Financial literacy Extra Challenge Worksheets for Ages 3-7

3 filtered results

-

From - To

Introducing our Financial Literacy Extra Challenge Worksheets for Ages 3-7! These engaging and interactive worksheets are designed to help young learners grasp essential financial concepts in a fun and age-appropriate manner. Covering topics like saving, spending, and sharing, our carefully crafted activities not only enhance counting and decision-making skills but also promote responsible money habits from an early age. Perfect for parents and educators, these worksheets support skills development through imaginative scenarios and practical exercises. Foster your child's financial understanding while encouraging a love for learning that will last a lifetime. Download these worksheets today and watch your little ones thrive!

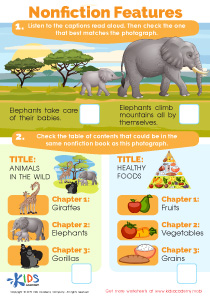

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is a critical life skill that lays the foundation for responsible money management from an early age. Parents and teachers should prioritize financial literacy for children aged 3-7 because these formative years shape their understanding of money, value, and decision-making. Introducing basic financial concepts, such as saving, spending, and sharing, can empower children to make informed choices later in life.

At this stage, kids are curious and eager to learn. Engaging them with simple, fun activities like using play money, tracking a savings jar, or discussing wants vs. needs can instill good habits. Moreover, understanding money fosters a sense of independence, encouraging children to set goals, whether it's saving for a toy or contributing to a family outing.

Additionally, fostering financial literacy early promotes confidence and reduces anxiety surrounding money as they grow. It prepares them for responsible adulthood, potentially reducing issues like debt and poor financial habits. Community involvement, such as workshops or interactive games, further enhances this learning experience, making it enjoyable and memorable. Ultimately, prioritizing financial literacy is an investment in our children’s future well-being and success. By instilling these skills now, we empower them to navigate their financial futures with confidence.

Assign to My Students

Assign to My Students