Understanding money Grade 3 Worksheets

4 filtered results

-

From - To

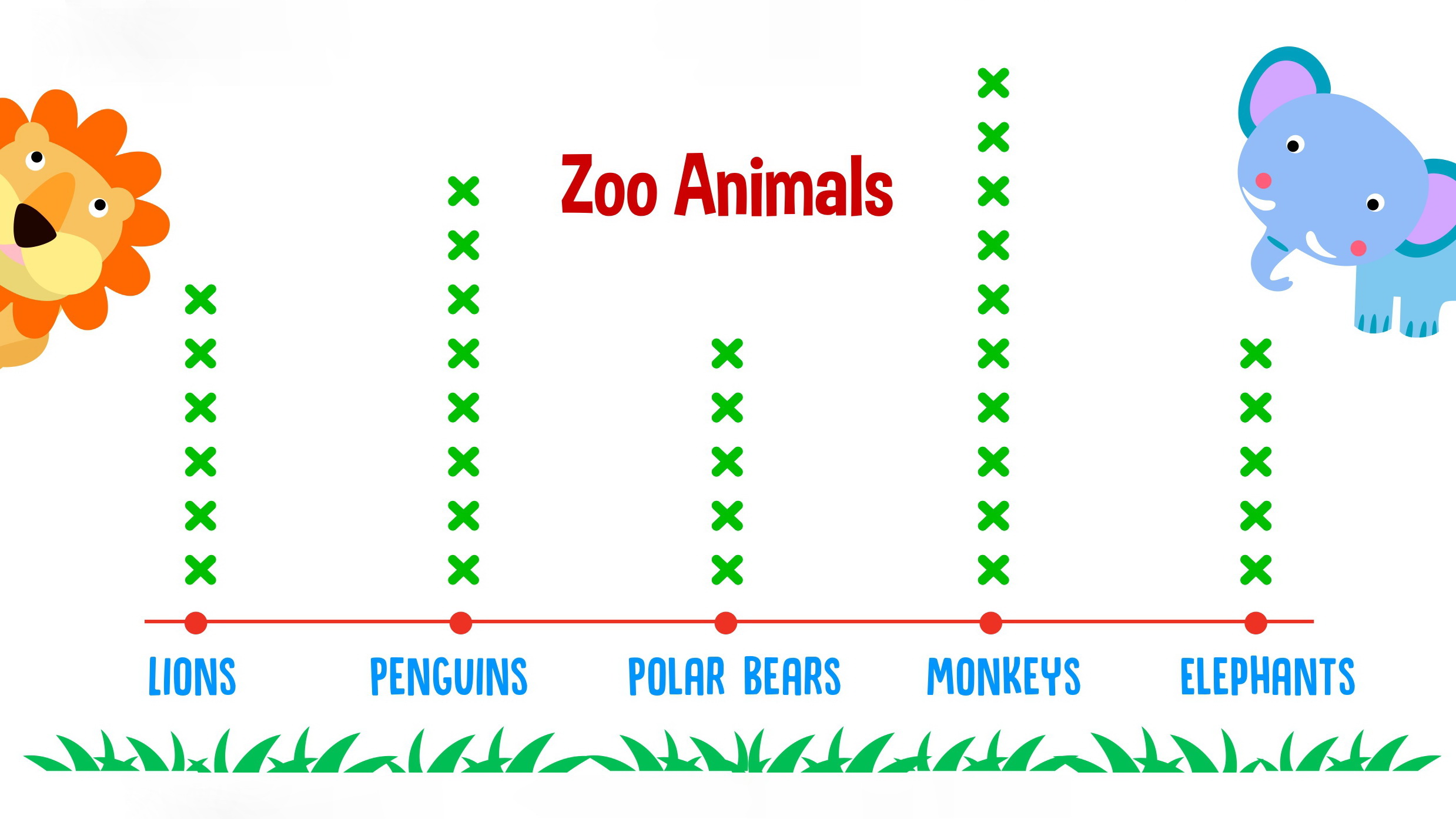

Empower your third graders with essential financial literacy skills using our "Understanding Money Grade 3 Worksheets." Designed to make learning about money fun and engaging, these worksheets help students identify coins and bills, understand their values, and enhance their counting abilities. Through hands-on activities and practical exercises, children will master the basics of making change, adding different denominations, and recognizing real-life money situations. Perfect for home or classroom use, our resources align with educational standards and support the development of critical mathematical and financial skills necessary for everyday life. Transform your students into savvy savers and smart spenders today!

