Financial literacy Grade 3 Money Worksheets

4 filtered results

-

From - To

Explore our engaging Financial Literacy Grade 3 Money Worksheets, designed to empower young learners with essential money management skills. Our worksheets offer fun and interactive activities that teach students how to recognize, count, and use money effectively. With colorful illustrations and real-life scenarios, students will practice determining coin values, making change, and understanding basic budgeting concepts. These resources encourage mathematical thinking while fostering financial responsibility. Perfect for classroom use or at-home learning, our worksheets aim to equip third graders with the fundamental skills they need to navigate the world of finance confidently. Begin your child's financial education journey today!

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy at a Grade 3 level is vital for building a strong foundation for children's future financial habits. At this age, students begin to understanding the concepts of money, saving, spending, and budgeting. By instilling these principles early, parents and teachers help children develop critical thinking skills about financial decision-making.

Teaching children about money management encourages them to become responsible consumers. They learn the value of saving, which fosters patience and delayed gratification—skills essential for navigating a world filled with instant gratification. Moreover, understanding basic financial concepts can empower children to make informed choices, reducing the likelihood of poor financial decisions in adulthood.

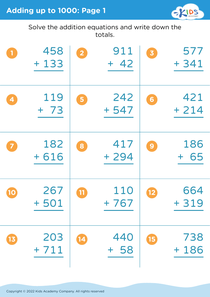

Incorporating financial literacy into the curriculum also enhances essential math skills. When children engage in activities such as counting money, making change, and planning budgets, they apply math in real-world situations. This integration helps solidify their math knowledge while making learning more relevant and exciting.

Furthermore, fostering financial literacy can alleviate anxiety around money, moving towards a generation more adept at managing their financial futures. Overall, prioritizing financial literacy in Grade 3 not only enriches a child's education but also equips them with lifelong skills essential for responsible financial behavior.

Assign to My Students

Assign to My Students