Money recognition Worksheets for Ages 4-7

9 filtered results

-

From - To

Enhance your child's money recognition skills with our engaging worksheets designed for ages 4-7! These fun and educational activities help children identify different coins and bills, understand their values, and develop essential mathematical skills. Our printable resources feature colorful visuals and interactive tasks that keep young learners motivated and excited about mastering money concepts. Ideal for use at home or in the classroom, these worksheets cater to various learning styles, making money learning accessible and enjoyable. Build a strong financial foundation for your child with our expertly crafted exercises that promote confidence and competence in managing money. Start your journey today!

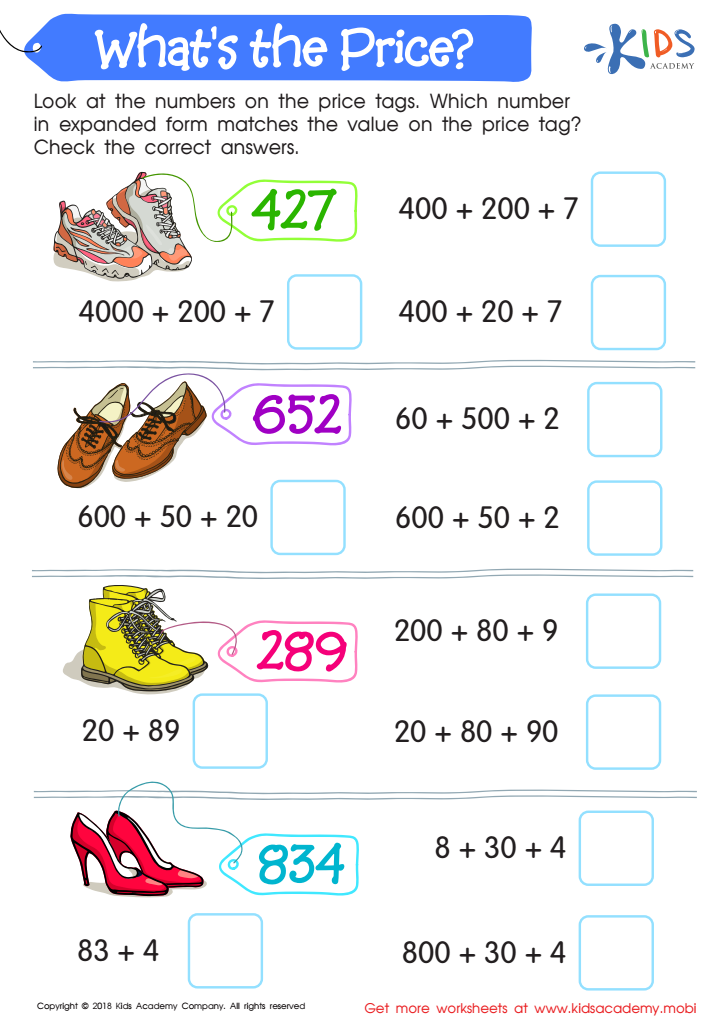

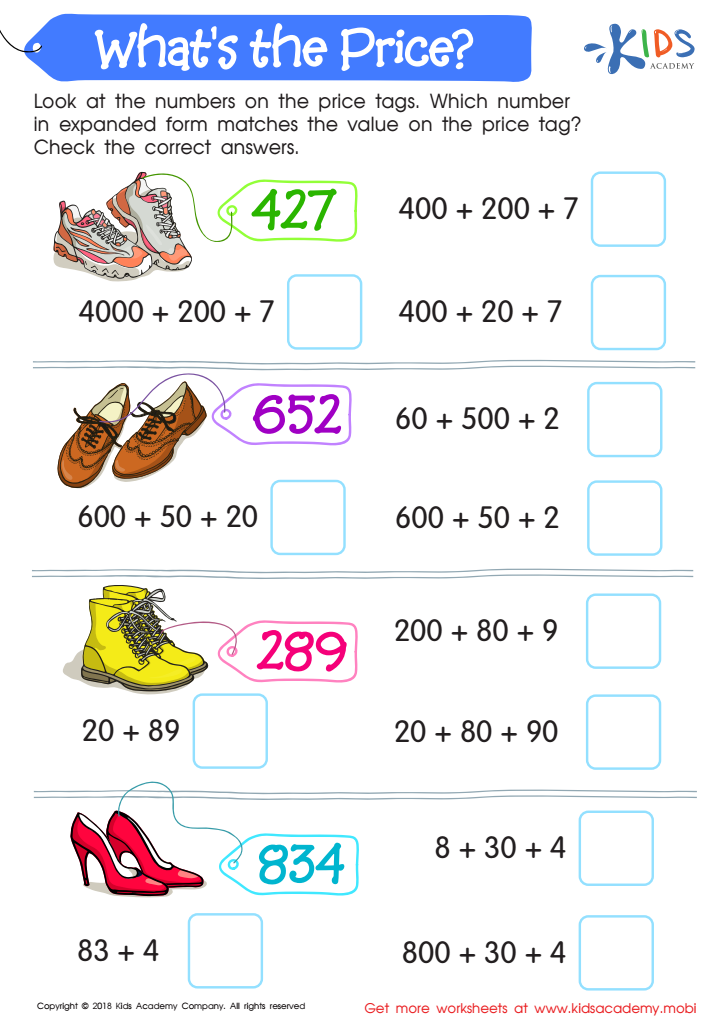

What's the Price? Worksheet

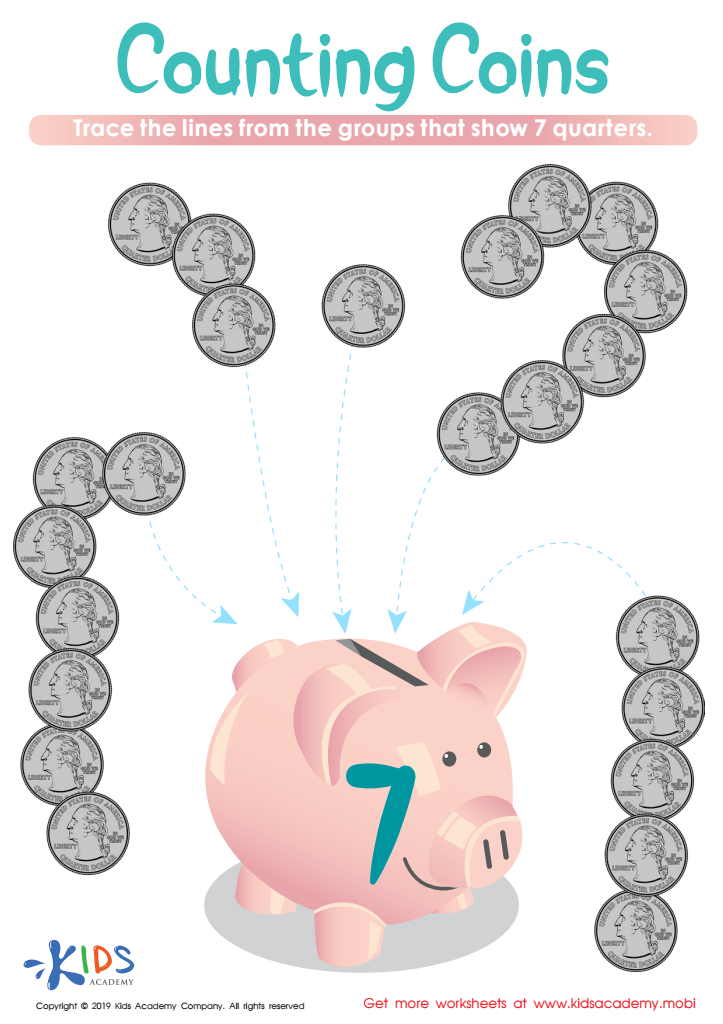

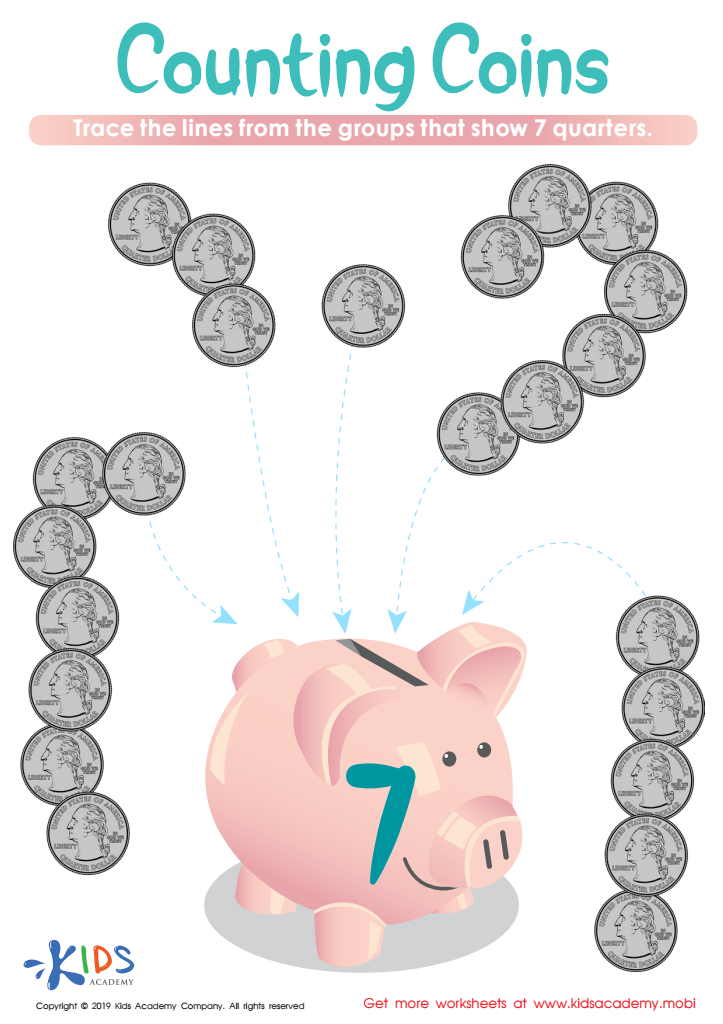

Counting Coins Worksheet

How Many Coins Money Worksheet

One Cent or the Penny Money Worksheet

Coin Names and Values Money Worksheet

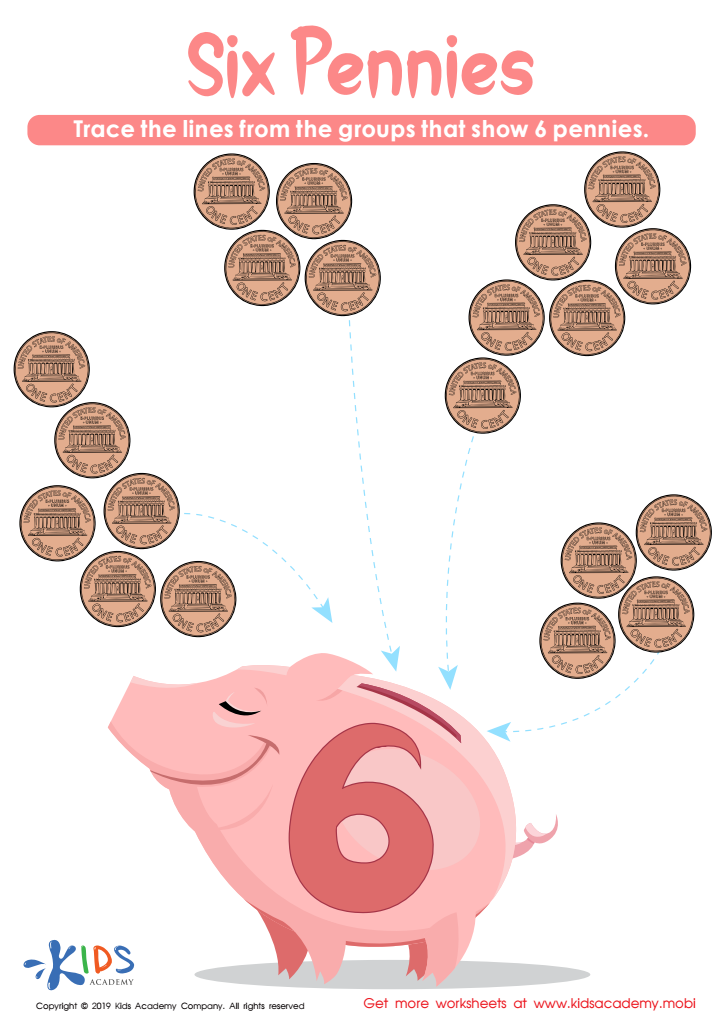

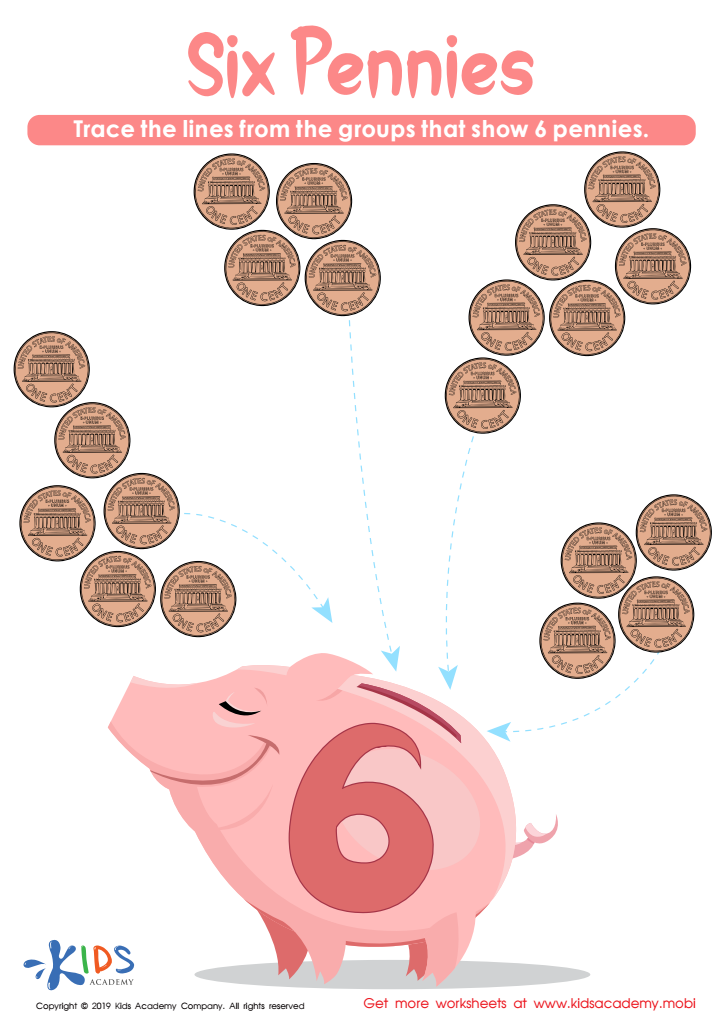

Six Pennies Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Money recognition is a crucial skill for children aged 4-7 as it lays the foundation for financial literacy and responsible money management later in life. At this formative stage, children begin to understand the concept of value and exchange through everyday experiences, such as shopping trips or playtime activities involving pretend transactions.

Early money recognition helps children develop critical cognitive skills, including counting, sorting, and problem-solving. By identifying and distinguishing between different coins and bills, children enhance their mathematical abilities while making learning fun and relevant. Understanding money also supports social skills, as children learn to communicate about purchases and share resources with peers.

Furthermore, financial literacy increasingly plays a vital role in a child's overall education, equipping them with tools to navigate an increasingly complex economy. Recognizing money fosters an appreciation for saving and budgeting, whether they are saving for a desired toy or learning the importance of making choices based on available resources.

Ultimately, by prioritizing money recognition, parents and teachers empower children to build confidence and competencies that contribute to their independence. This investment in their early development sets the stage for informed financial decisions in adulthood, promoting a healthier relationship with money.

Assign to My Students

Assign to My Students