Money management Normal Worksheets for Ages 3-6

3 filtered results

-

From - To

Introducing our Money Management Normal Worksheets for ages 3-6, designed to instill financial literacy in young learners. These engaging, age-appropriate printables from Kids Academy help children grasp basic money concepts, including identifying coins and notes, understanding value, and practicing simple transactions. By incorporating fun activities and relatable scenarios, our worksheets make learning about money interactive and enjoyable. Perfect for parents and teachers, these worksheets aim to build foundational skills essential for future financial understanding, ensuring kids start their money management journey early and confidently. Download today and give your child the tools they need for lifelong financial success!

Grocery Store Worksheet

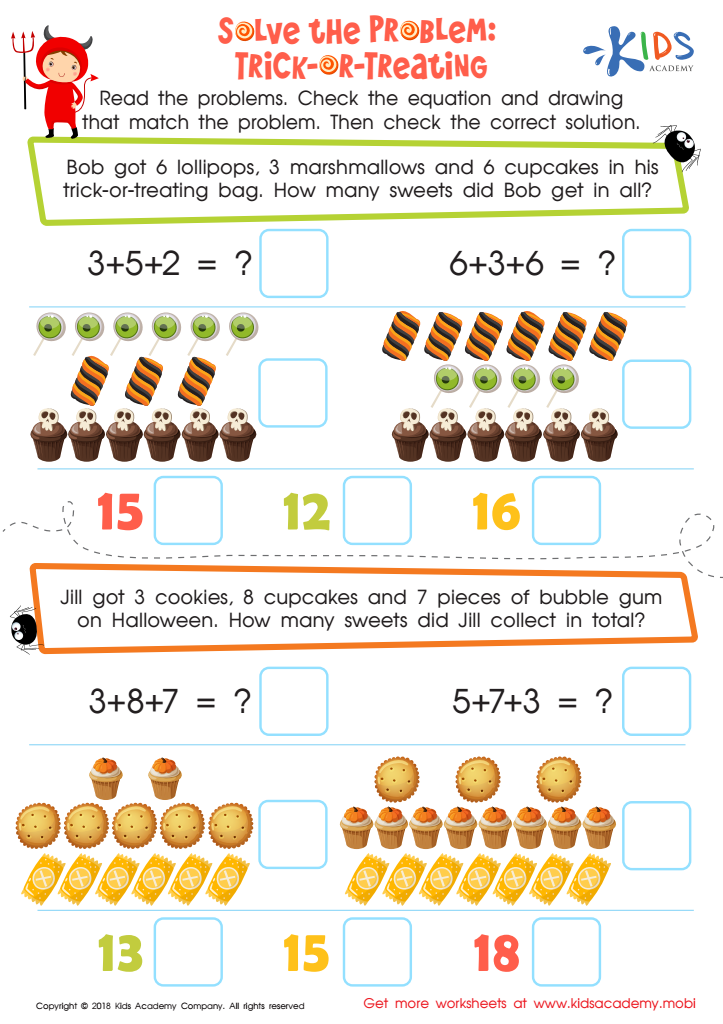

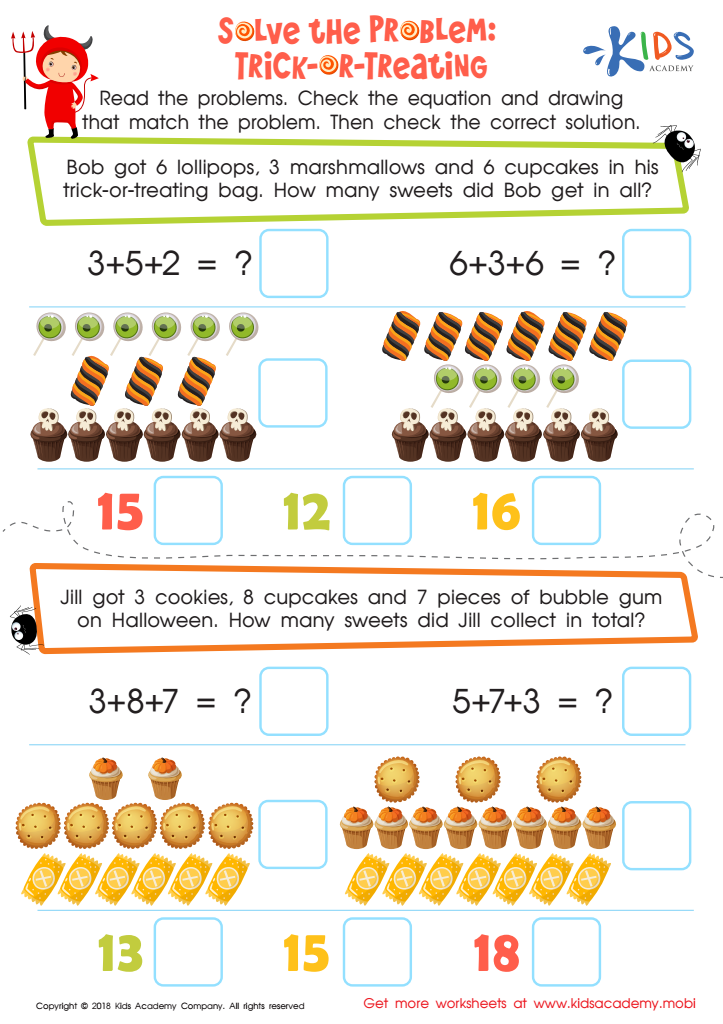

Solve the Problem: Trick–or–treating Worksheet

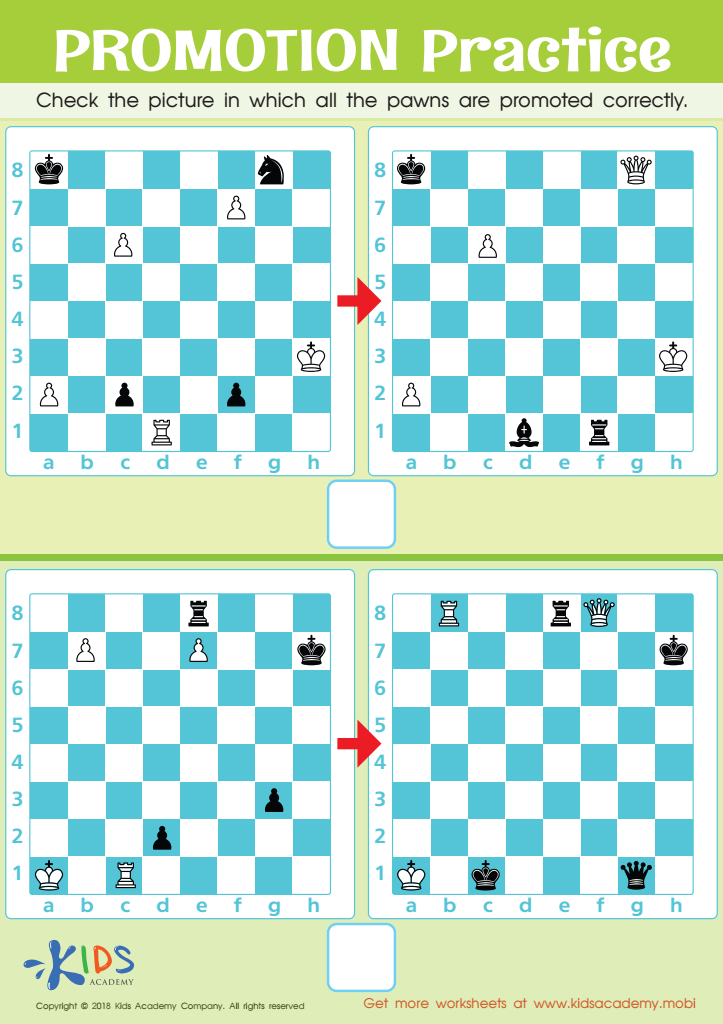

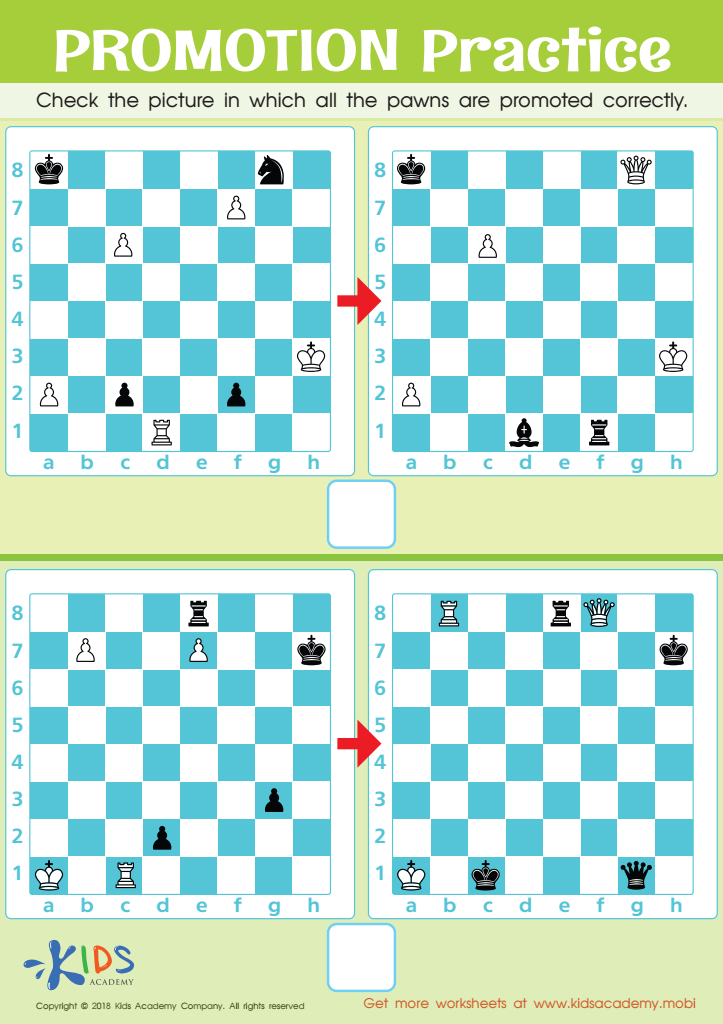

Promotion Practice Worksheet

Introducing money management fundamentals to children aged 3-6 is crucial for their future financial well-being. At this young age, kids are incredibly receptive and can start forming healthy financial habits that will stick with them throughout their lives. Understanding the basic concepts of saving, spending, and valuing money can establish a foundation for future financial literacy.

Parents and teachers should care about this because it teaches responsibility and the concept of making choices. Learning that money is earned and has to be allocated wisely can help children appreciate the value of everything they have. This makes them less likely to take things for granted and more mindful of their spending.

Moreover, early lessons in money management help in developing math skills. Counting coins and making small transactions can enhance their numerical understanding in a practical, real-world context. This is a fun and engaging way to build a crucial academic skill.

Financial education at a young age can also foster independence and confidence. It equips children with the tools to make decisions and solve problems, attributes that are beneficial beyond financial matters. Therefore, both parents and teachers should integrate basic money management lessons into daily activities, setting the stage for a financially responsible adulthood.

Assign to My Students

Assign to My Students