Money calculation skills Worksheets for Ages 3-7

3 filtered results

-

From - To

Discover our engaging Money Calculation Skills Worksheets, specially designed for children aged 3 to 7. These worksheets provide a fun and interactive way for young learners to develop essential money management skills. Through vibrant illustrations and age-appropriate activities, kids will explore the concepts of counting coins, understanding values, and simple addition and subtraction involving money. Our resources help build confidence and competence in math, setting a strong foundation for financial literacy. Perfect for parents and educators, these worksheets make learning about money enjoyable and effective. Start nurturing your child’s math skills today with our exciting, printable worksheets!

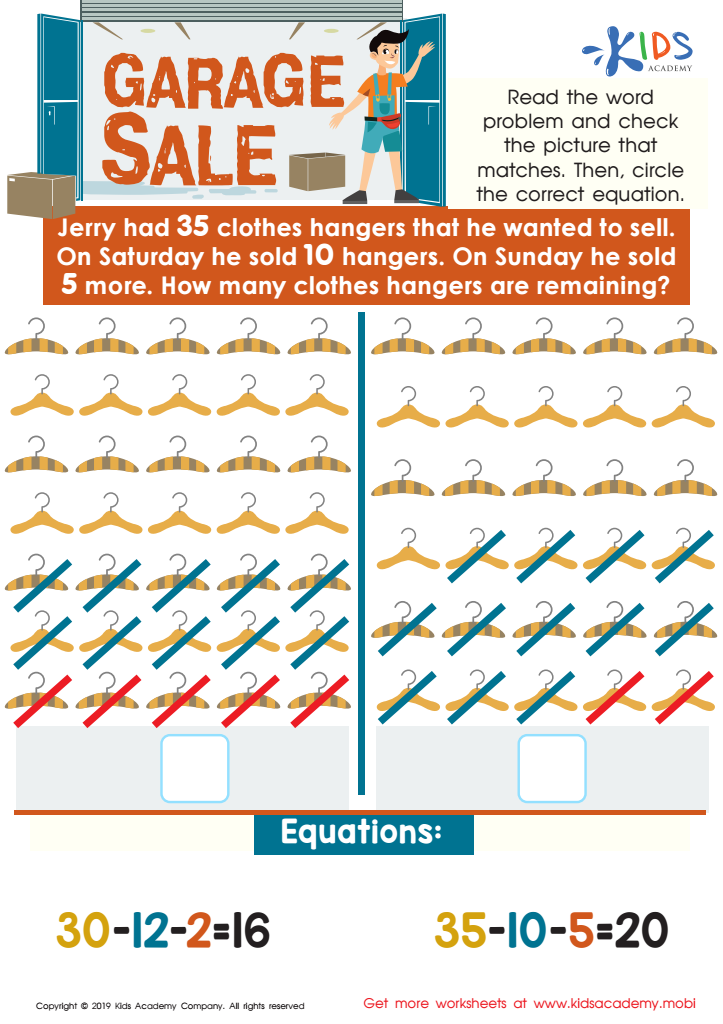

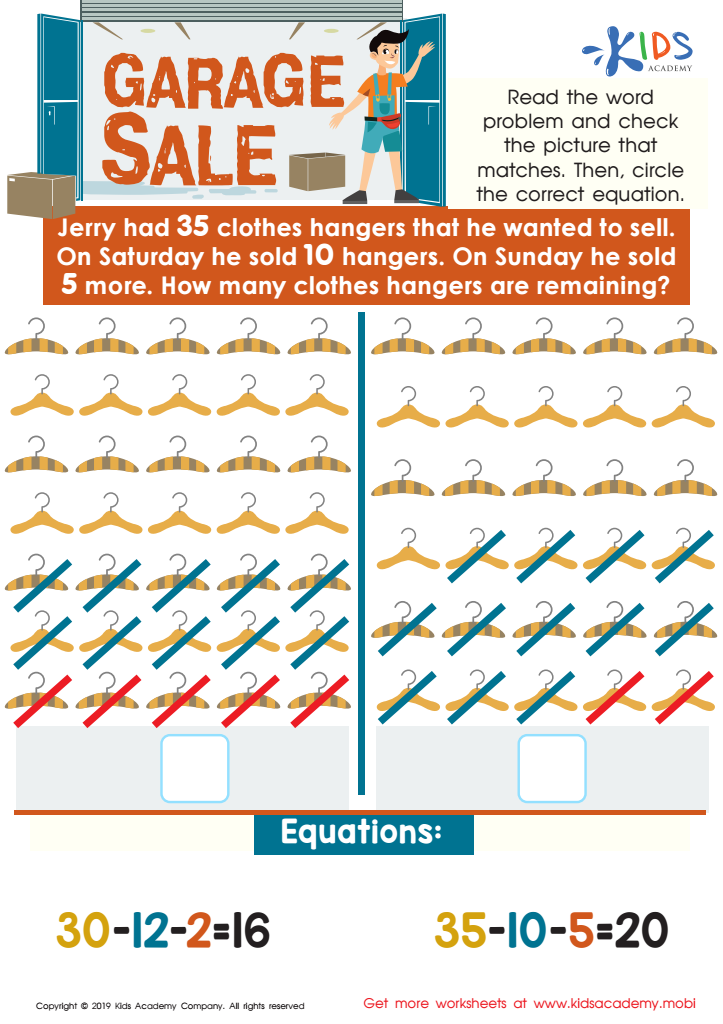

