Financial literacy Grade 1 Worksheets

4 filtered results

-

From - To

Welcome to our Financial Literacy Grade 1 Worksheets page! Designed to introduce young learners to the basics of managing money, these engaging worksheets help first graders understand concepts such as counting coins, budgeting, and making smart spending choices. With fun activities and colorful illustrations, students will grasp essential skills that lay the foundation for their financial futures. Parents and educators can easily access these printable resources to enhance classroom lessons or home learning experiences. Equip your child with knowledge that empowers them to become informed decision-makers! Explore our collection of kid-friendly worksheets today and watch your child's confidence grow.

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

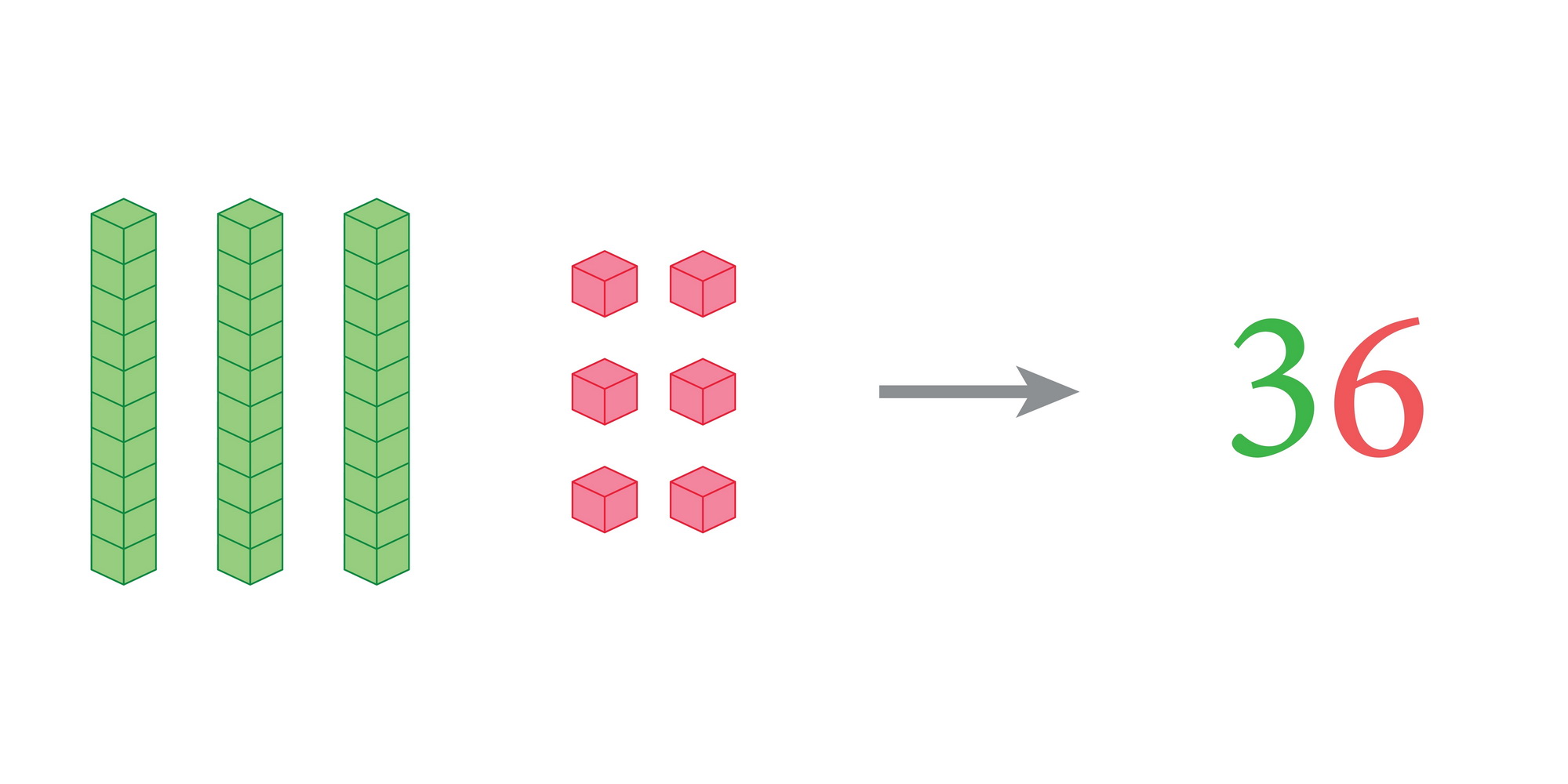

Financial literacy is essential for children, starting as early as Grade 1. Teaching young students about money promotes foundational skills that will benefit them throughout their lives. At this age, children begin to grasp basic concepts such as counting, value recognition, and the significance of saving. Introducing financial literacy helps reinforce these math skills while making learning relevant and practical.

Parents and teachers should care about financial literacy because it fosters responsible decision-making, instills good saving habits, and encourages a positive mindset towards money. Children who understand the basics of earning, spending, and saving are better equipped to make informed choices about their finances in the future. It can also empower them to set financial goals and cultivate discipline as they learn to differentiate between needs and wants.

Moreover, instilling financial literacy at a young age encourages family engagement, as parents can involve their children in discussions about budgeting for family activities or saving for special occasions. This cooperative learning builds trust and communication within the family. Ultimately, equipping Grade 1 students with financial knowledge lays the groundwork for a prosperous and responsible adult life, promoting confidence and independence as they navigate their financial futures.

Assign to My Students

Assign to My Students

.jpg)