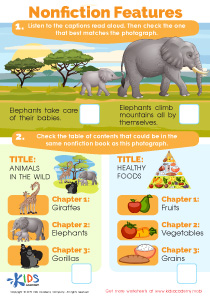

Understanding currency Extra Challenge Worksheets for Ages 3-6

3 filtered results

-

From - To

Enhance your child's financial literacy with our "Understanding Currency Extra Challenge Worksheets for Ages 3-6." These engaging activities are designed to introduce young learners to basic monetary concepts in an enjoyable way. From identifying coins and bills to simple exercises on counting money, our worksheets foster critical thinking and problem-solving skills. Each task is tailored to keep young minds stimulated, ensuring that learning about currency is both fun and educational. Perfect for preschoolers and kindergarten students, these printable worksheets support early numeracy and help build a strong foundation for future financial understanding. Start the journey to financial literacy today!

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

Understanding currency is essential for young children, even as early as ages 3-6, and it provides vital foundational skills with lifelong benefits. When parents and teachers include currency-related challenges, they prepare children not only in basic arithmetic but also in the practical aspects of everyday life.

At this tender age, concepts like recognizing coins and bills, understanding their values, and simple transactions promote cognitive development. These activities help youngsters develop their number sense, which is critical for more advanced math skills. Moreover, these exercises enhance critical thinking and decision-making skills. When children figure out how many coins they need to buy an item or receive as change, they practice problem-solving in a real-world context.

Introducing currency also establishes the basics of financial literacy early on. It allows kids to grasp concepts like saving, spending, and the value of work—skills they will need throughout their lives.

Furthermore, hands-on activities with money are engaging and fun, making learning more memorable. In short, incorporating the Understanding Currency Extra Challenge for children ages 3-6 fosters both academic and practical skills that are indispensable. It sets the stage for them to become more responsible and proficient in managing their personal finances as they grow.

Assign to My Students

Assign to My Students

.jpg)