Money management skills Worksheets for Ages 6-8

4 filtered results

-

From - To

Teach your young children essential money management skills with our engaging worksheets designed for ages 6-8. Developed by experts, these printable activities make learning about saving, spending, and budgeting fun and interactive. Our worksheets cover basic concepts like identifying coins and bills, understanding values, and making simple purchases, all tailored to fit young learners’ developmental stages. By mastering these foundational skills, kids can build a solid financial literacy foundation that will serve them throughout their lives. Visit Kids Academy to explore our full range of money management worksheets and set your children on the path to smart financial habits today!

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

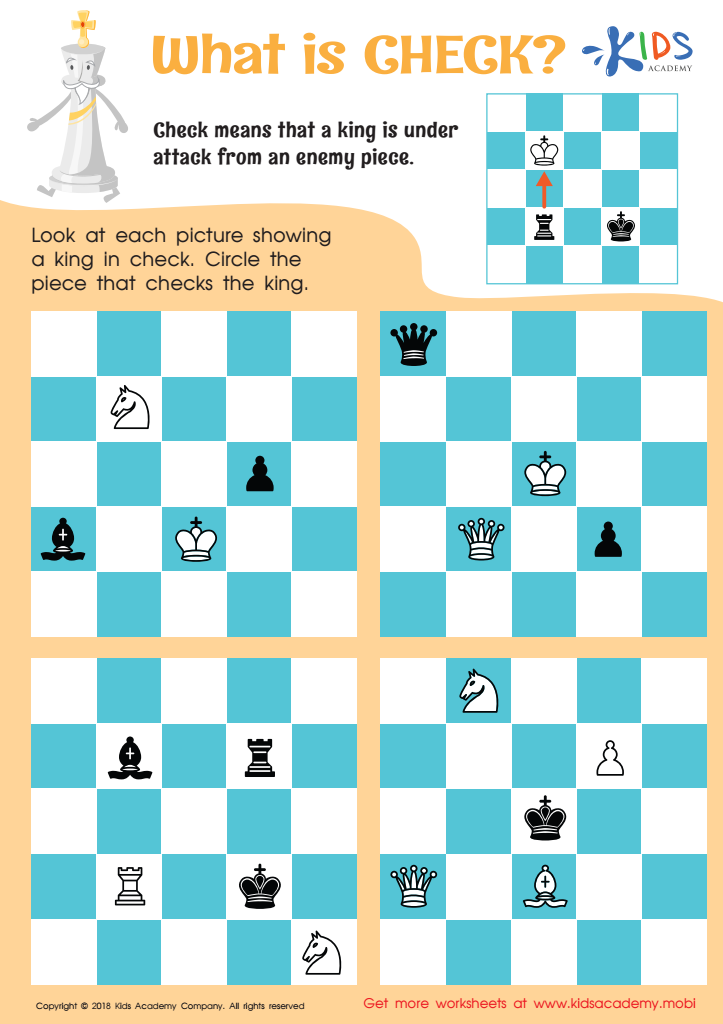

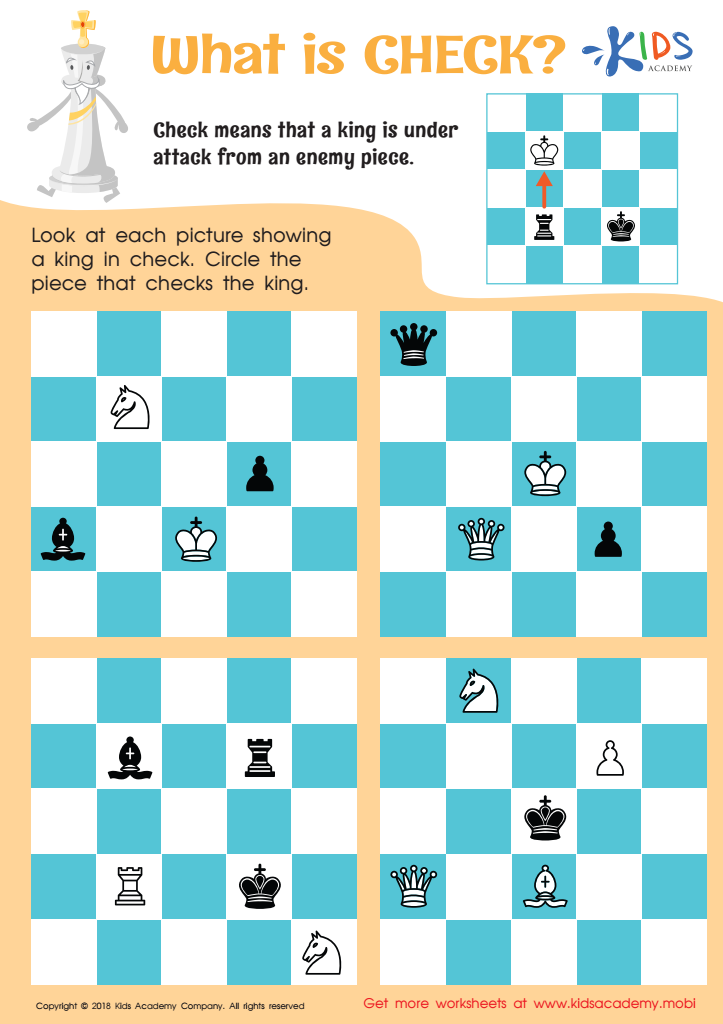

What is Check? Worksheet

Teaching money management skills to children aged 6-8 is vital for fostering financial literacy from a young age. At this formative stage, children are like sponges, absorbing information and habits that will shape their future behavior. Introducing basic money concepts early provides a foundation for responsible financial decisions later in life.

First, understanding money helps children grasp the value of hard work and savings. When they earn a small allowance for chores and learn to save for desired items, they experience firsthand the satisfaction of achieving their goals through diligence. This nurtures patience and delayed gratification, essential traits for financial discipline.

Second, money management lessons promote mathematical skills. Counting coins, comparing prices, and budgeting involve practical applications of math, making it engaging and relevant. This reinforces numerical competency in a fun, context-driven manner.

Moreover, early financial education fosters decision-making and problem-solving skills. When children face choices about spending their allowance, they must weigh options and consider consequences, enhancing critical thinking.

Finally, instilling money management values at a young age lays a foundation for future financial security. Children who appreciate the importance of saving, budgeting, and smart spending grow into adults who are better equipped to manage finances effectively, avoid debt, and plan for the future. As such, integrating these skills is crucial for developing well-rounded, financially responsible individuals.

Assign to the classroom

Assign to the classroom

%20(1).jpg)