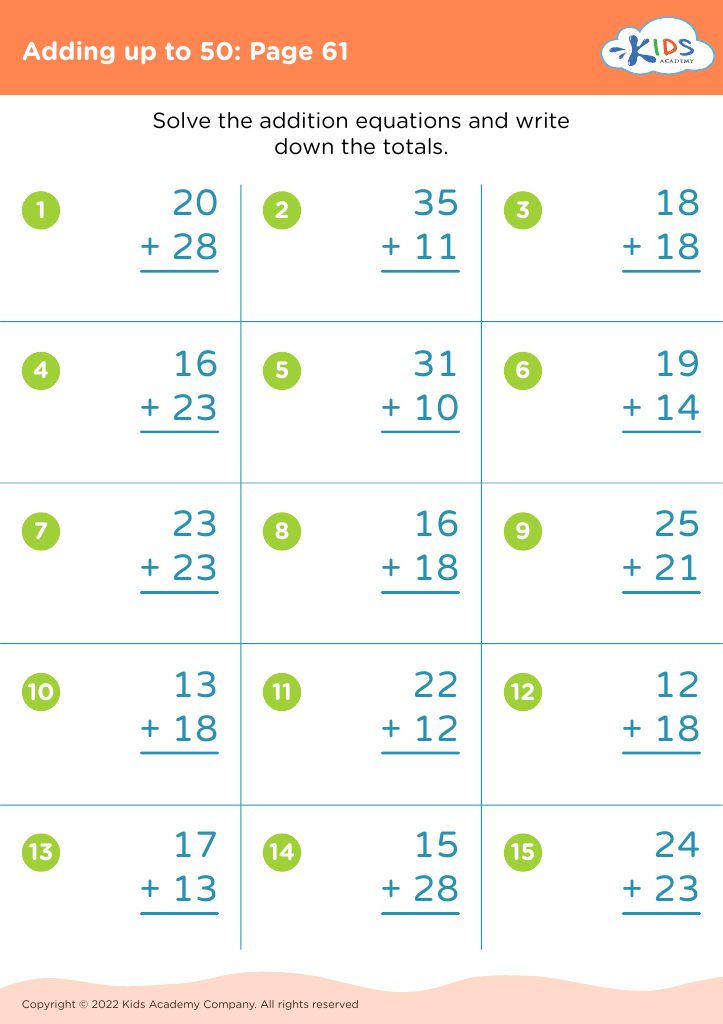

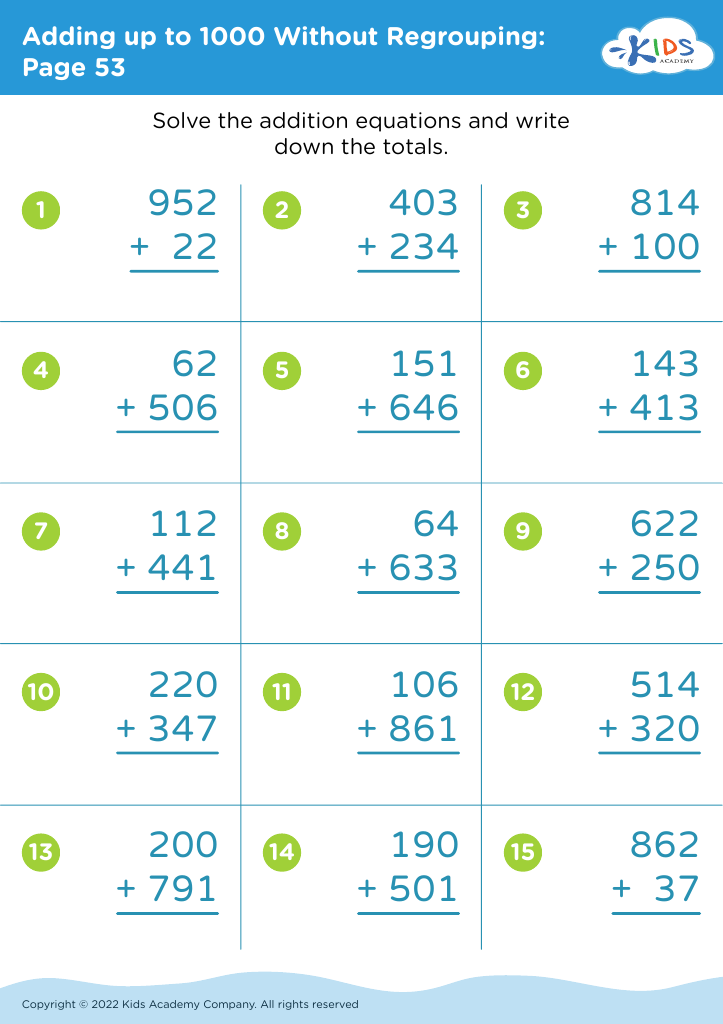

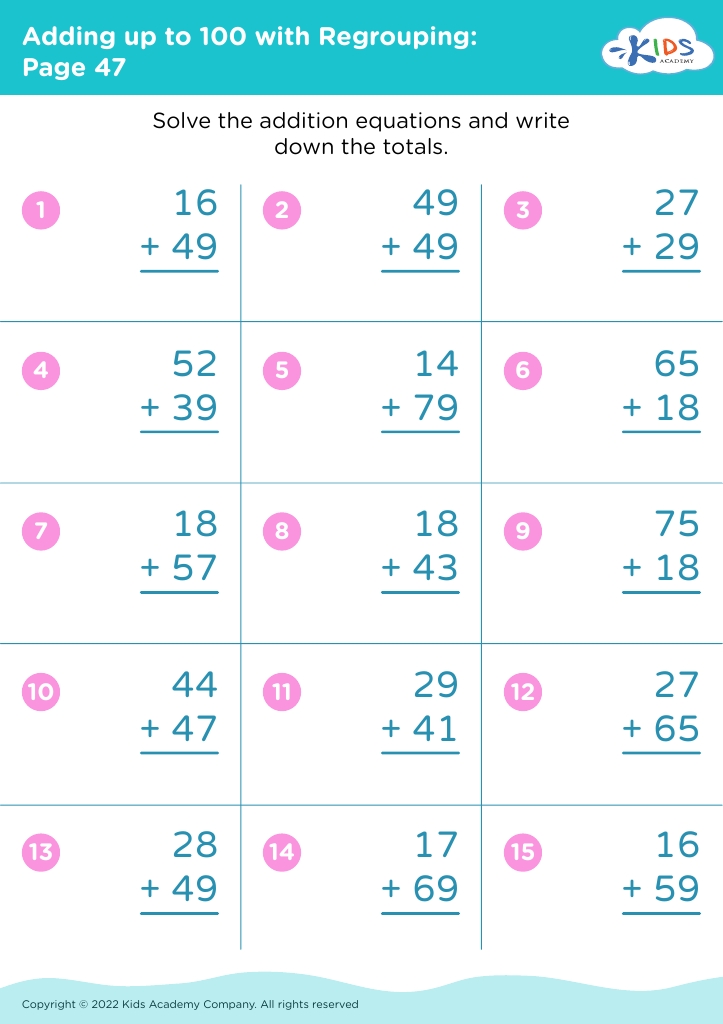

Understanding money Addition Worksheets for Ages 6-9

3 filtered results

-

From - To

Enhance your child’s financial literacy with our Understanding Money Addition Worksheets, designed specifically for ages 6-9. These engaging and interactive worksheets introduce essential money concepts while practicing addition skills. Children will learn to identify coins, calculate totals, and solve realistic money problems, fostering both numerical understanding and practical life skills. Our tailored activities make learning about money fun and relatable, ensuring that your young learners grasp the importance of financial competency early on. With vibrant graphics and age-appropriate challenges, these worksheets provide an excellent foundation for understanding money in everyday situations, setting your child up for success in math and beyond!

Understanding money addition is crucial for children aged 6-9, as it lays the foundation for both mathematical skills and practical life lessons. At this developmental stage, children are naturally curious about the world around them, including how money works. Teaching them to add monetary values not only reinforces their basic arithmetic but also helps them grasp more complex financial concepts in the future.

When parents and teachers prioritize money addition, they empower children with essential skills for budgeting and making informed spending decisions later on. Children learn to identify coins and bills, understand their values, and practice addition with real-life scenarios, thus making math enjoyable and relevant.

Furthermore, this encourages financial literacy, a skill often overlooked in traditional education. By fostering an understanding of money early on, children develop a healthy relationship with it, recognizing its worth and the importance of saving and planning. They become equipped not only to handle everyday transactions, like shopping, but also to understand the broader economic principles that govern their activities.

In essence, caring about money addition is investing in children's preparedness for responsible adult lives, helping them become confident, informed consumers in a complex financial world.