Money recognition Money Worksheets for Ages 3-5

5 filtered results

-

From - To

Introduce your little ones to the world of finance with our "Money Recognition Worksheets for Ages 3-5" from Kids Academy! Designed for preschoolers and kindergarteners, these engaging and colorful worksheets teach children to identify different coins and understand their values through fun activities. Perfect for early learners, the exercises help build essential counting skills while fostering a foundation for future financial literacy. Visit Kids Academy to access our age-appropriate, skill-enhancing money worksheets, making learning both enjoyable and effective for your young explorers. Start them on the path to money mastery today!

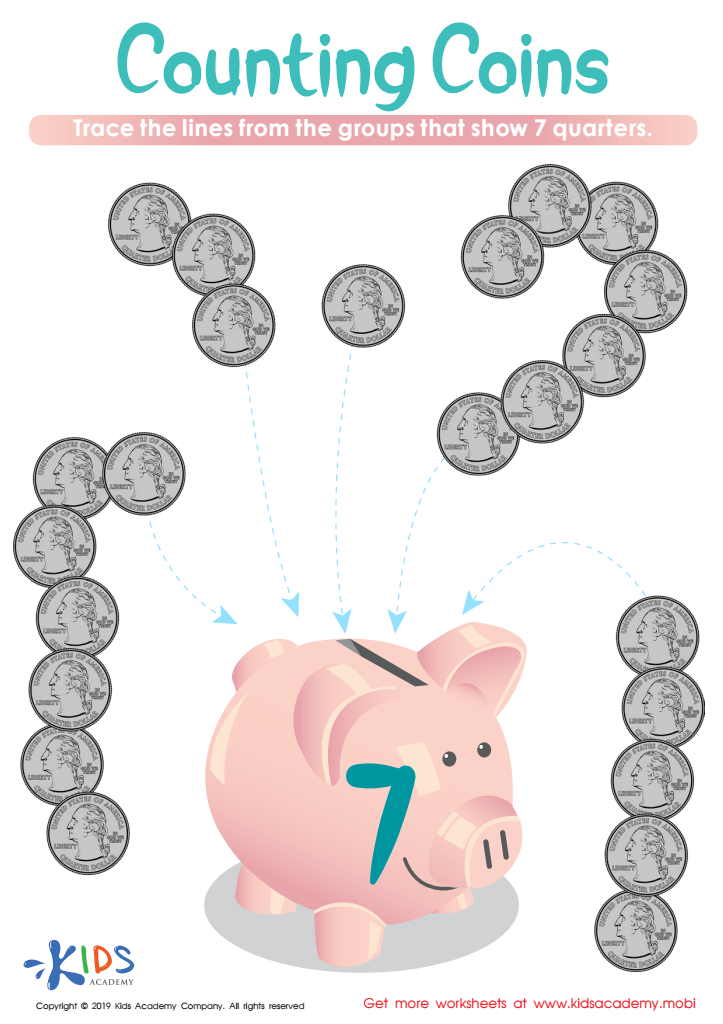

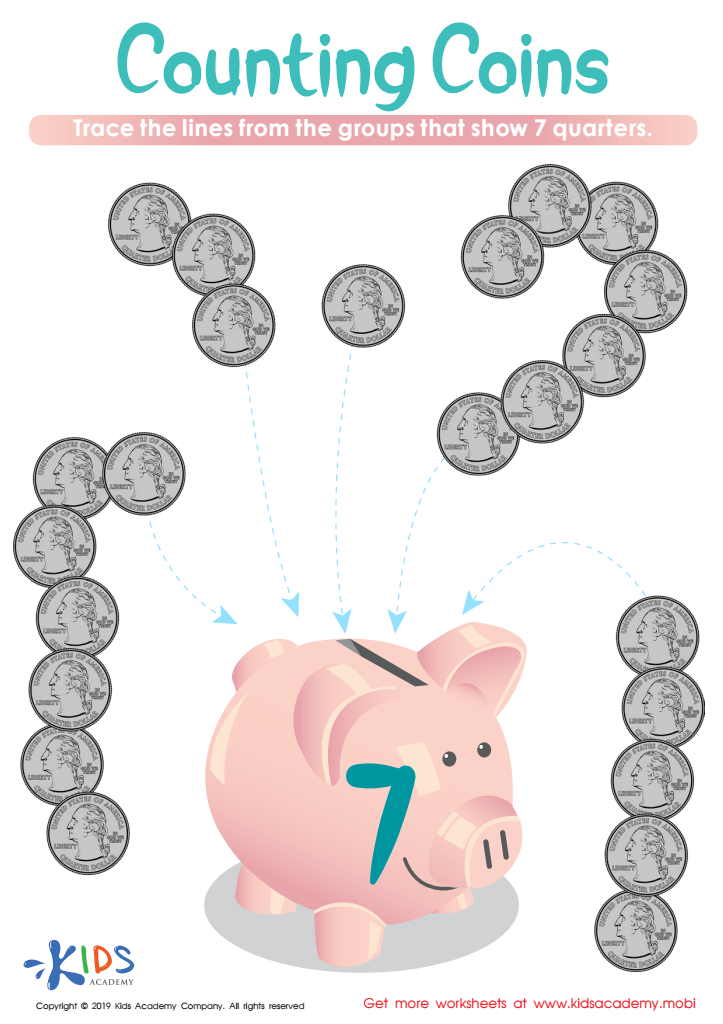

Counting Coins Worksheet

How Many Coins Money Worksheet

One Cent or the Penny Money Worksheet

Coin Names and Values Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Money recognition is a crucial skill for young children, especially between the ages of 3-5, as it lays the foundation for their future financial literacy and life skills. Parents and teachers should care about early money recognition for several key reasons.

Firstly, learning about money helps develop basic mathematical skills. Recognizing and understanding different denominations encourage counting, sorting, and matching abilities, which are essential for learning numbers and other arithmetic concepts.

Secondly, early exposure to money can foster cognitive and critical thinking skills. Children learn the value of different coins and banknotes, understand the concept of exchange, and begin to grasp the idea of saving and spending. These lessons play a vital role in developing decision-making and problem-solving abilities.

Thirdly, early money recognition supports social and emotional growth. By engaging in pretend play with money, children learn about social interactions, trade principles, and sharing. It can also boost their confidence as they demonstrate understanding and use of familiar everyday items.

Lastly, instilling financial awareness at a young age can set children up for future success. By understanding money concepts early, they are better prepared to manage their finances wisely as they grow older. Thus, educators and parents play a significant role in shaping these future savvy consumers who can make informed financial choices.

Assign to My Students

Assign to My Students