Financial literacy Math Worksheets for Ages 8-9

4 filtered results

-

From - To

Enhance your child's understanding of financial literacy with our engaging Math Worksheets for ages 8-9. Designed to make learning about money fun and interactive, these worksheets cover essential financial concepts such as saving, budgeting, and basic financial decision-making. Through a variety of exercises and real-life scenarios, children will develop crucial skills that set the foundation for smart financial habits. Perfect for both classroom and home use, these worksheets align with educational standards, ensuring your child gains the knowledge to manage finances confidently. Visit our page to equip your young learners with the skills they need for a financially savvy future!

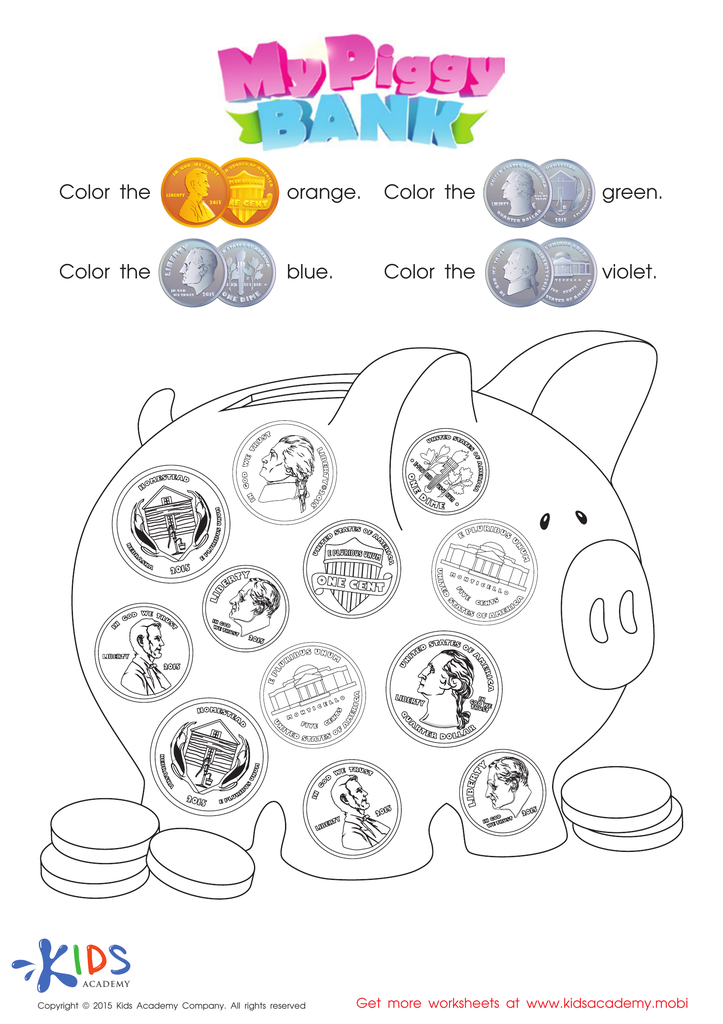

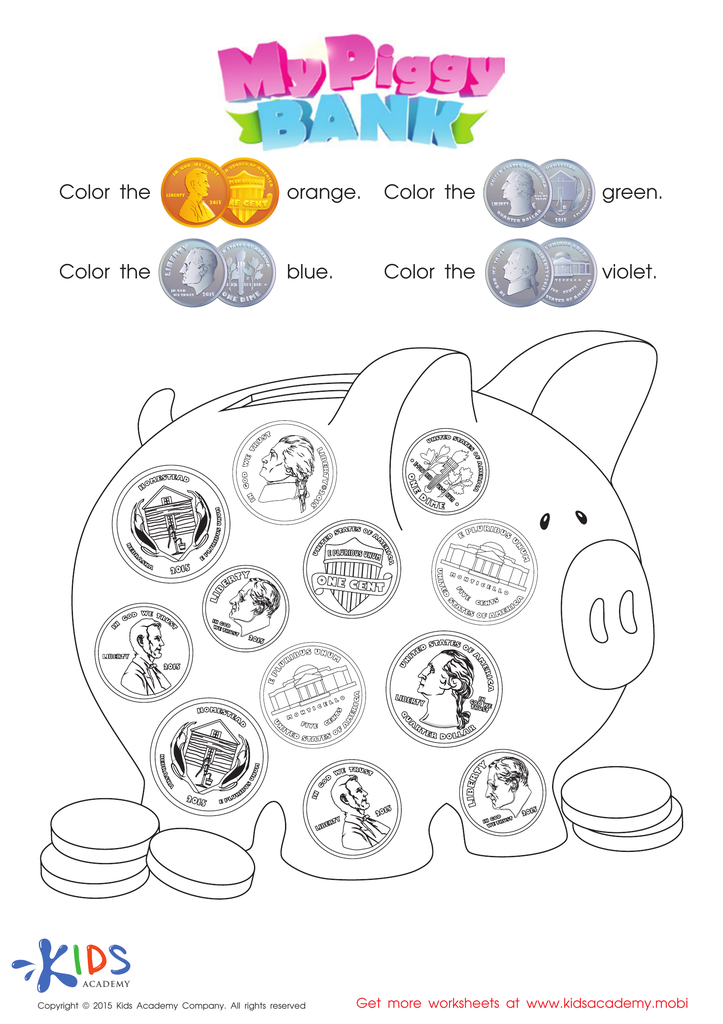

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

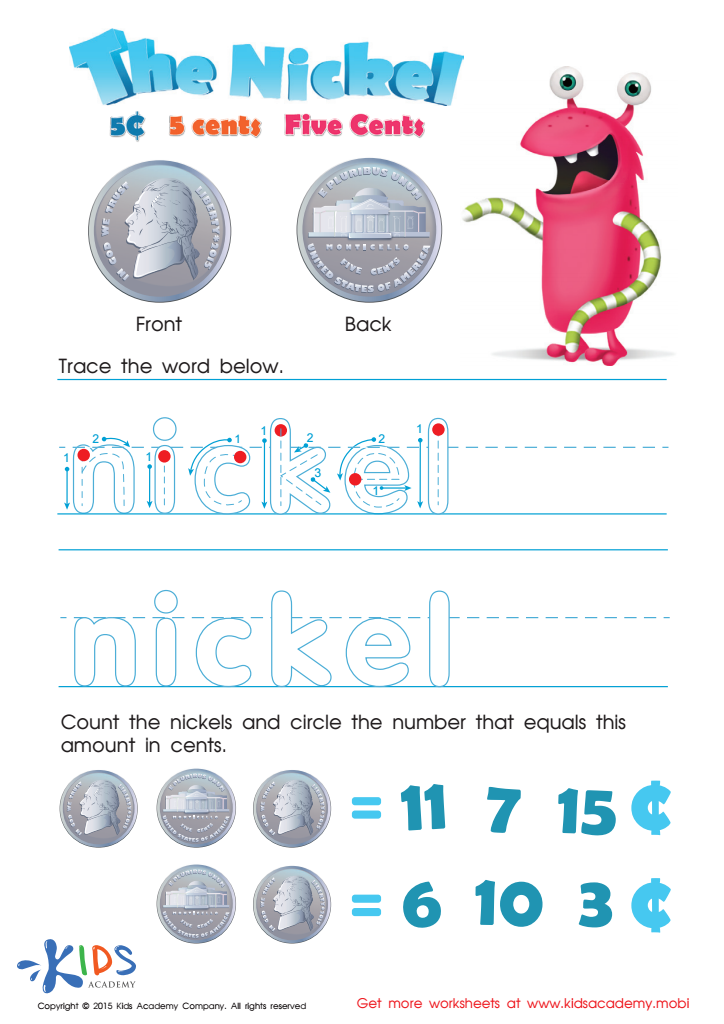

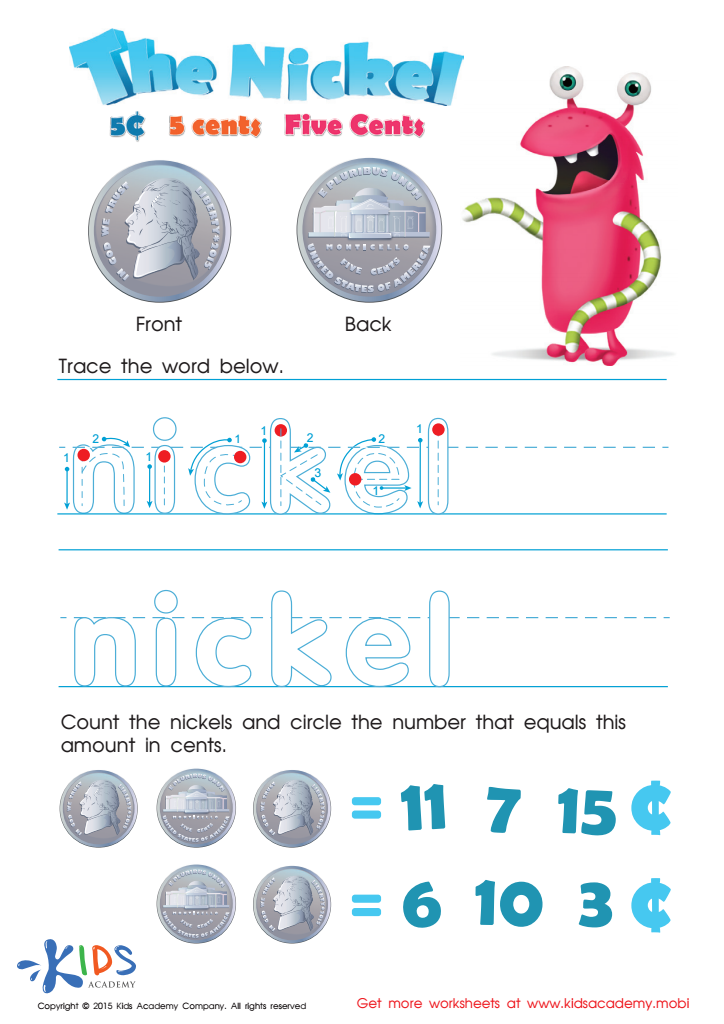

Five Cents or the Nickel Money Worksheet

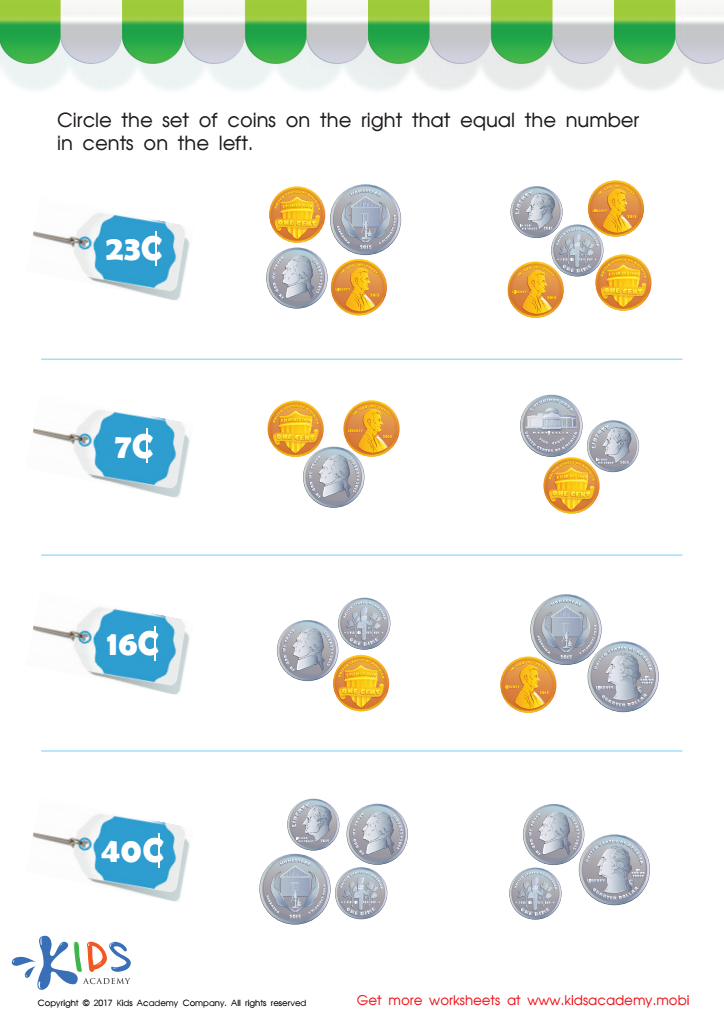

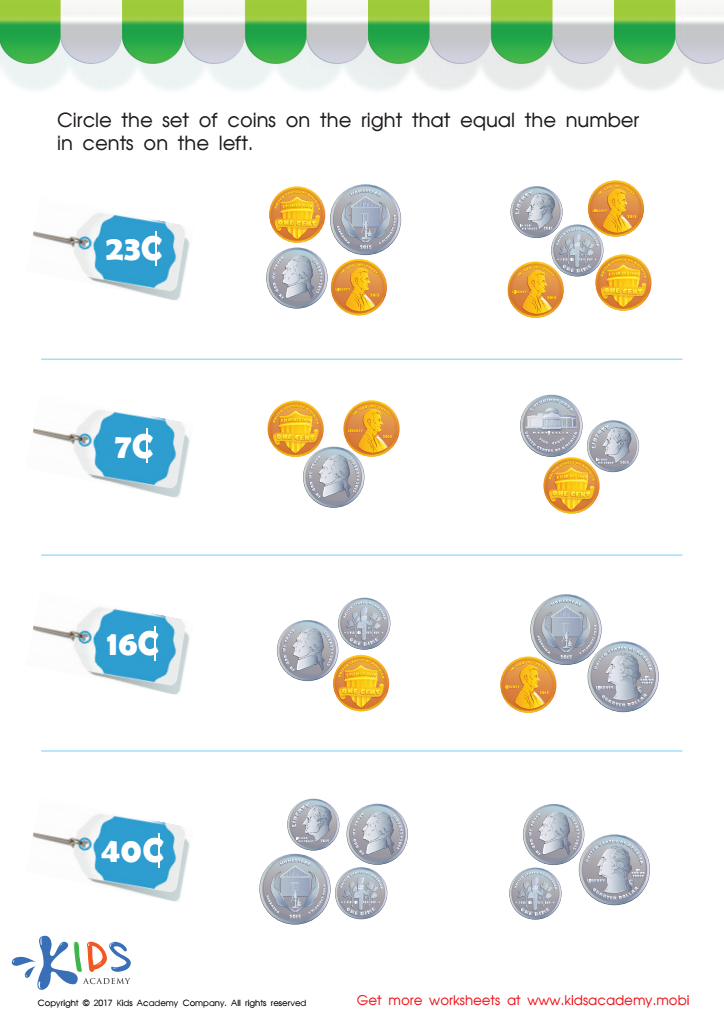

Picking the Coins You Need Money Worksheet

Financial literacy at an early age equips children with essential skills for navigating daily life and making thoughtful financial decisions. For young minds aged 8-9, understanding basic money concepts such as saving, spending, and budgeting sets the groundwork for future financial health. Parents and teachers can play a pivotal role in embedding these crucial lessons early on.

Teaching financial literacy develops numeracy skills, allowing children to practice addition, subtraction, and other mathematical operations meaningfully. When kids comprehend that math is not just abstract numbers but something that applies to buying a toy or saving for a game, they appreciate its real-world significance. This contextual learning enhances both their math proficiency and enthusiasm for the subject.

Additionally, financial literacy fosters critical thinking and responsibility in young learners. Understanding needs versus wants, the value of money, and the importance of saving helps children develop wise decision-making skills that extend beyond finances into other areas of life. By integrating such lessons early, parents and teachers can instill habits and values that contribute to their overall well-being.

Parents and teachers should care about financial literacy math for 8-9 year-olds because it cultivates practical life skills, boosts academic achievement, and lays the foundation for responsible financial behavior in the future.

Assign to My Students

Assign to My Students