Money management skills Addition & Subtraction Worksheets

3 filtered results

-

From - To

Discover the essential "Money Management Skills Addition & Subtraction Worksheets" designed to help young learners develop key financial literacy. These engaging worksheets focus on teaching students how to add and subtract money, making math fun and practical. Your child will gain confidence in managing currency while solving real-life problems involving prices, purchases, and change. Adopting interactive exercises, these worksheets provide students with the foundation needed to make informed financial decisions later in life. Perfect for early-grade education, they support curriculum goals and enhance critical thinking. Equip your child with vital skills for a successful financial future! Explore our collection today!

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

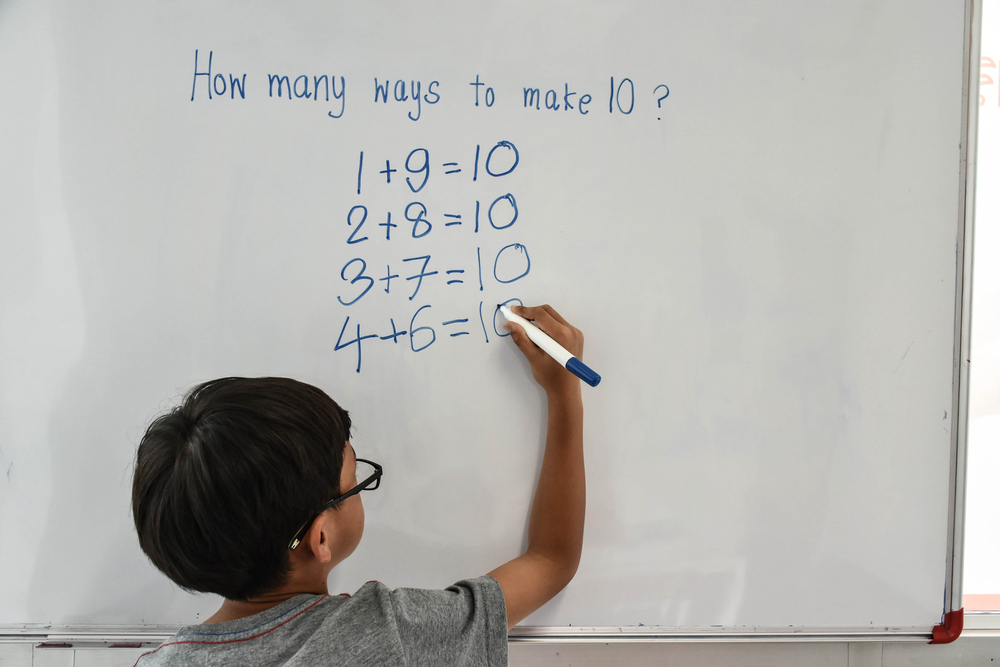

Money management skills, particularly in the context of addition and subtraction, are fundamental for children's financial literacy and everyday decision-making. Teaching these concepts early equips children with essential tools to understand and navigate financial situations they will encounter throughout life.

Firstly, grasping addition and subtraction lays the foundation for more complex mathematical concepts. When children learn to add and subtract amounts of money, they develop problem-solving skills and critical thinking necessary for budgeting, saving, and spending wisely. For instance, when figuring out how to buy items within a set budget, they develop an understanding of value and importance of making educated financial choices.

Secondly, these skills foster responsibility and independence. By managing small amounts of money through allowances or simple transactions, children experience the consequences of their financial decisions. They learn to track expenses, prioritize needs over wants, and delay gratification—a fundamental trait in money management.

Finally, instilling early money management skills reduces anxiety around finances as children grow into adolescents and adults. Parents and teachers play a vital role in this process, as they can create learning opportunities around real-life financial scenarios, setting the stage for future financial success and stability.

Assign to My Students

Assign to My Students