Financial literacy Extra Challenge Money Worksheets for Ages 3-7

3 filtered results

-

From - To

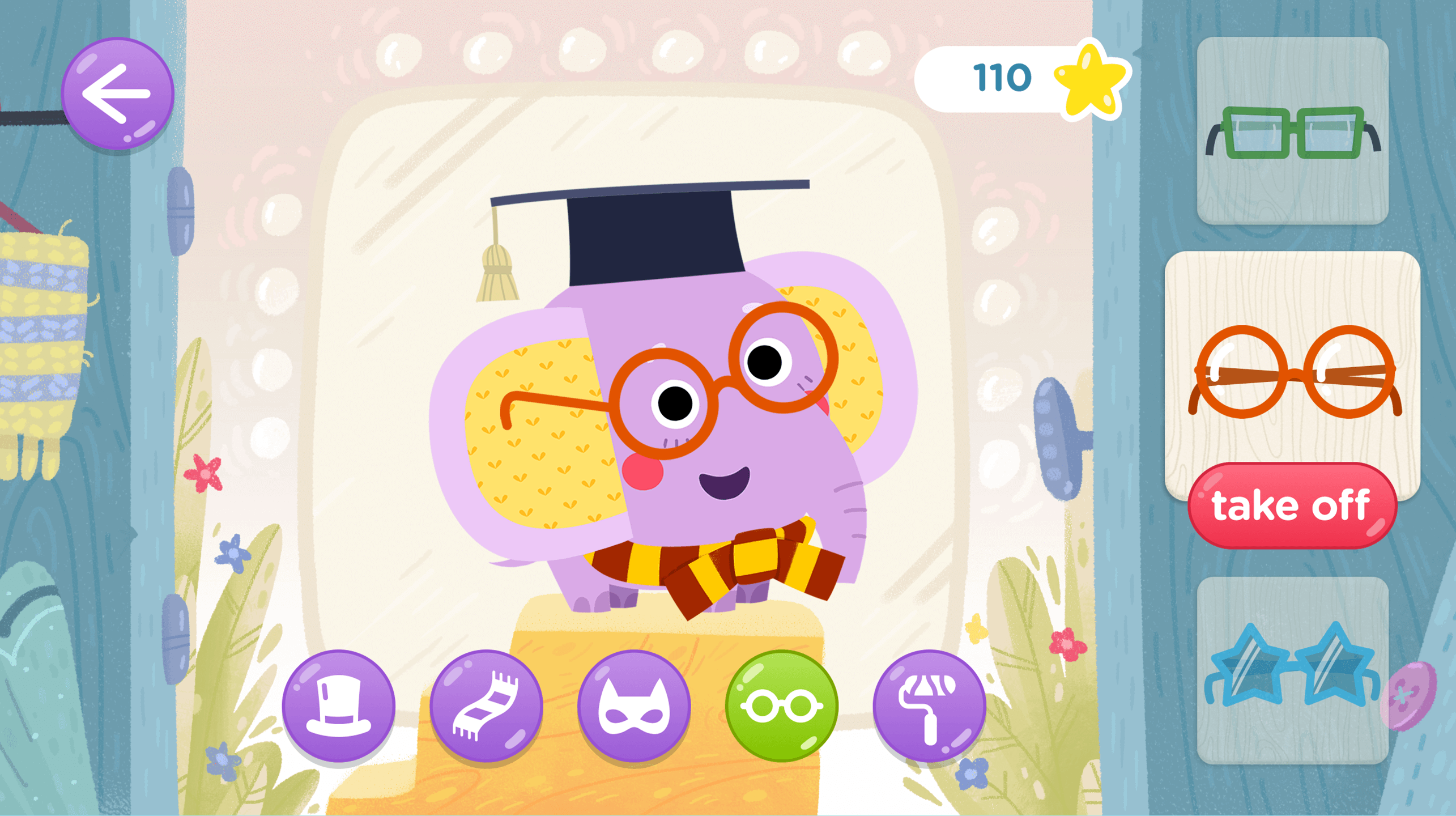

Introducing our Financial Literacy Extra Challenge Money Worksheets designed for young learners aged 3-7. These engaging worksheets are crafted to make financial education fun and accessible. Through various exercises, children will practice counting, recognizing, and managing money. The activities are carefully curated to align with early developmental stages, fostering essential skills in numeracy and financial understanding. By incorporating real-life scenarios, these worksheets help children grasp valuable concepts that will benefit them in everyday situations. Ideal for homeschooling or supplemental classroom practice, our worksheets offer a fantastic starting point for building a strong foundation in financial literacy.

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Introducing financial literacy through games like Extra Challenge Money for children ages 3-7 is essential for several reasons. Firstly, these early years are formative; young brains are incredibly receptive to new concepts. Instilling good habits early fosters an understanding of money's value, savings, and basic financial management principles.

Educational games are engaging and simplify complex ideas, making learning enjoyable rather than overwhelming. Extra Challenge Money can teach kids counting, addition, and subtraction, which are fundamental math skills aligned with many school curriculums. More importantly, these challenges introduce children to the concept of budgeting, distinguishing between needs and wants, and the benefits of savings, which are rarely covered in conventional early-age education.

For parents and teachers, these games are tools to begin essential conversations about money in a safe, controlled, and fun environment. This can prevent future financial pitfalls, as children learn, often through scenarios, about responsibility and consequences related to finances.

By making financial literacy a part of early education, we set a foundation for responsible money management. This preventive approach could result in adults better equipped to handle personal finances, avoiding debt, maintaining savings, and ultimately contributing to a healthier economy. Thus, investing in such educational tools has lasting, positive effects on individual lives and broader society.

Assign to My Students

Assign to My Students