Financial literacy Money Worksheets for 7-Year-Olds

4 filtered results

-

From - To

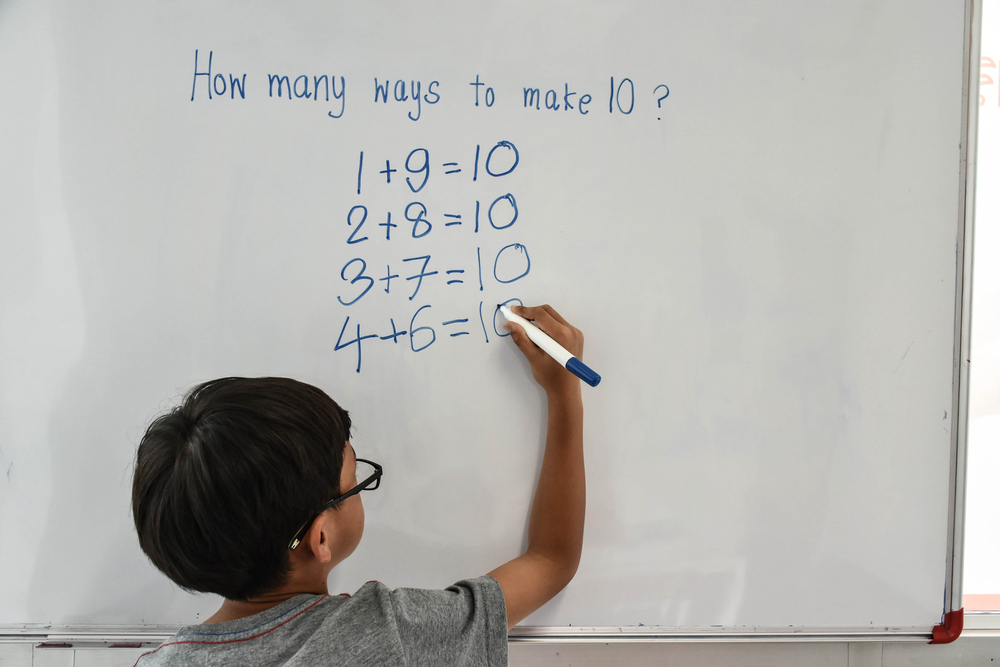

Introducing our engaging Financial Literacy Money Worksheets designed specifically for 7-year-olds! These interactive worksheets empower young learners to develop essential money management skills through fun activities. Kids will practice counting coins and bills, understanding the value of money, and making simple transactions. Our well-structured worksheets encourage hands-on learning, reinforcing concepts like saving, spending, and budgeting. Perfect for both classroom and home use, these resources foster financial confidence in children, setting the foundation for responsible money habits. Help your child become money-smart with our thoughtfully crafted worksheets that combine education and enjoyment for a complete learning experience!

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is crucial for 7-year-olds as it lays the foundation for responsible money management in the future. Teaching children about money at this age empowers them to understand the value of saving, spending, and budgeting. By introducing concepts such as saving allowances, distinguishing between wants and needs, and prompted discussions about money, children begin to cultivate essential life skills.

Parents and teachers play a pivotal role in modeling financial behaviors. When they prioritize financial literacy, they help instill good habits that can prevent future financial difficulties. For instance, learning the basics of money management early helps children make informed decisions, develop critical thinking skills, and fosters a sense of responsibility and independence.

Moreover, these lessons can effectively prevent common pitfalls associated with poor financial awareness, such as consumerism and debt. Engaging children in fun activities like role-playing or using educational games to teach about earning and spending enhances their learning experience. By equipping children with financial knowledge, parents and teachers not only boost their confidence but also ensure that today's learners become tomorrow's informed and responsible adults. Ultimately, financial literacy creates well-rounded individuals ready to navigate the complexities of their financial futures.

Assign to My Students

Assign to My Students