Understanding economics Worksheets for Ages 4-9

3 filtered results

-

From - To

Discover our engaging "Understanding Economics Worksheets" designed for children ages 4-9! These worksheets introduce fundamental economic concepts through fun and interactive activities that captivate young minds. Students will explore basic principles of money, goods, services, and trade in a playful, accessible manner. Our worksheets promote critical thinking and real-world connections, making economics relatable for early learners. Parents and educators can easily incorporate these resources into lesson plans or home activities, fostering a solid foundation for future learning in economics. Unlock your child's potential and encourage them to grasp essential skills through our thoughtfully crafted worksheets today!

Human and Capital Resources Worksheet

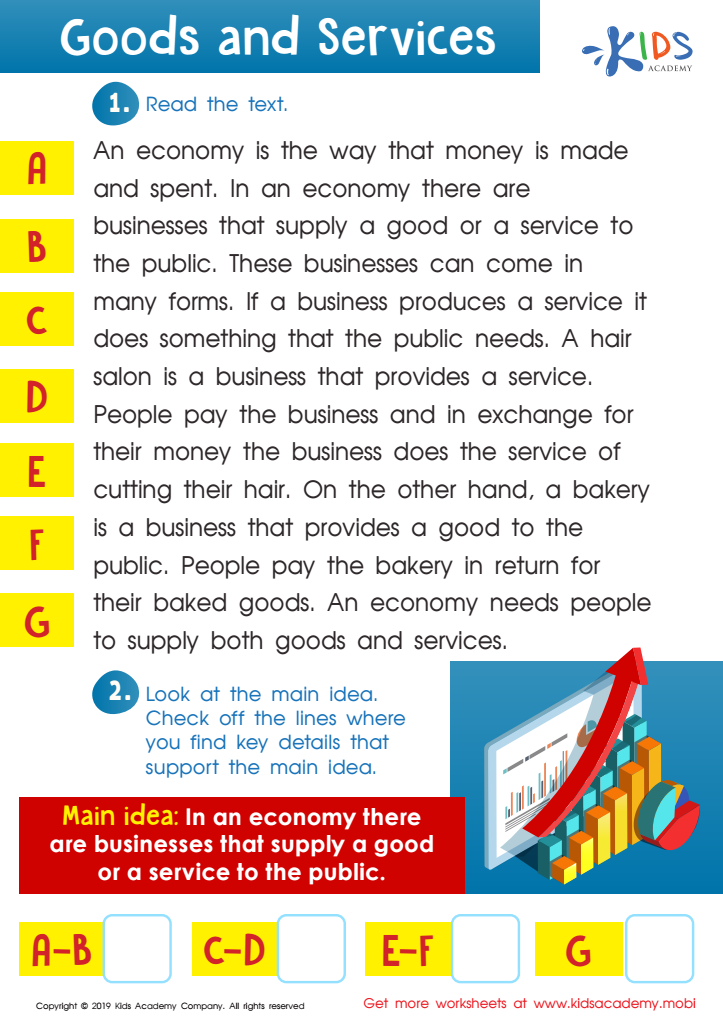

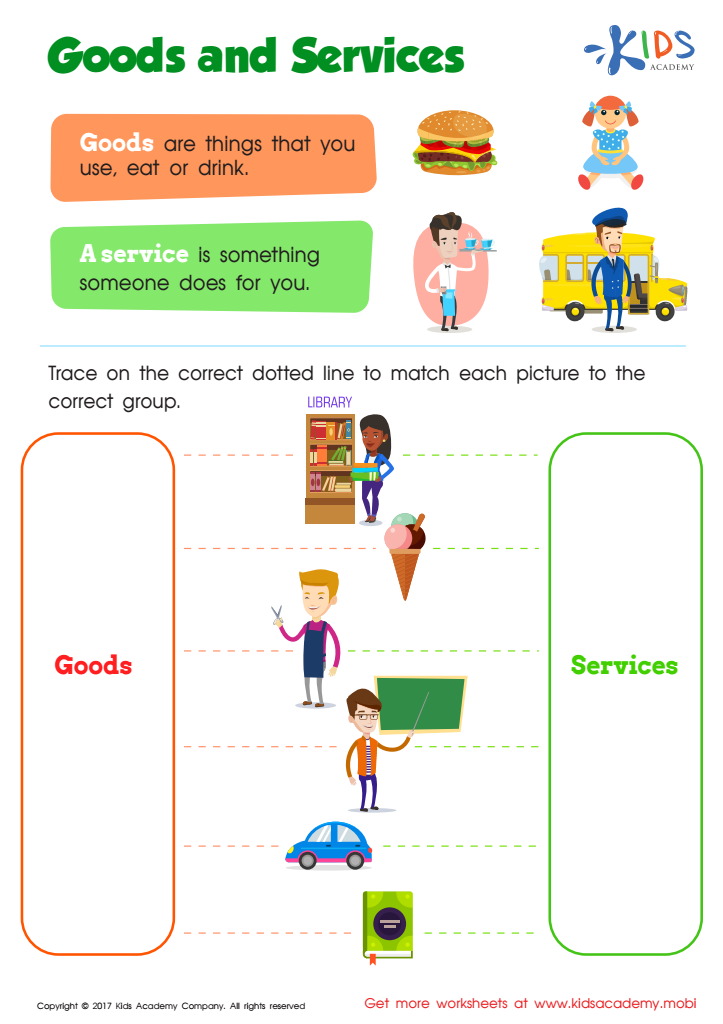

Goods and Services Worksheet

Understanding economics at an early age helps children develop essential life skills that foster responsible decision-making. When parents and teachers introduce economic concepts to children aged 4-9, they lay the groundwork for critical thinking and problem-solving abilities that are vital for life's challenges.

At this developmental stage, children are naturally curious about their environment, making it an opportune moment to introduce ideas like needs versus wants, saving, sharing, and the value of money. Teaching economics can facilitate discussions about choices and consequences, encouraging children to consider how their actions impact themselves and others.

Moreover, early exposure to economic principles promotes a sense of empowerment. Children learn to understand the importance of budgeting their allowance or resources, which instills values of financial responsibility from a young age. Lessons on trading or bartering can also enhance social skills and cooperation.

Incorporating play-based learning, such as role-playing a market or running a lemonade stand, can make economic concepts engaging and memorable. Ultimately, nurturing an understanding of these ideas equips children with lifelong skills that can contribute to intelligent consumer behavior, responsible citizenship, and financial independence in their future. Thus, parents and teachers play a crucial role in preparing children for a financially literate adulthood.

Assign to My Students

Assign to My Students