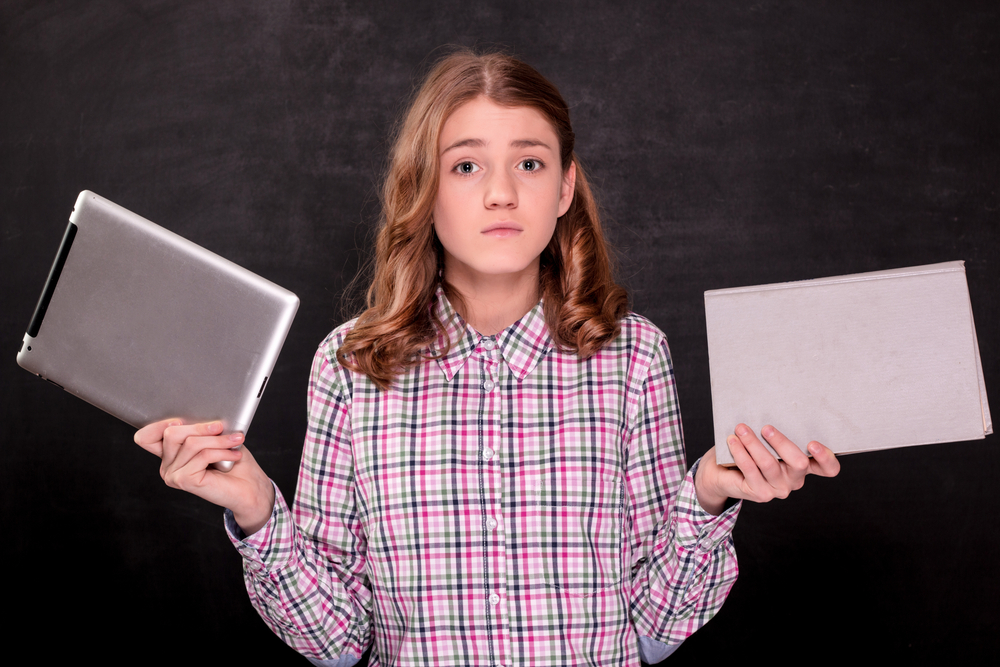

Financial literacy Extra Challenge Grade 3 Worksheets

3 filtered results

-

From - To

Boost your child's understanding of money management with our Financial Literacy Extra Challenge Grade 3 Worksheets. Designed to make learning fun and engaging, these printable worksheets cover essential topics like saving, spending, earning, and budgeting. Tailored for third graders, each sheet encourages critical thinking and teaches the importance of wise financial decisions. Perfect for classroom use or at-home practice, our worksheets align with educational standards and foster lifelong skills. Elevate your child's financial acumen with exercises that transform fundamental concepts into fun, practical lessons. Let’s make financial literacy accessible and enjoyable for young learners!

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy for third graders is essential because it lays the foundation for smart money management in the future. Introducing financial concepts at an early age helps children understand the value of money, savings, and the importance of budgeting. When parents and teachers emphasize financial literacy through extra challenges, they equip students with the skills needed to make informed economic decisions.

Children who learn to manage money early can develop good financial habits, such as saving a portion of their allowance or understanding the difference between wants and needs. These lessons enhance critical thinking and problem-solving skills. For example, a child saving for a desired toy learns patience, goal-setting, and the reward of disciplined saving.

Incorporating financial literacy in the curriculum fosters lifelong skills that go beyond mathematics. It encourages responsible citizenship by teaching students about earning, spending, saving, and sharing. Financial literacy is not just about handling money; it’s also about nurturing confidence and independence.

By introducing these concepts through engaging activities and challenges, parents and teachers help children develop a positive relationship with money. This, in turn, reduces financial anxiety and fosters a sense of security as they grow older, resulting in more financially stable adults. So, nurturing financial literacy from an early age is a critical investment in the child's future.

Assign to My Students

Assign to My Students