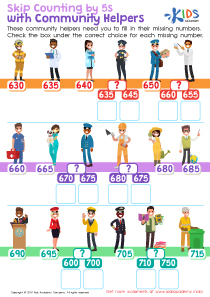

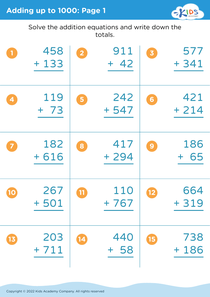

Financial literacy Grade 2 Math Worksheets

4 filtered results

-

From - To

Boost your second grader's financial savvy with our engaging Financial Literacy Grade 2 Math Worksheets. Created by educational experts, these printable worksheets introduce essential money concepts, such as identifying coins, understanding their values, and basic budgeting skills. Through fun, interactive activities, kids build a solid financial foundation while honing subtraction, addition, and critical thinking skills. Perfect for classroom use or at-home practice, these worksheets make learning about money practical and enjoyable, preparing young students for future financial success. Explore our collection today and watch your child’s confidence and knowledge grow with every worksheet!

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy for Grade 2 students is crucial because it lays the groundwork for responsible money management and decision-making in the future. At this young age, children are beginning to understand the concept of numbers, which makes it the perfect time to introduce basic financial principles in a way that's relatable and enjoyable. When parents and teachers incorporate financial literacy into a Grade 2 math curriculum, they help students develop critical skills.

For example, understanding currency, counting money, and making simple transactions teach children the value of money and the basics of budgeting. This knowledge can foster a sense of responsibility and the habit of saving. Teaching these concepts early can also help children distinguish between needs and wants, making them more financially thoughtful.

Furthermore, integrating financial literacy with math has the added benefit of making math more practical and engaging. Solving real-world problems like how many coins make a dollar or how much change to expect when buying something helps solidify math skills in a meaningful context. The goal is to nurture confident and knowledgeable individuals who can make informed financial decisions. Therefore, building this foundation in Grade 2 significantly contributes to the development of financially savvy adults in the future.

Assign to My Students

Assign to My Students