Understanding money Math Worksheets for Ages 5-9

6 filtered results

-

From - To

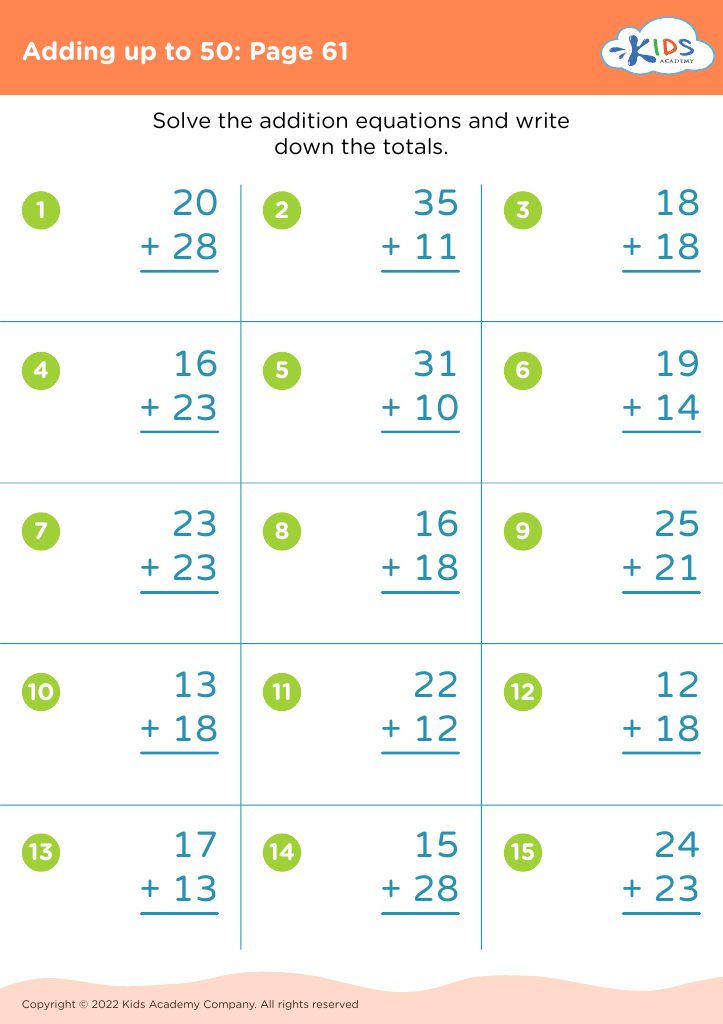

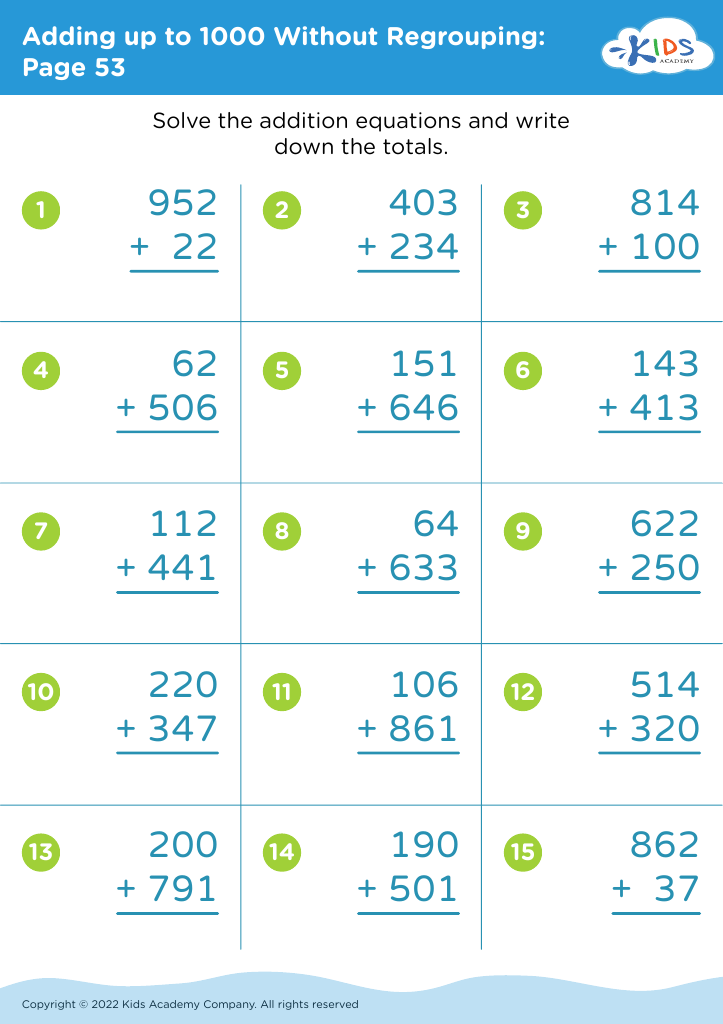

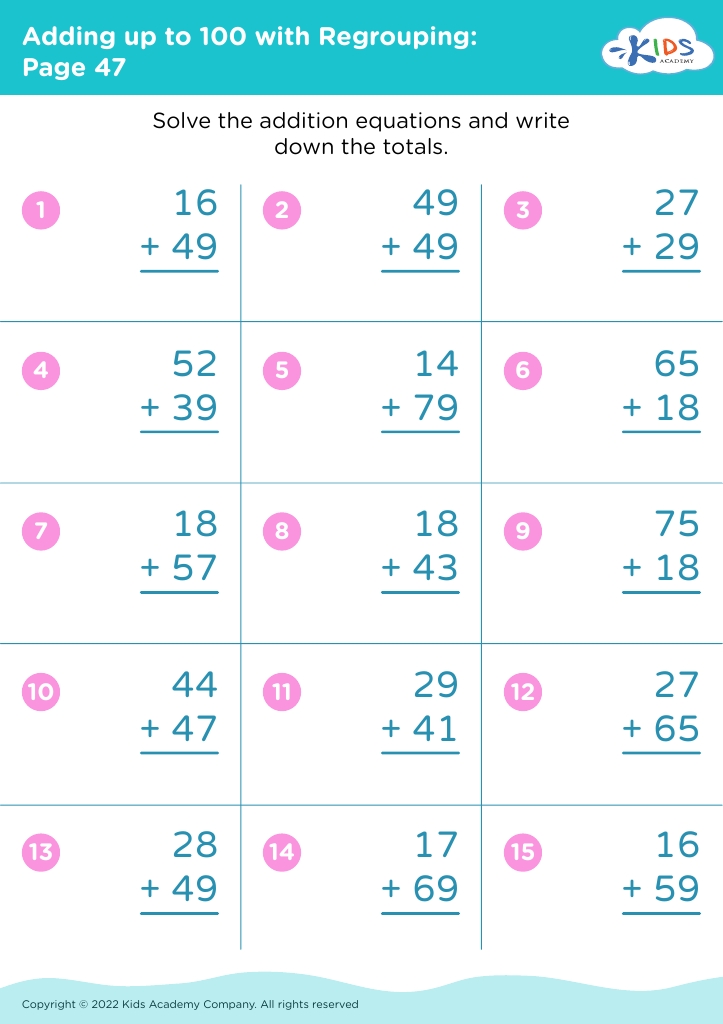

Explore our engaging "Understanding Money Math Worksheets" designed specifically for children ages 5-9! These interactive worksheets help young learners grasp essential money concepts through fun and relatable activities. Kids will practice counting coins, identifying bills, and solving real-life money problems, all while building their confidence in math skills. Featuring colorful illustrations and various challenges, these worksheets make learning about money enjoyable and memorable. Perfect for at-home reinforcement or classroom use, our resources cater to diverse learning styles, ensuring every child can thrive. Start your child's journey to financial literacy today with these delightful and educational math worksheets!