Garage Sale Worksheet

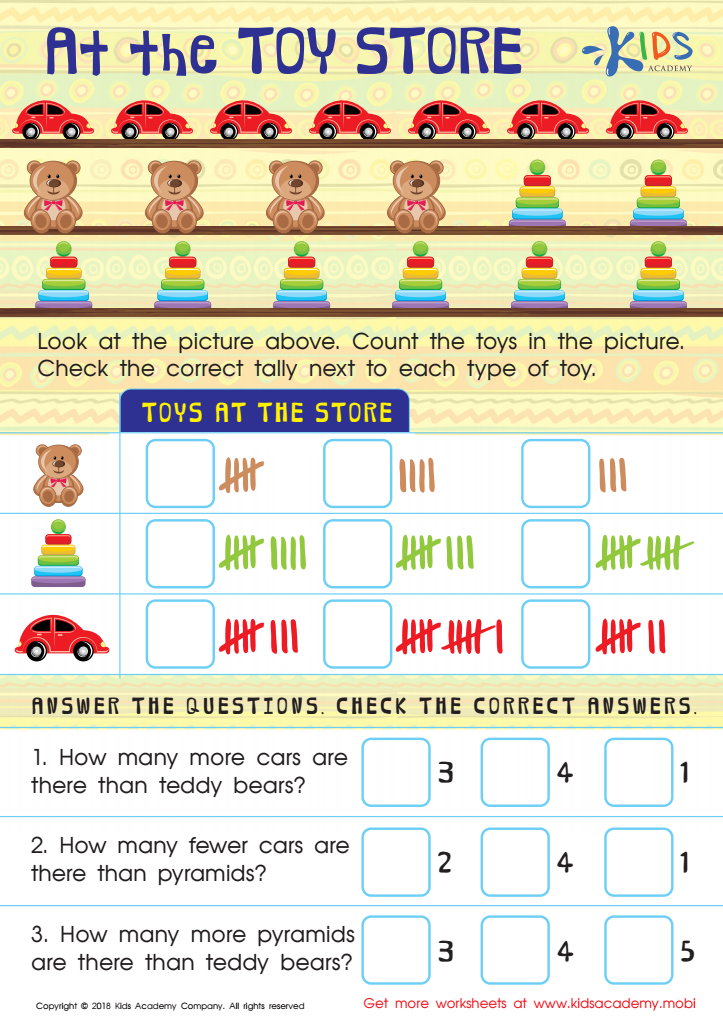

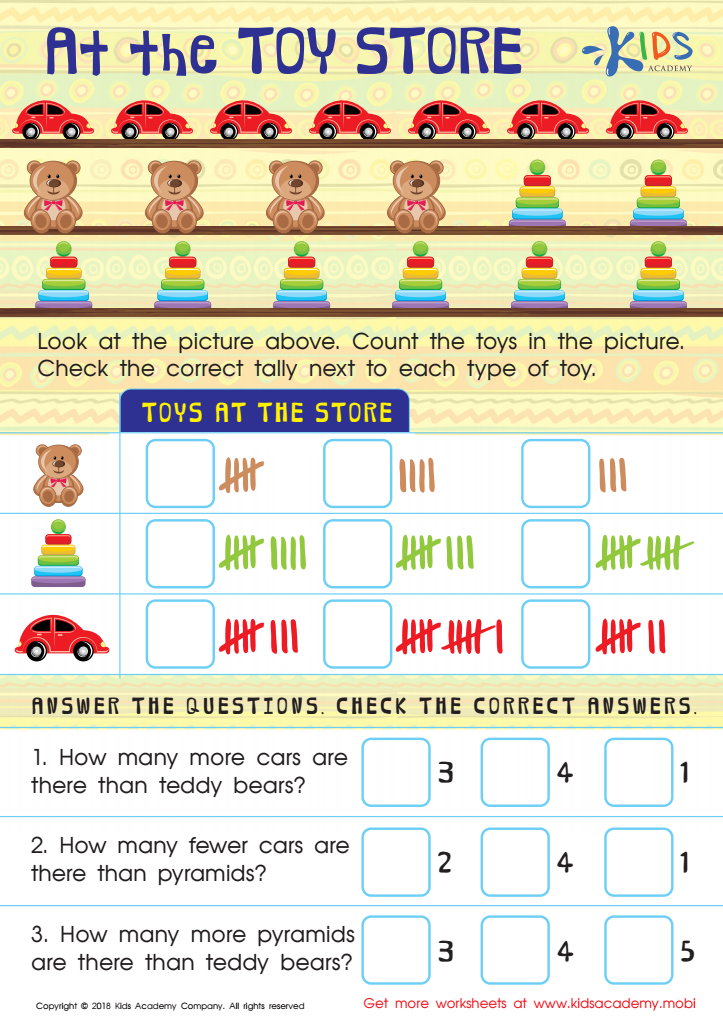

Tally Chart: At the Toy Store Worksheet

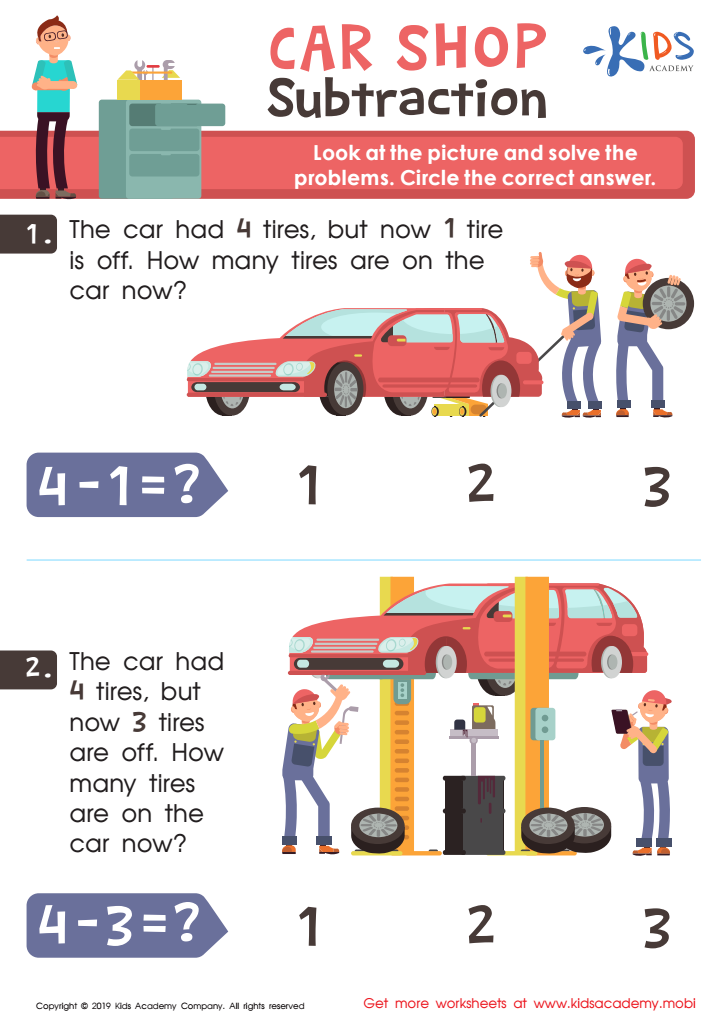

Car Shop Subtraction Worksheet

Developing money calculation skills in children aged 3 to 7 is crucial for several reasons. Firstly, early exposure to concepts of money and counting enhances mathematical understanding and cognitive development. As children learn to recognize coins, bills, and their values, they're not only preparing for future mathematics but also building essential problem-solving abilities.

Secondly, understanding money fosters practical life skills. Children who grasp the basics of currency can participate in simple transactions, learning the value of saving, spending, and sharing. This financial literacy lays a foundation for responsible future financial behaviors, empowering them to make informed choices.

Additionally, incorporating money-related activities into everyday life can boost children's confidence and independence. Tasks such as counting change during shopping trips or helping with a budget can make learning enjoyable while instilling a sense of responsibility.

Finally, money calculation encourages social interactions. Engaging in games or lessons involving money helps children develop communication skills as they discuss transactions and negotiate values.

In summary, fostering money calculation skills in young children equips them with essential lifelong abilities, enhances their problem-solving skills, promotes financial literacy, and encourages independence, paving the way for their future success.

Assign to My Students

Assign to My Students

.jpg)