Financial literacy Extra Challenge Money Worksheets for 8-Year-Olds

3 filtered results

-

From - To

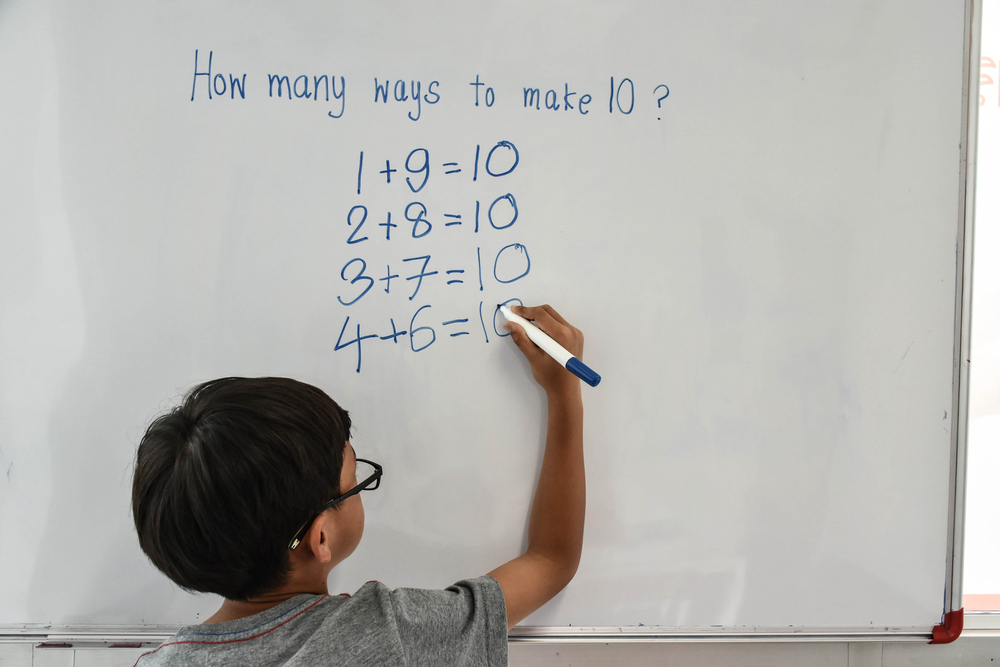

Introducing our Financial Literacy Extra Challenge Money Worksheets for 8-Year-Olds! Designed to enhance your child's understanding of money management, these engaging worksheets provide exciting math problems focused on counting and using money in real-life scenarios. With a variety of challenges, your child will learn to identify coins, calculate totals, make change, and develop essential financial skills. Empower young learners with fun exercises that foster confidence in their financial decision-making. Perfect for at-home learning, classroom enrichment, or as extra practice, these worksheets will stimulate your child's critical thinking while laying a solid foundation for a financially literate future. Dive into financial fun today!

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Parents and teachers should prioritize financial literacy for 8-year-olds because it lays the foundation for lifelong financial responsibility. At this age, children are developing their understanding of money, making it an ideal time to introduce key concepts such as saving, spending, budgeting, and making choices. Early exposure to financial education equips them with essential skills, helping them understand the value of money and the importance of making informed decisions.

Teaching financial literacy also fosters critical thinking and problem-solving. Children learn to evaluate different options, and set goals for savings and spending, which enhances their overall cognitive development. Additionally, instilling a sense of responsibility about money can reduce the likelihood of poor financial habits in adulthood, potentially alleviating issues like debt or financial dependence.

Moreover, as society becomes increasingly complex, understanding financial concepts is crucial for participating in the economy. This knowledge empowers children to navigate future financial opportunities, setting them up for success. By encouraging financial literacy from a young age, parents and educators not only prepare children for future independence but also contribute to building a financially savvy generation that can make a positive impact on their communities. Hence, fostering financial literacy is a vital investment in children's future well-being.

Assign to My Students

Assign to My Students