Money management Normal Worksheets for Ages 4-7

3 filtered results

-

From - To

Introduce your little ones to the essentials of money management with our engaging Normal Worksheets designed specifically for ages 4-7. Created to build foundational financial literacy, these colorful and interactive printable materials cover basic concepts like identifying coins, understanding value, and simple budgeting. Each worksheet merges fun activities with valuable lessons, helping young learners develop smart money skills early on. Perfect for teachers and parents, our Money Management Normal Worksheets offer a playful, hands-on approach that prepares kids for future financial success. Start cultivating a healthy relationship with money through our kid-friendly, expertly crafted worksheets.

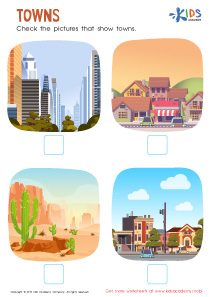

Grocery Store Worksheet

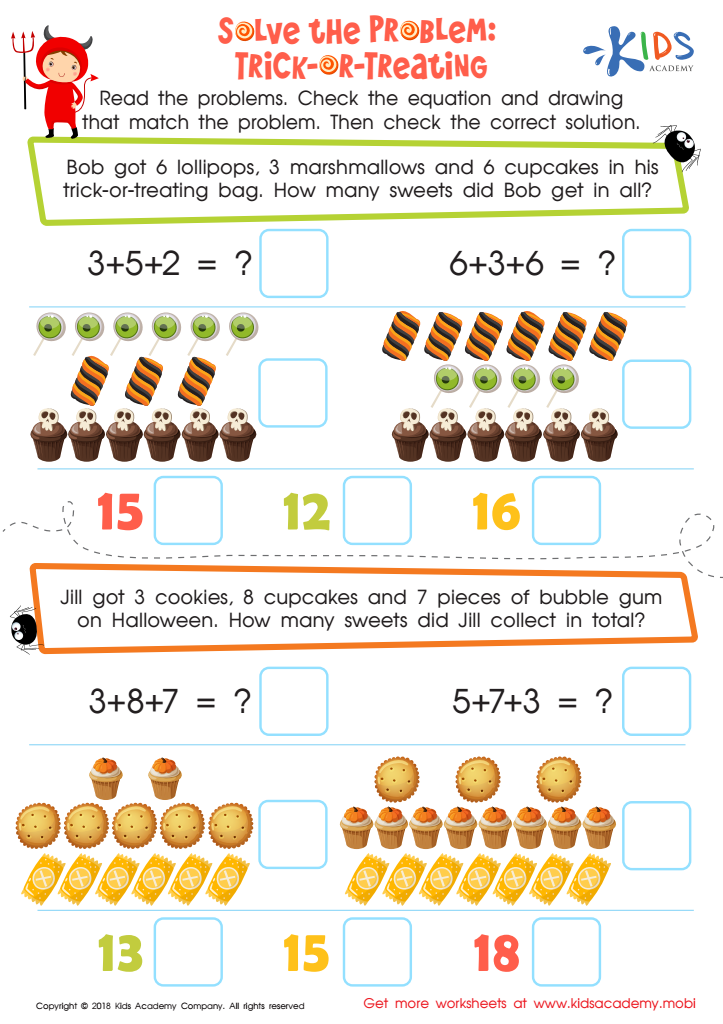

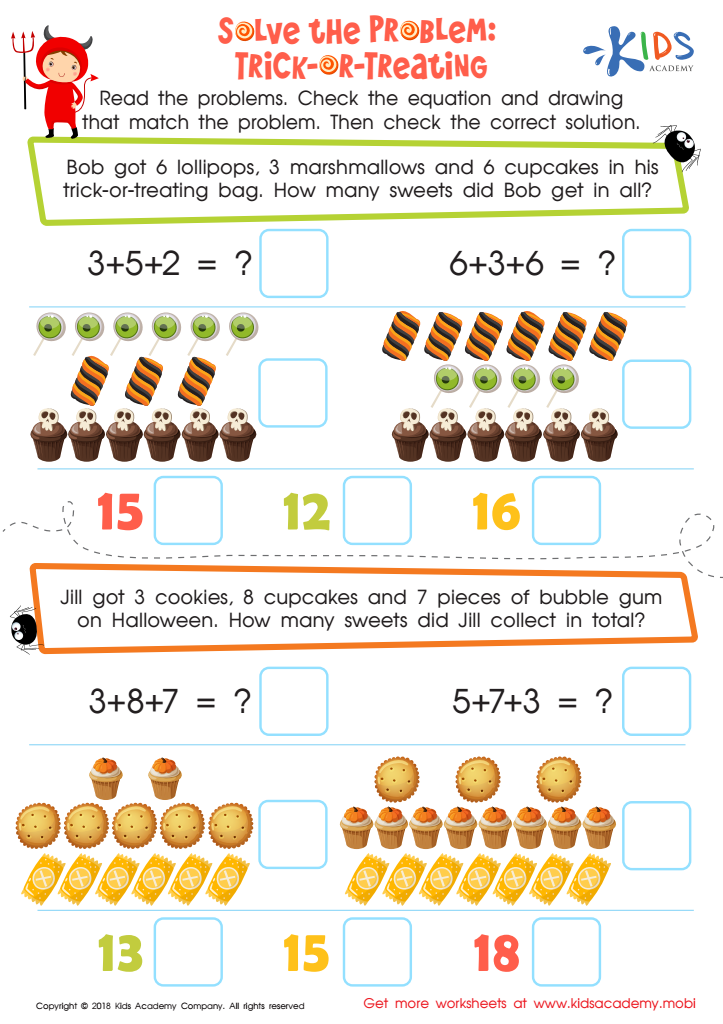

Solve the Problem: Trick–or–treating Worksheet

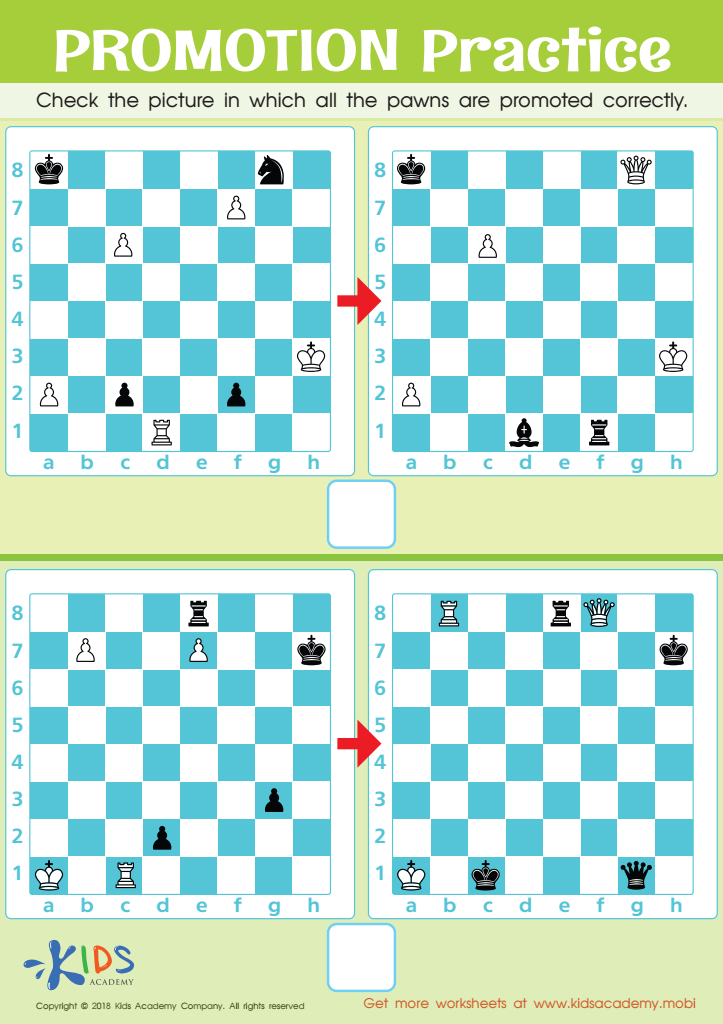

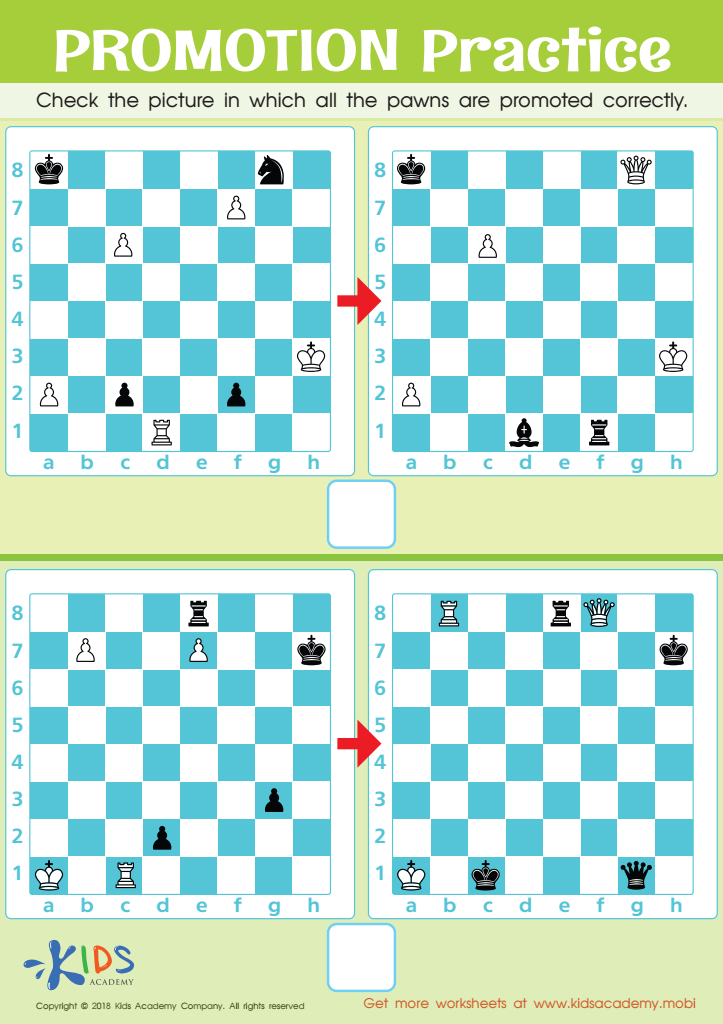

Promotion Practice Worksheet

Teaching money management to children ages 4-7 is crucial for multiple reasons. During these formative years, children are highly impressionable and eager to learn. Introducing concepts like saving, spending, and sharing can lay a strong foundation for responsible financial habits later in life. At this age, children can grasp basic ideas about the value of money and the difference between needs and wants.

Early education in money management can help children understand the importance of saving for future goals, rather than spending impulsively. This helps in developing patience and delayed gratification, which are essential life skills. Simple activities like sorting coins, setting up a small savings jar, and discussing what things cost can make learning about money engaging and practical.

For parents, instilling these habits early provides opportunities for quality bonding and meaningful conversations about financial choices. For teachers, incorporating basic financial literacy can enhance the curriculum by integrating math and social studies, making learning more holistic and applicable to real life.

Moreover, as financial complexities and marketing strategies increasingly target young consumers, equipping them with the skills to navigate these influences becomes vital. Thus, early engagement in money management sets the stage for financial well-being and responsible citizenship in adulthood.

Assign to My Students

Assign to My Students

.jpg)

.jpg)