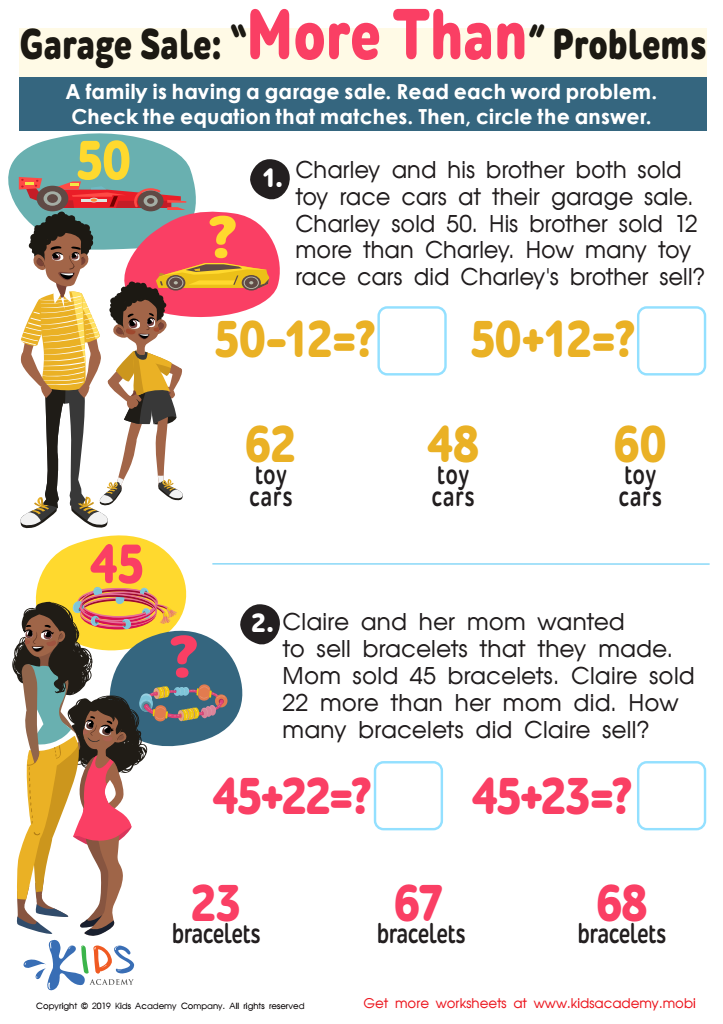

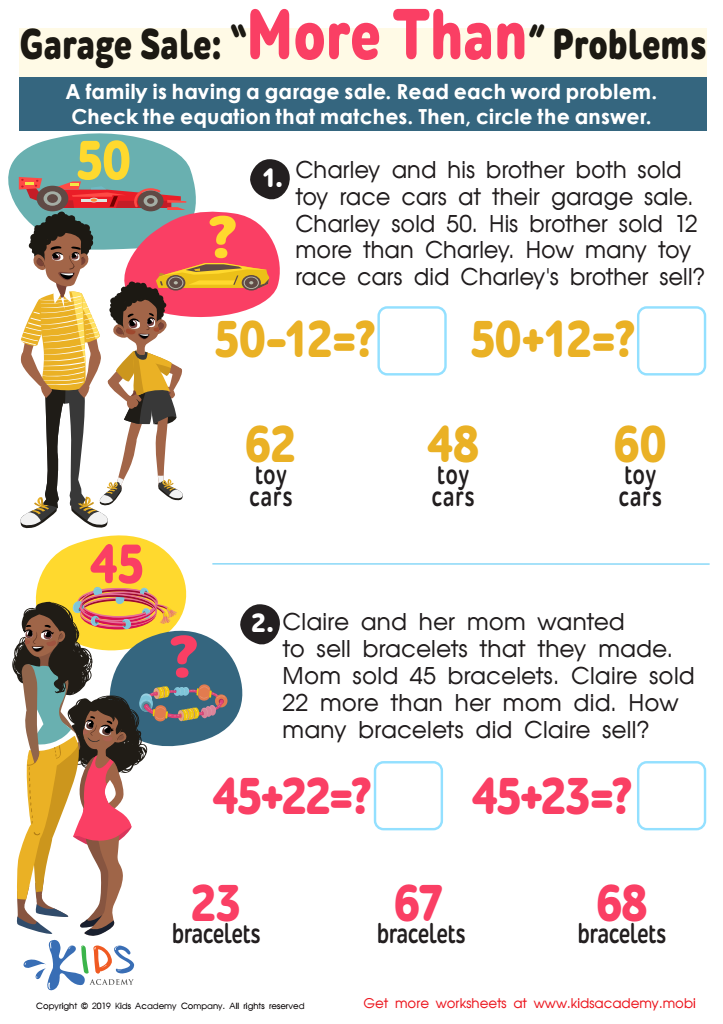

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

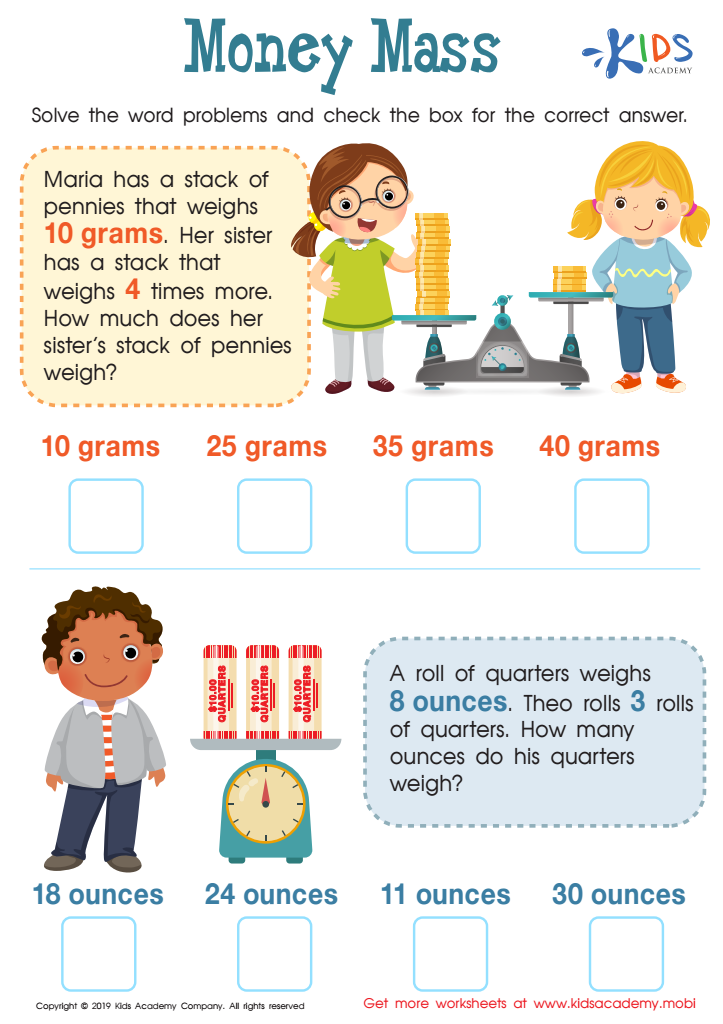

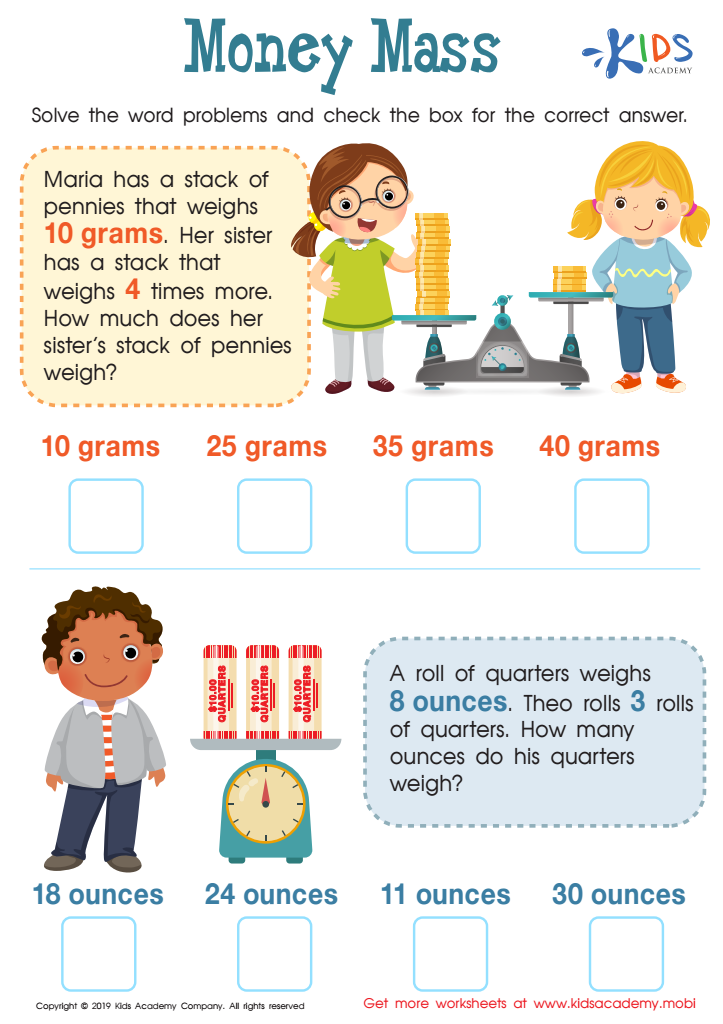

Money Mass Worksheet

Understanding money is a vital skill that parents and teachers should emphasize for third graders, as it lays the foundation for sound financial literacy and responsibility. At this developmental stage, children are not too young to begin grasping basic money concepts like counting coins, recognizing bills, making simple transactions, and understanding the value of saving. Learning about money helps children gain practical math skills, which benefit their academic achievement in other areas.

Teaching kids about money can instill important life lessons, such as budgeting, which can translate into better decision-making about wants versus needs. This early education can also encourage habits that ward off future financial issues by promoting smart spending and the importance of saving. Moreover, children who understand the basics of money are often more confident and less anxious about financial matters as they grow older.

Beyond the practical aspects, learning about money can empower children with a sense of responsibility and encourage independence. As kids grasp these concepts, they begin to appreciate the work behind earnings and the significance of thoughtful consumption. Teachers and parents, by prioritizing financial education, ensure that children are equipped with essential skills for adulthood, fostering a generation that's better prepared to manage their personal finances proficiently.

Assign to My Students

Assign to My Students