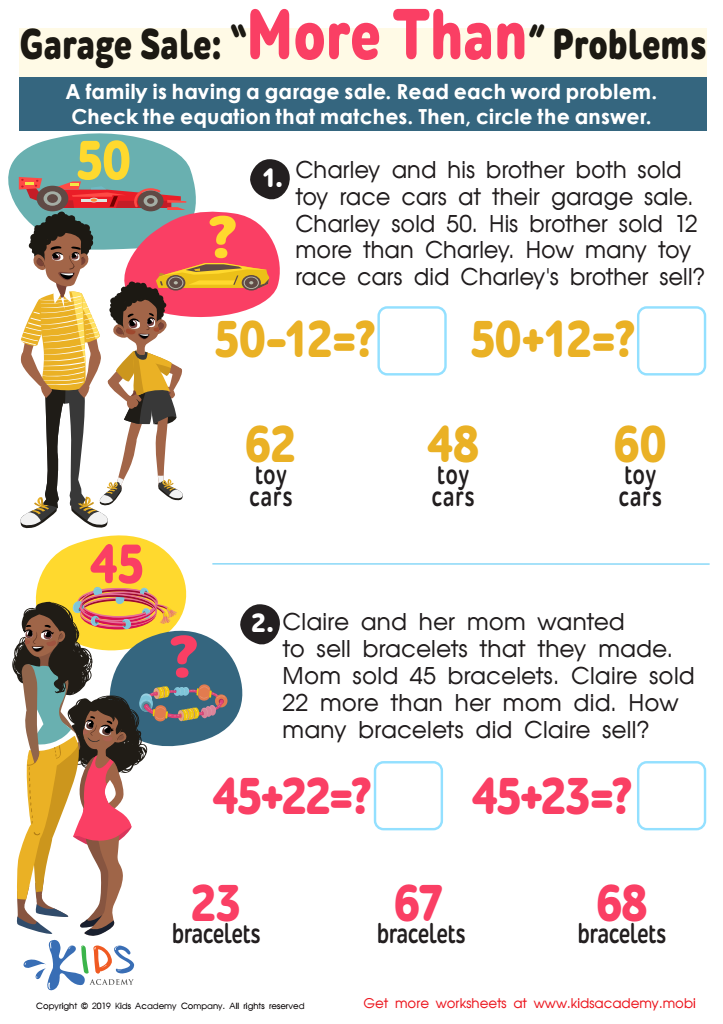

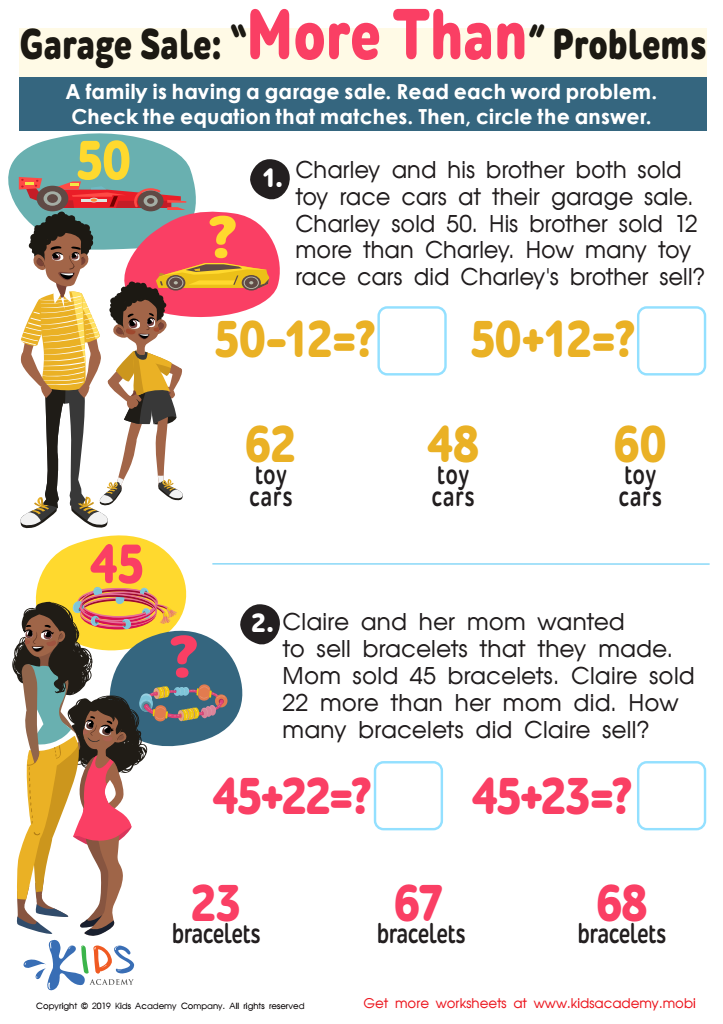

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

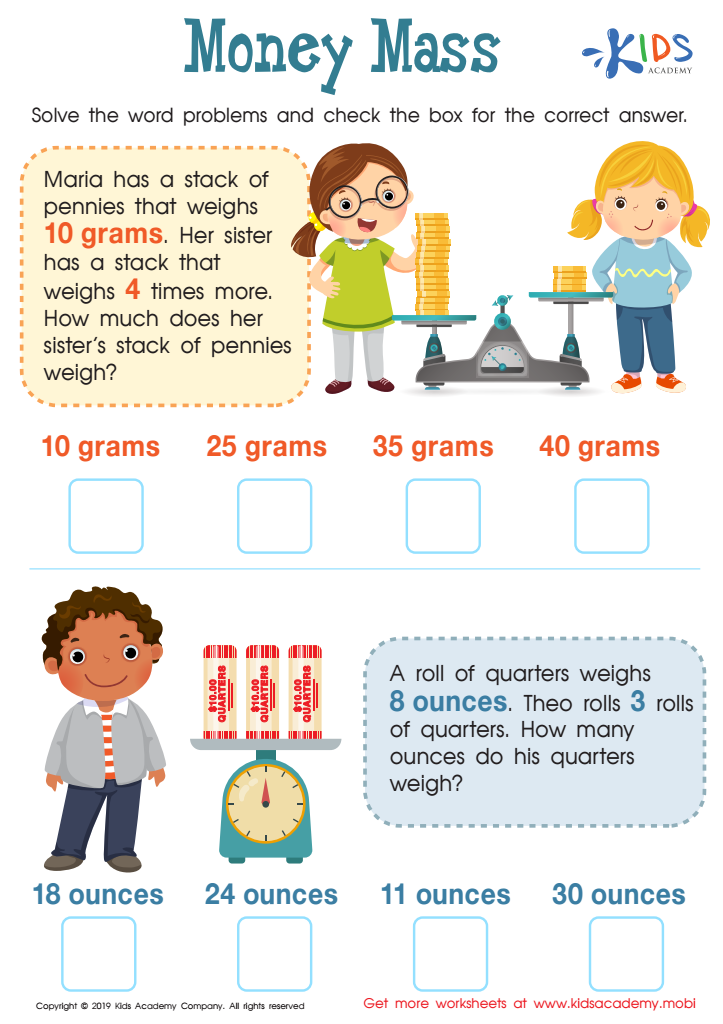

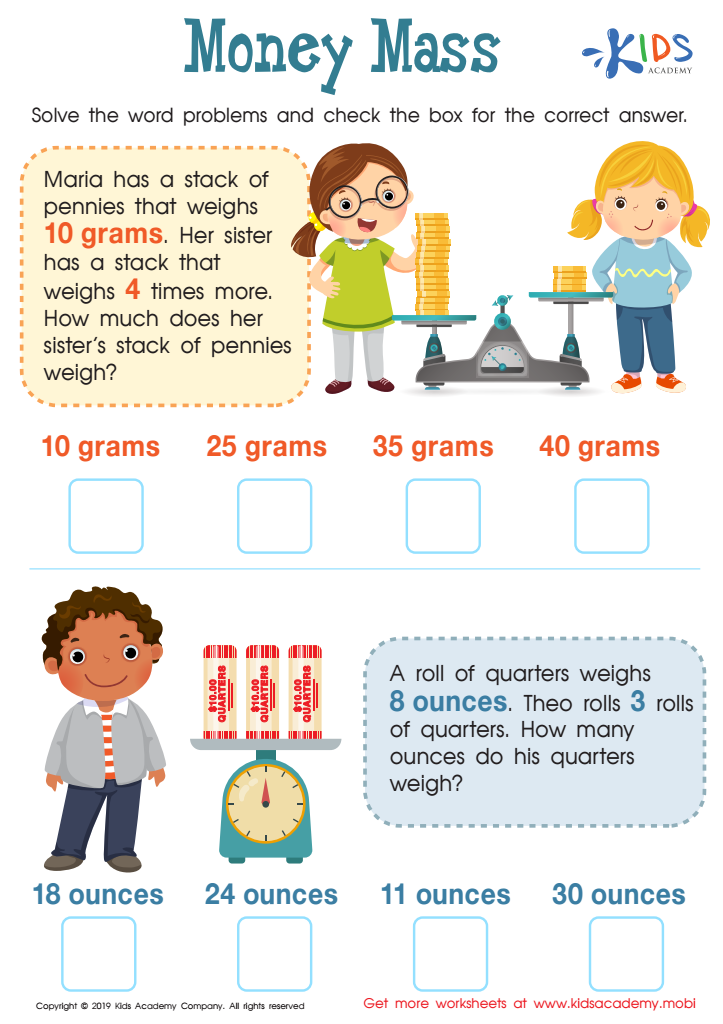

Money Mass Worksheet

Understanding money math for ages 5-9 is crucial for children's education and future success. During these formative years, children develop foundational math skills, including addition, subtraction, and problem-solving—essential components when dealing with money. Parents and teachers should care because early financial literacy lays the groundwork for responsible budgeting, saving, and spending behaviors later in life.

Introducing concepts related to money, such as valuing coins, making change, and simple financial decisions, helps cultivate practical life skills. Engaging children in activities like playing store or using play money fosters hands-on learning, making abstract math concepts more concrete and relatable. Moreover, understanding money has broader implications beyond math; it teaches children the importance of value, responsibility, and consequences of financial decisions.

Additionally, promoting financial literacy from a young age can reduce financial anxiety and empower children to make informed choices as they grow. By prioritizing money math education, parents and teachers not only support cognitive development but also instill confidence and independence in children, ultimately preparing them for a successful and responsible adulthood. This critical investment in their education results in empowered individuals who can navigate the complexities of financial systems in the future.

Assign to My Students

Assign to My Students