Money recognition Extra Challenge Money Worksheets

4 filtered results

-

From - To

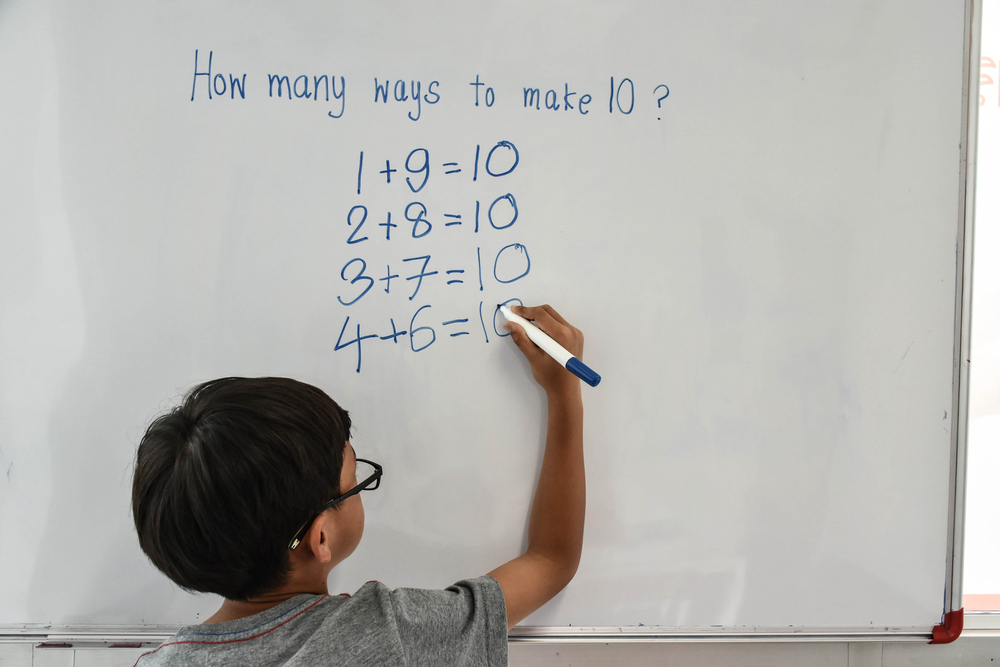

Challenge your students' money recognition skills with our "Money Recognition Extra Challenge Money Worksheets." Perfect for young learners, these worksheets push beyond basic coin and bill identification by introducing more complex exercises. Suitable for both classroom and at-home practice, they offer a fun, engaging way to enhance financial literacy. Students will encounter a variety of scenarios requiring them to count, compare, and make change using real-world examples. By working through these challenging problems, children will build a solid foundation in money management and boost their confidence in handling finances. Equip them with the skills they need for future success!

How Many Coins Money Worksheet

One Cent or the Penny Money Worksheet

Coin Names and Values Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Parents and teachers should care about Money Recognition Extra Challenge because it lays a fundamental groundwork for children’s financial literacy and life skills. Understanding the value of money, distinguishing different denominations, and knowing how to manage it are crucial competencies that benefit children throughout their entire lives. Early exposure helps demystify financial concepts, fostering responsible spending, saving habits, and basic arithmetic skills.

Moreover, integrating money recognition into engaging challenges can significantly enhance cognitive development. It sharpens problem-solving abilities, critical thinking, and attention to detail, which are valuable in all areas of education. For educators, it offers a practical application for mathematical concepts like addition, subtraction, multiplication, and even fractions. Parents can use everyday scenarios, such as grocery shopping or budgeting for an outing, turning routine activities into learning opportunities.

Emphasizing money management early instills a sense of responsibility, making children more mindful of resources and preventing poor financial decisions later on. It is more than just a practical skill; it’s an essential life lesson in planning and prioritizing. By caring about money recognition, parents and teachers are empowering children to become financially savvy and independent individuals who can confidently navigate the complexities of adult life.

Assign to My Students

Assign to My Students