Financial literacy Extra Challenge Worksheets for Ages 5-9

3 filtered results

-

From - To

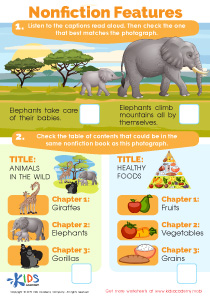

Enhance your child's financial literacy with our Extra Challenge Worksheets designed for ages 5-9! These engaging, age-appropriate activities teach essential money management skills, including saving, budgeting, and smart spending. Developed by education experts, each worksheet blends fun illustrations with practical exercises, making complex concepts simple and enjoyable. Perfect for classrooms or homeschooling, they're a great way to introduce young learners to the world of finance. Equip your kids with the knowledge they need for a financially savvy future. Visit Kids Academy and start your journey towards financial literacy today!

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Ensuring financial literacy for children aged 5-9 is crucial for their future well-being and success. At this young age, kids are naturally curious and develop foundational skills that persist throughout their lives. Introducing financial literacy early helps them understand basic concepts like money, saving, and making choices, which are essential skills for managing their financial futures responsibly.

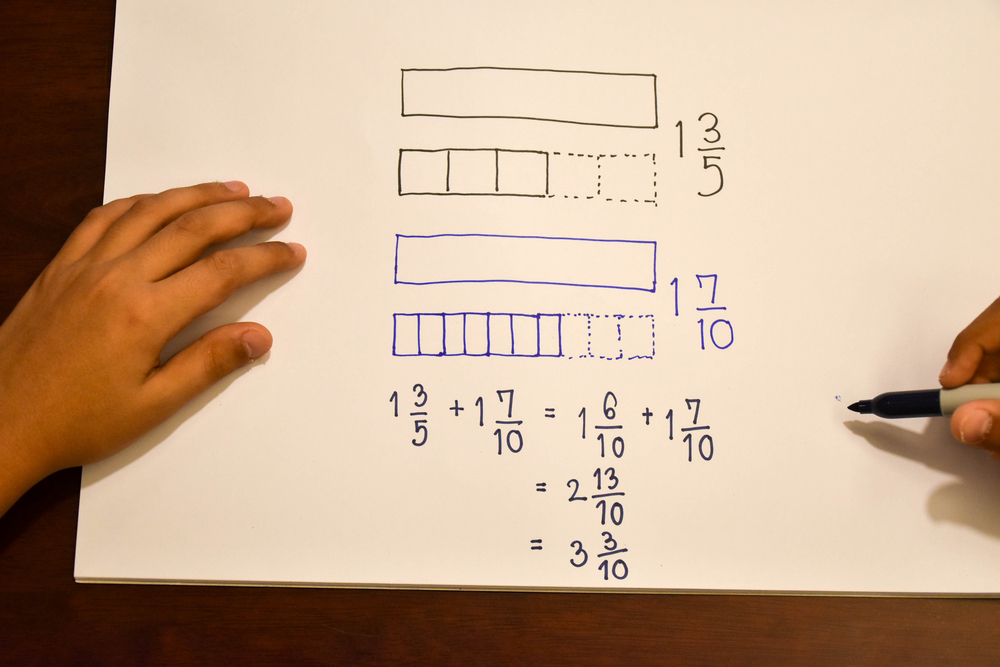

Parents and teachers play a vital role in shaping a child's perspective on money. Activities that introduce money concepts early in a child’s development set the stage for responsible money management later. For example, using games and practical, hands-on experiences, such as setting up a small saving jar or participating in a mini 'store' activity, helps children comprehend the value of money and the importance of saving.

Additionally, early exposure to financial literacy can reduce future stress and equip children with the knowledge to make informed decisions. It also builds confidence and fosters a sense of responsibility. Parents and teachers caring about financial literacy challenges ensure children are not just academically prepared but are also equipped with life skills that are critical for independent and successful adult life.

By making financial literacy fun and engaging at an early age, children will perceive financial concepts as part of their everyday life, which greatly enhances their chances of becoming financially responsible adults.

Assign to My Students

Assign to My Students