Understanding money Worksheets for Ages 3-5

3 filtered results

-

From - To

Introduce your preschooler to the world of finance with our engaging Understanding Money Worksheets for ages 3-5! Designed to captivate young minds, these printable worksheets use fun activities and colorful illustrations to teach early learners about coins and bills. Kids will enjoy sorting, counting, and recognizing money while developing essential math and problem-solving skills. Perfect for homeschooling or classroom use, these resources make learning about money interactive and exciting. Help your child build a solid foundation in financial literacy with our expert-designed worksheets, setting the stage for future success in money management!

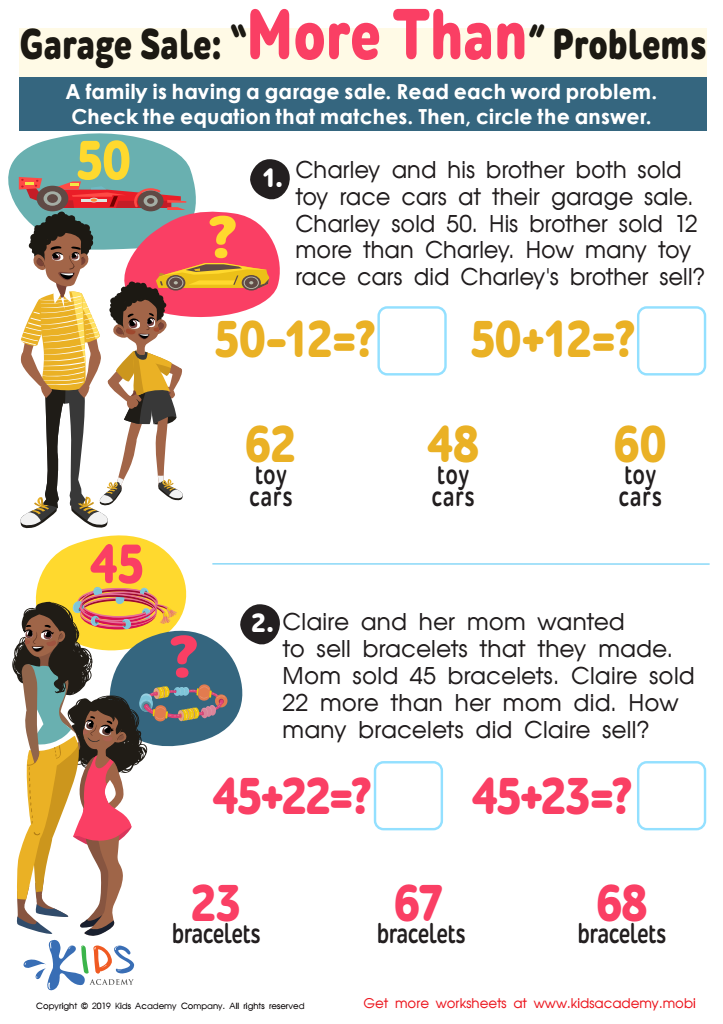

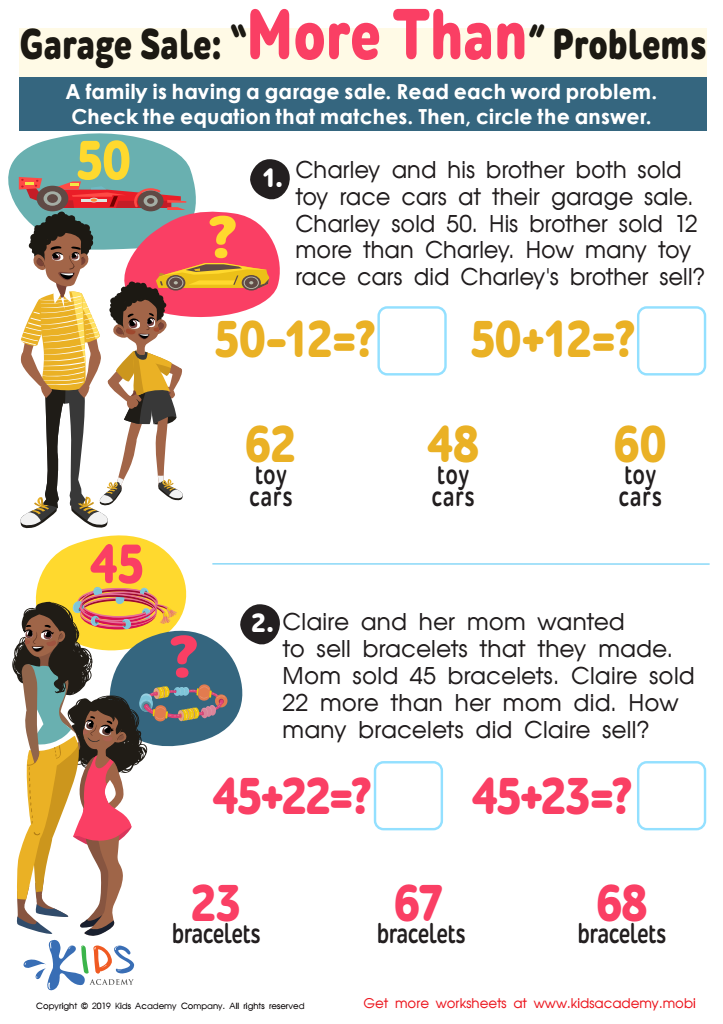

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

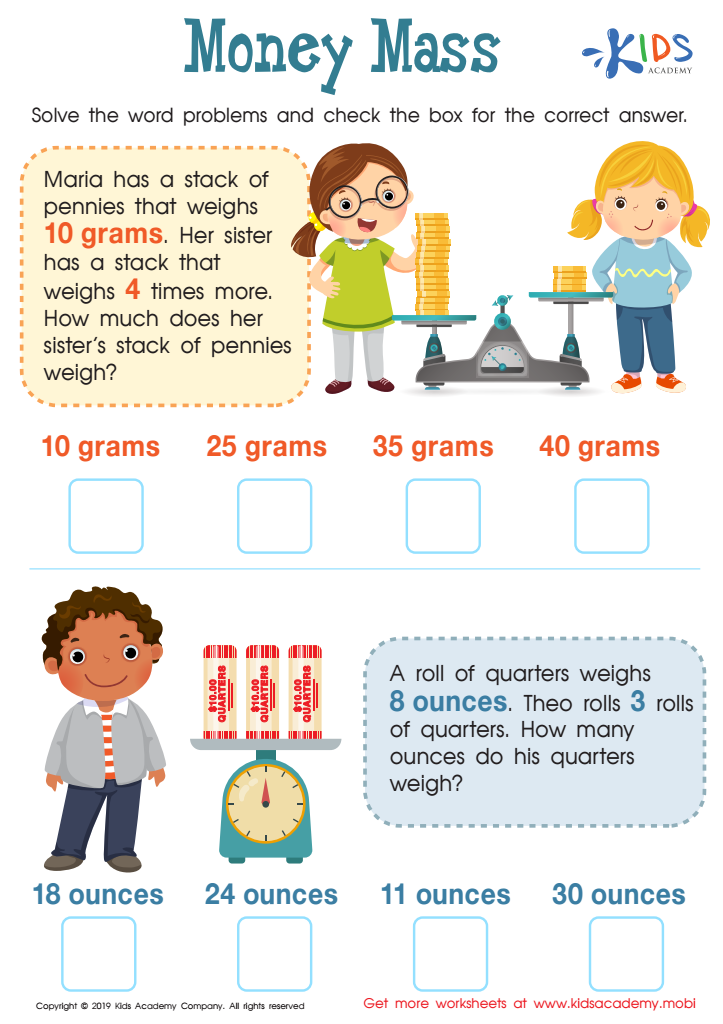

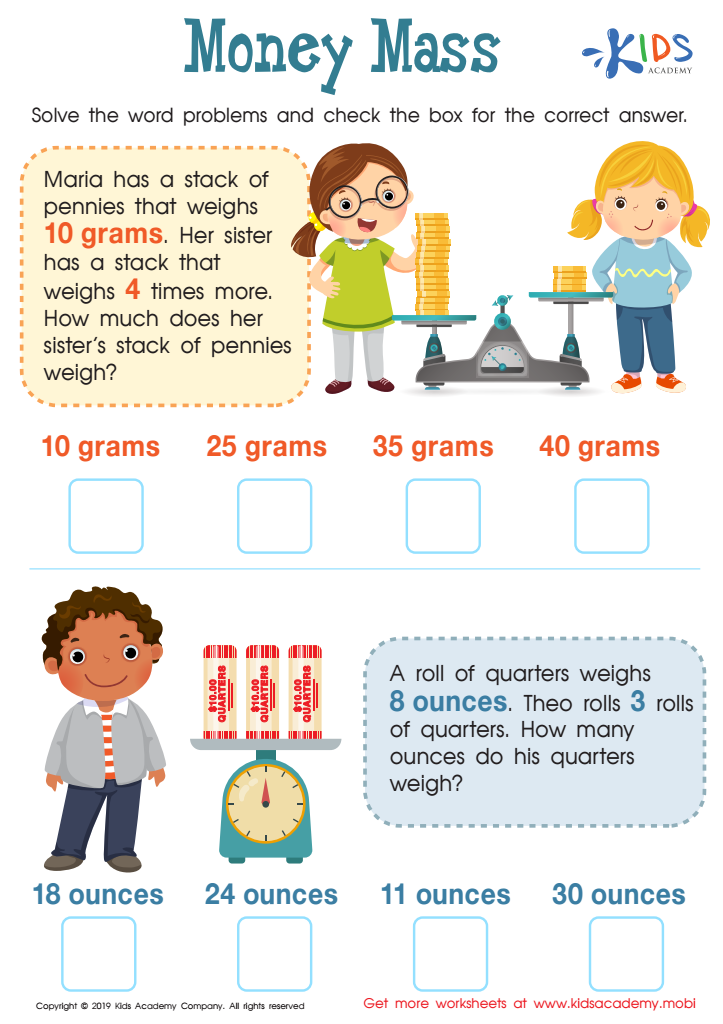

Money Mass Worksheet

Understanding money at an early age, even for children as young as ages 3-5, is important for several reasons. First, it helps establish basic financial literacy, which lays the groundwork for future money management skills. When young children grasp basic concepts like counting coins, recognizing different bills and learning simple transactions, they are building foundational skills that will be crucial throughout their lives.

Secondly, introducing young children to the idea of money can promote valuable life skills such as responsibility and decision-making. For instance, when children understand that purchasing an item requires money and that money is limited, they begin to learn about choices and consequences. This might encourage them to think before making a purchase, laying the groundwork for prudent financial decisions in the future.

Moreover, early introduction to money can provide practical math practice in a context that's engaging and understandable. Concepts like addition, subtraction, and even the notion of saving can be illustrated through simple activities that involve playing with pretend money or small allowances.

Lastly, awareness of money here brings an added sense of independence and confidence in social settings, such as a child saving up to buy a small toy. Altogether, understanding money creates a positive trajectory for lifelong financial well-being and critical thinking skills.

Assign to My Students

Assign to My Students

.jpg)