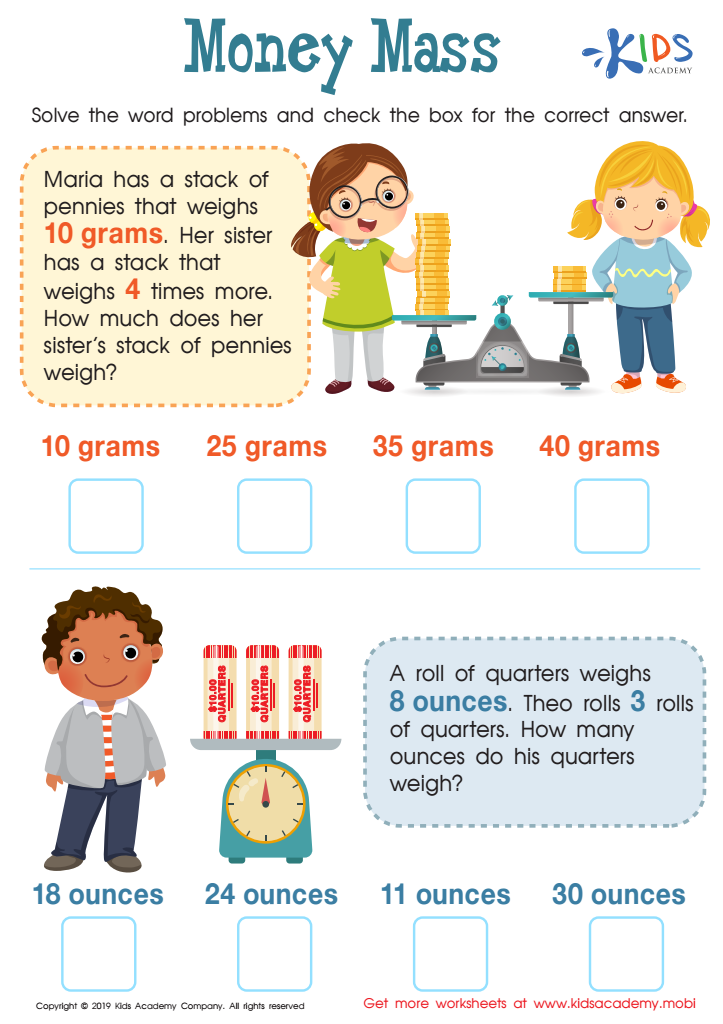

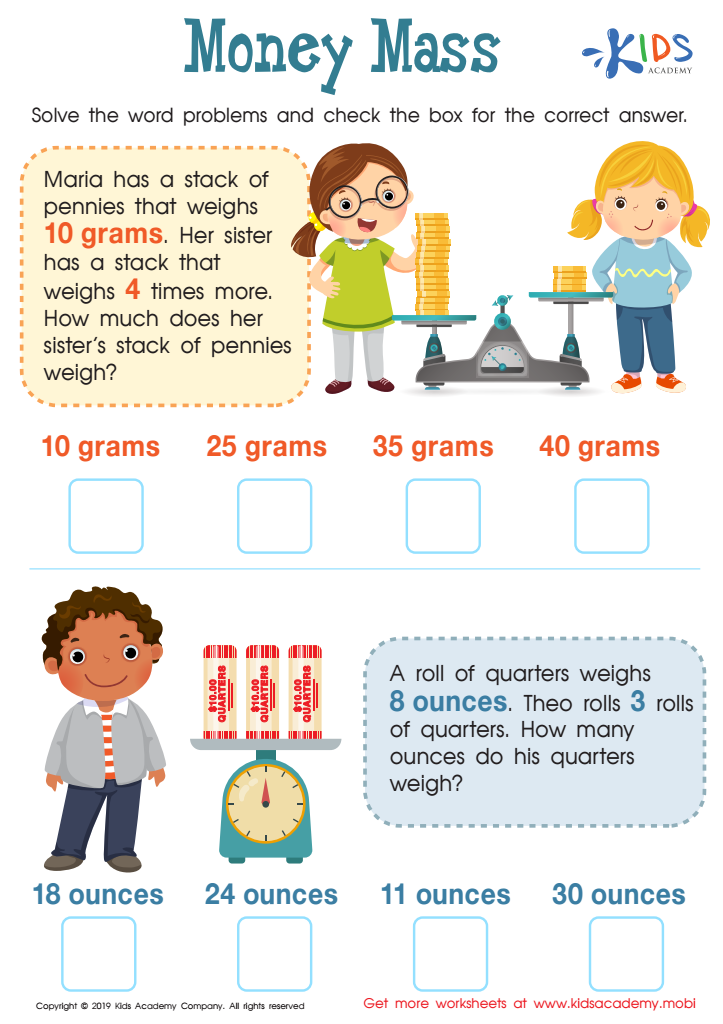

Money Mass Worksheet

Understanding money at an early age is essential for developing smart financial habits later in life. For 5-year-olds, grasping basic money concepts can lay a strong foundation for responsible financial management. Parents and teachers can make a significant impact by nurturing these skills early on.

First, introducing money basics, like identifying coins and bills, teaches children the value of currency. They begin to understand that money is used to buy things, helping them develop an appreciation for the cost and worth of different items. This awareness fosters gratitude and mindful spending.

Second, early money education promotes essential math skills such as counting, addition, and subtraction. These foundational skills are crucial for academic success in later years. By incorporating money-related activities, children get a practical and engaging context for applying math concepts.

Moreover, teaching children to save and make spending choices helps them develop decision-making and goal-setting skills. By understanding the difference between needs and wants, they learn to prioritize and plan—skills that are valuable throughout life.

Lastly, involving children in discussions about money fosters open communication, reducing anxiety and misconceptions about finances. Both parents and teachers play pivotal roles in demystifying money and preparing children for future financial responsibilities. By caring about financial literacy early on, we empower the next generation to make informed, responsible financial decisions.

Assign to My Students

Assign to My Students

.jpg)