Financial literacy Extra Challenge Worksheets for Ages 4-5

3 filtered results

-

From - To

Boost your child's financial literacy with our engaging Extra Challenge Worksheets designed for ages 4-5! These fun and interactive activities introduce essential money concepts in a playful manner, helping young learners understand basic financial skills such as saving, spending, and the value of money. Our worksheets feature vibrant illustrations and age-appropriate tasks that will capture children's interest and encourage their curiosity about financial matters. Ideal for parents and educators, these resources promote critical thinking and foundational math skills while laying the groundwork for responsible financial habits. Get started today and empower your little ones with valuable knowledge for their future!

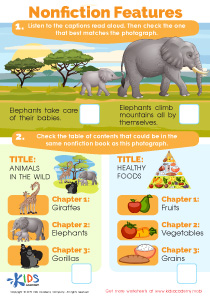

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is essential for young children, as it lays the foundation for responsible adulthood. For children ages 4-5, understanding basic financial concepts can significantly influence their lifelong relationship with money. Parents and teachers should care about financial literacy at this age because it fosters critical thinking, decision-making, and problem-solving skills.

At this stage, introducing simple concepts like saving, spending, and sharing can help children understand the value of money. Activities like playing store or using play money can make learning engaging and fun. This early exposure can lead to better financial habits in the future, reducing the likelihood of debt and poor spending choices.

Additionally, incorporating financial literacy helps children develop a sense of responsibility and encourages goal-setting. For example, if a child is saving for a toy, they learn to manage their desires and appreciate what they achieve through effort. By engaging in discussions about money, parents and teachers can reinforce these concepts, promoting an environment where children feel comfortable exploring financial topics.

Ultimately, by instilling financial awareness early on, we equip the next generation with the skills necessary to navigate an increasingly complex financial landscape. It sets them on a path toward financial independence and security.

Assign to My Students

Assign to My Students