Financial literacy Math Worksheets for Ages 4-5

4 filtered results

-

From - To

Introduce your 4-5-year-olds to the basics of financial literacy with our engaging Math Worksheets! Carefully designed to blend fun and learning, these worksheets cover essential skills like understanding money, recognizing coins, and grasping simple concepts of savings and spending. Each activity is crafted to be age-appropriate, promoting both cognitive and numerical development. Our printable resources make learning interactive and enjoyable, ensuring young learners build a solid foundation in money management. Perfect for parents and educators aiming to instill financial confidence early on. Set the stage for smart financial choices with Kids Academy's educational worksheets!

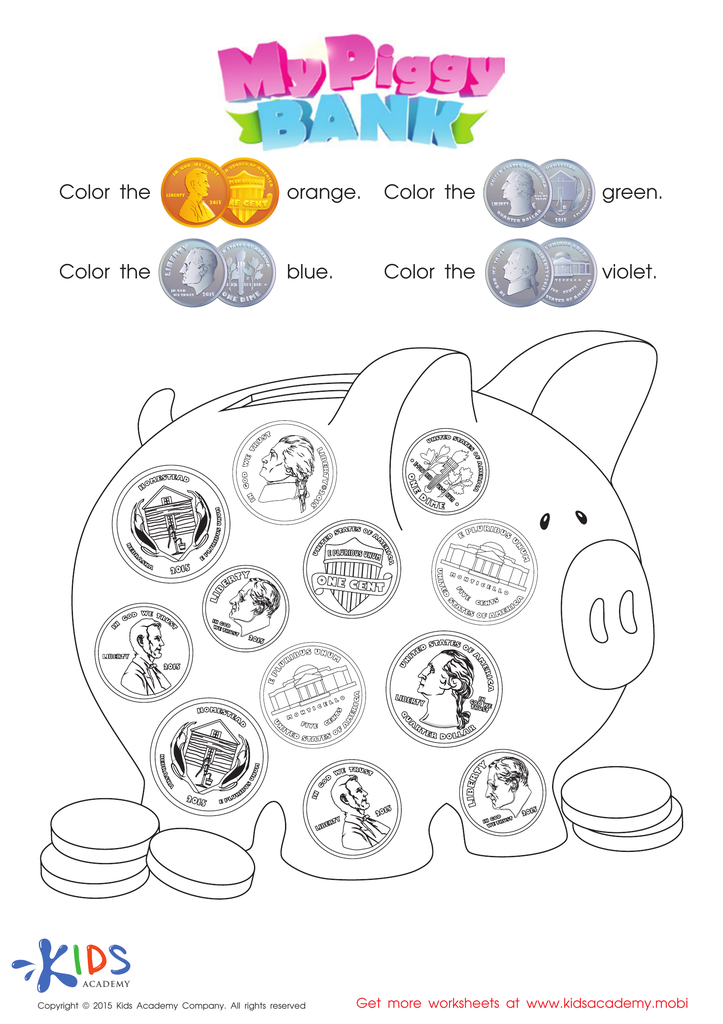

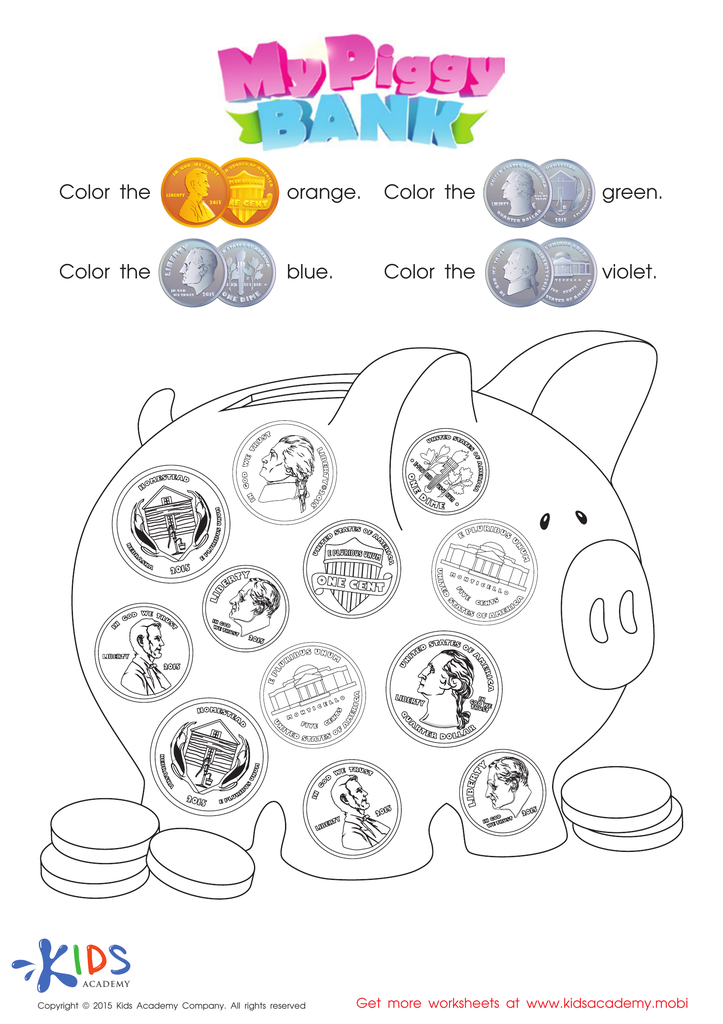

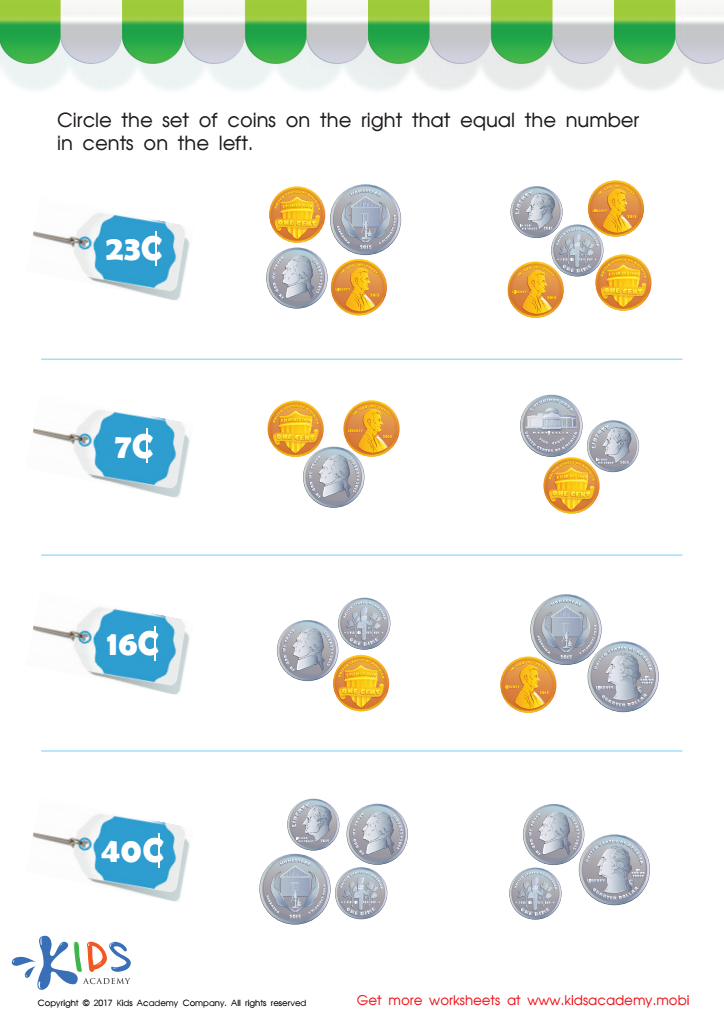

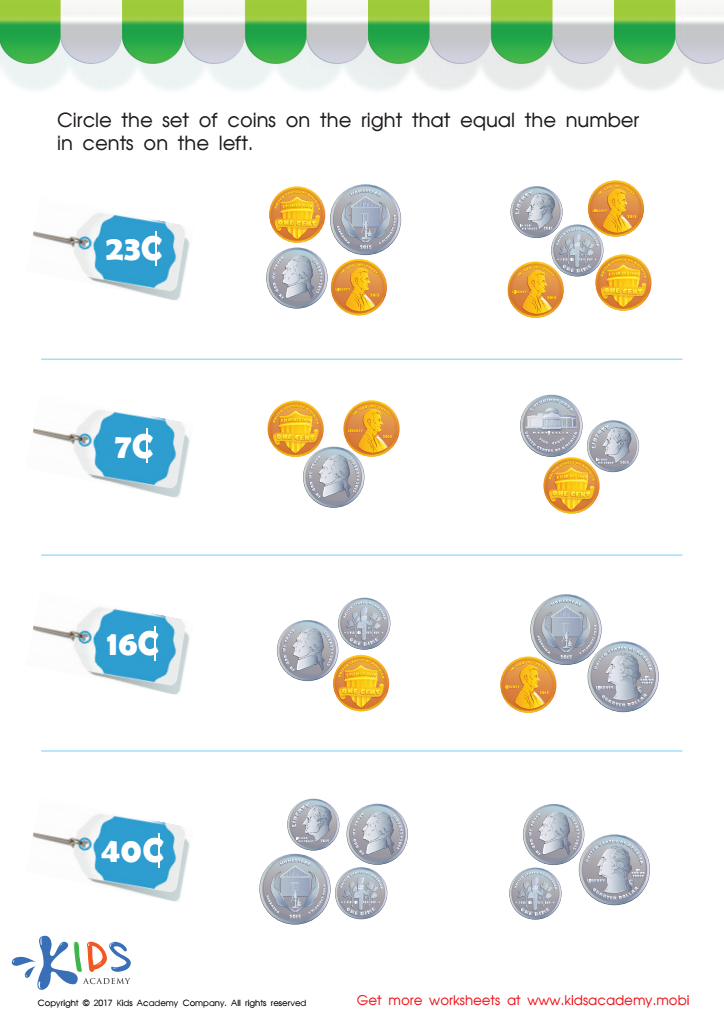

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

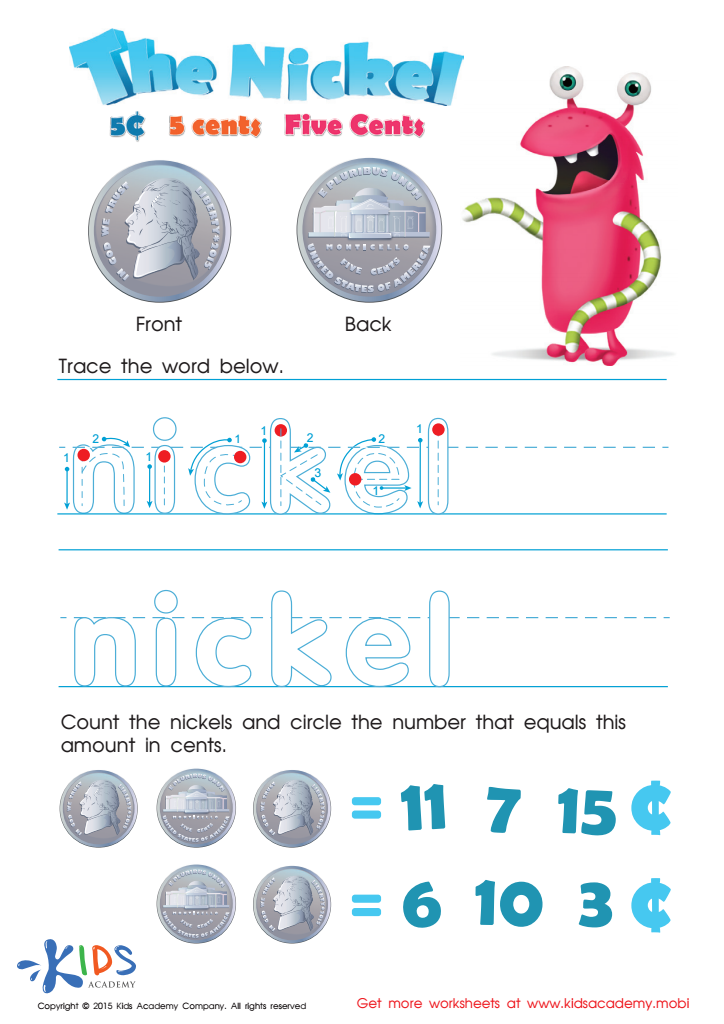

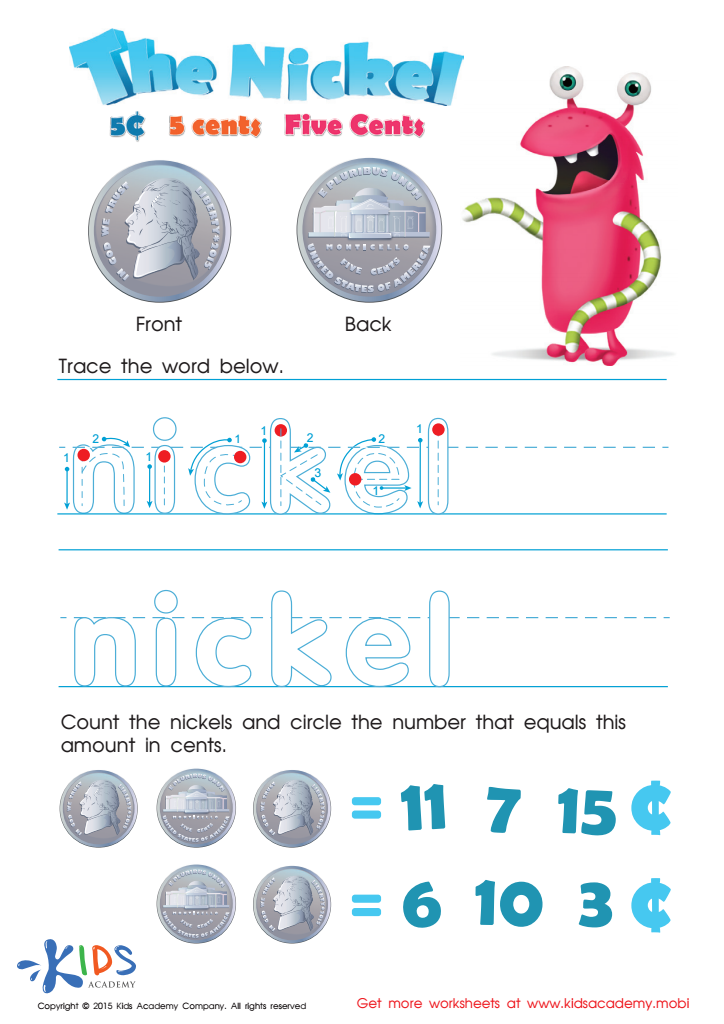

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Teaching financial literacy through math to children ages 4-5 is crucial for several reasons. At this formative stage, children's brains are exceptionally receptive to learning new concepts, including basic numbers and counting. Introducing financial literacy through simple math helps them grasp essential skills that form the foundation for more complex financial understanding later in life.

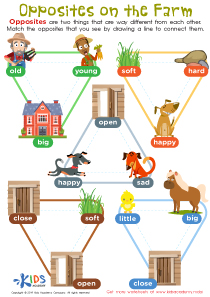

When parents or teachers engage young children with basic financial concepts—like identifying coins, understanding simple transactions, and recognizing the difference between needs and wants—they are setting the stage for responsible financial behaviour. These concepts can be introduced in fun, age-appropriate ways through games, stories, and hands-on activities. For example, using play money during role-play shop scenarios can make counting and simple arithmetic a practical skill rather than an abstract concept.

Moreover, early financial literacy nurtures important cognitive abilities like reasoning, problem-solving, and critical thinking. Teaching children the value of money, even in very basic terms, helps them appreciate savings and delayed gratification, reducing potential financial stress in the future. Fostering a positive and proactive relationship with money from a young age instils confidence and independence, equipping them with lifelong skills necessary for making informed financial decisions. Parents and teachers investing time in this area are not just teaching math; they are building a solid groundwork for future financial well-being.

Assign to My Students

Assign to My Students