Financial literacy Extra Challenge Grade 2 Math Worksheets

3 filtered results

-

From - To

Boost your second graders' money management skills with our "Financial Literacy Extra Challenge Grade 2 Math Worksheets." Designed by experts, these engaging and challenging activities help young learners understand the value of money through practical examples and age-appropriate problems. From learning to count coins and bills to making change and understanding simple financial concepts, our worksheets provide a solid foundation in financial literacy. Encourage smart money habits early, promote critical thinking, and build a lasting understanding of financial principles. With our well-crafted worksheets, prepare your child for future financial success in a fun and interactive way.

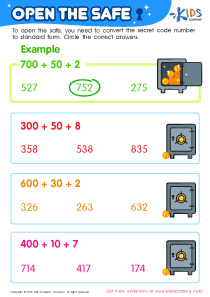

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Incorporating financial literacy into Grade 2 math is crucial for building a foundation of responsible money management from an early age. Parents and teachers play pivotal roles in shaping children's understanding of money, which will directly influence their ability to make informed financial decisions in the future.

Introducing financial concepts such as saving, spending, and budgeting through engaging activities and math challenges helps children grasp the real-world applications of their math skills. This not only enhances their numerical proficiency but also instills in them a sense of financial responsibility and planning. By learning to identify different coins and bills, and understanding basic transactions, children begin to appreciate the value of money and the importance of making thoughtful financial choices.

Moreover, financial literacy fosters essential life skills like critical thinking and problem-solving. These skills enable children to face various financial scenarios with confidence and resilience. In a world where financial stability is closely tied to overall well-being, ensuring that children have a strong financial foundation early on reduces the risk of future financial difficulties.

Ultimately, parents and teachers who prioritize financial literacy give children the tools to achieve long-term financial security and success. Such an early start can bridge knowledge gaps, promote economic empowerment, and cultivate a generation of financially savvy individuals.

Assign to My Students

Assign to My Students