Money management skills Easy Addition & Subtraction Worksheets for Ages 4-8

3 filtered results

-

From - To

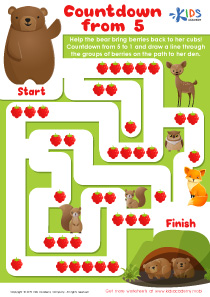

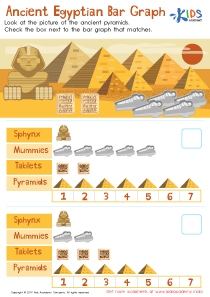

Discover essential money management skills for young learners with our Easy Addition & Subtraction Worksheets, designed for ages 4-8. These engaging and interactive worksheets help children practice their math abilities while understanding the basics of managing money, such as counting coins and making simple transactions. Perfect for at-home or classroom use, our resources encourage critical thinking and reinforce mathematical concepts in a fun, relatable context. With colorful visuals and age-appropriate problems, students will gain confidence in addition and subtraction, laying the foundation for important financial literacy skills. Start your child on the path to financial savvy today! Printable and user-friendly, learning is just a click away.

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

Teaching money management skills through easy addition and subtraction is vital for children aged 4-8 for several reasons. Firstly, early financial literacy equips kids with a practical understanding of money, fostering a sense of responsibility and informed decision-making from a young age. Basic math skills, like addition and subtraction, are foundational for budgeting, saving, and making purchases later in life.

Moreover, incorporating money concepts into everyday learning makes math exciting and relevant. Children learn to recognize coins, understand their values, and engage in simple transactions, enhancing their counting and problem-solving skills. This practical application of math can build confidence in their abilities, making them more willing to tackle complex financial concepts as they grow.

Parents and teachers play a crucial role in guiding children in these areas. By using playful and engaging activities—like grocery store play, saving in jars, or managing allowances—adult involvement becomes key in reinforcing these lessons. Such early education not only supports academic growth but also nurtures important life skills, preparing children for financial independence in the future. Ultimately, instilling these concepts early empowers children to be smart consumers and stewards of their finances as they navigate their lives.

Assign to My Students

Assign to My Students