Money management skills Worksheets for Ages 5-9

4 filtered results

-

From - To

Introducing our interactive Money Management Skills Worksheets for Ages 5-9! These engaging, printable resources are designed to teach young learners essential financial literacy concepts, including saving, spending, and budgeting through fun, age-appropriate activities. Our worksheets help kids understand the value of money and build a solid foundation for future financial responsibility. Each activity encourages critical thinking, decision-making, and practical application of money management. Perfect for both classroom settings and at-home learning, these worksheets make finance education accessible and enjoyable for young minds. Start your child's journey to financial literacy today with our comprehensive collection!

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

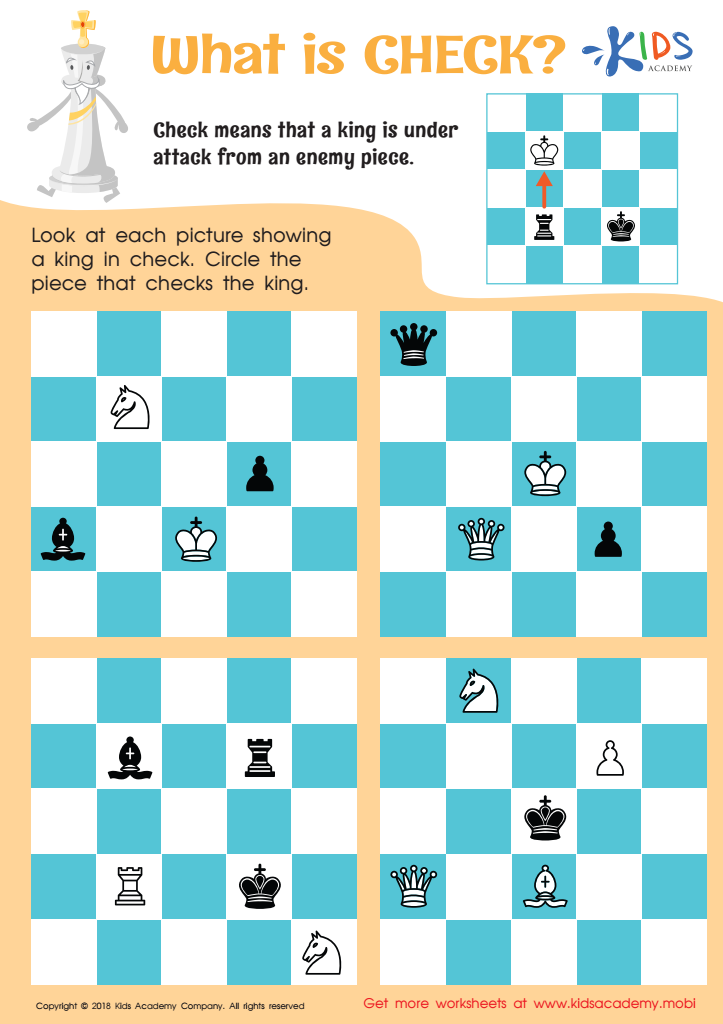

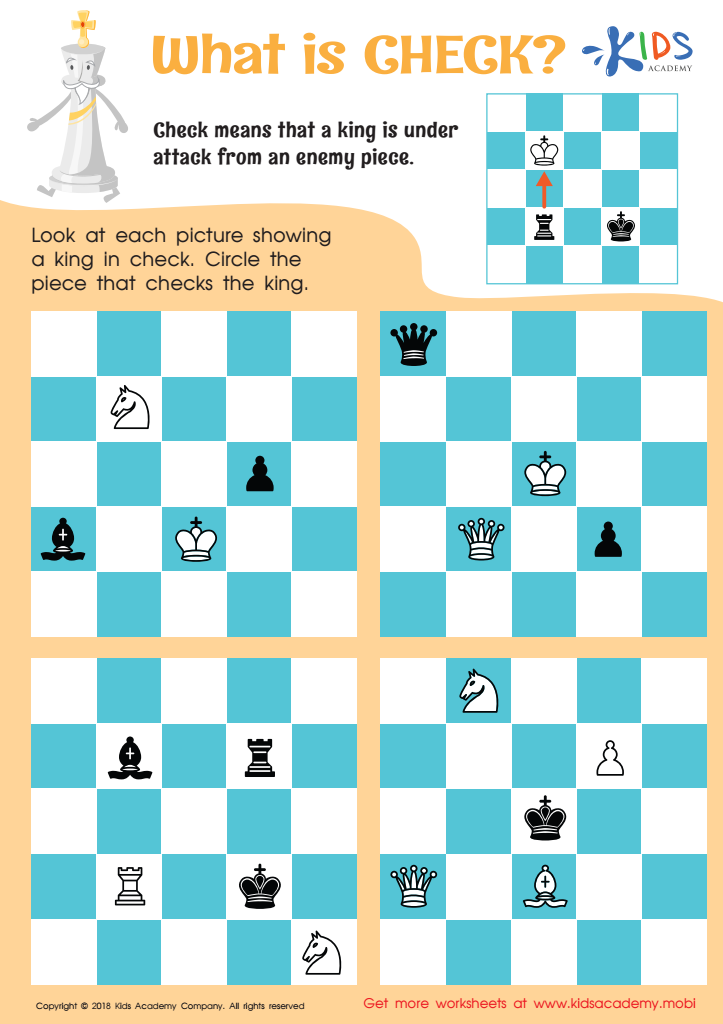

What is Check? Worksheet

Teaching money management skills to children aged 5-9 is incredibly important as it lays a foundational understanding of financial literacy that can benefit them throughout their lives. At this young age, children are at a prime stage for cognitive development and are highly impressionable, making it an ideal time to introduce basic financial concepts. Understanding simple ideas like saving, spending, and the value of money can foster responsible behavior and decision-making skills.

By instilling these financial habits early on, parents and teachers can help children develop a curious and respectful attitude towards money. This early education can make children more aware of the difference between needs and wants, promoting better budgeting as they grow older. It builds a mindset that prioritizes saving and planning over impulse purchases.

Moreover, teaching money management actively involves mathematical skills such as counting, addition, and subtraction, reinforcing school concepts in a real-world context. It also encourages organizational skills and delayed gratification, both critical life skills.

Ultimately, children who learn about money management early are more likely to become financially independent adults, capable of making informed decisions about their finances. Both teachers and parents play a crucial role in fostering these essential skills, contributing to the overall financial well-being and stability of future generations.

Assign to My Students

Assign to My Students