Financial literacy Math Worksheets for Ages 3-5

4 filtered results

-

From - To

Introduce your little ones to the fundamentals of financial literacy with our engaging Math Worksheets designed for ages 3-5! These playful and interactive worksheets combine essential math skills with everyday financial concepts, helping children understand money, counting, budgeting, and savings in a fun way. With vibrant illustrations and age-appropriate activities, kids will learn to recognize coins, practice counting, and explore the importance of making smart choices with money. Perfect for home or classroom use, our printable worksheets ensure that young learners build a strong foundation for their financial futures while developing critical math skills. Start their financial journey today!

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy math for ages 3-5 is crucial for laying a strong foundation for a child's future understanding of money management. At this early stage, children develop essential cognitive skills, and introducing them to basic financial concepts can shape their attitudes towards saving, spending, and sharing. Concepts like counting, sorting, and simple addition can be integrated into financial literacy through playful activities involving money.

Parents and teachers should care because early exposure to these concepts can foster critical life skills, such as problem-solving and decision-making. When children learn to recognize coins, understand their value, and associate them with real-life purchases, they gain practical math skills in a relevant context.

Moreover, instilling positive financial habits from a young age can promote responsible behavior as they grow older. Research indicates that attitudes towards money formed in childhood often influence financial behaviors in adulthood. By engaging young learners in enjoyable financial activities through games, storytelling, or imaginative play, parents and teachers can enhance their math proficiency while equipping them with valuable life skills. Ultimately, supporting financial literacy at this age makes financial discussions less daunting later on and creates a pathway towards confident, informed financial decision-making.

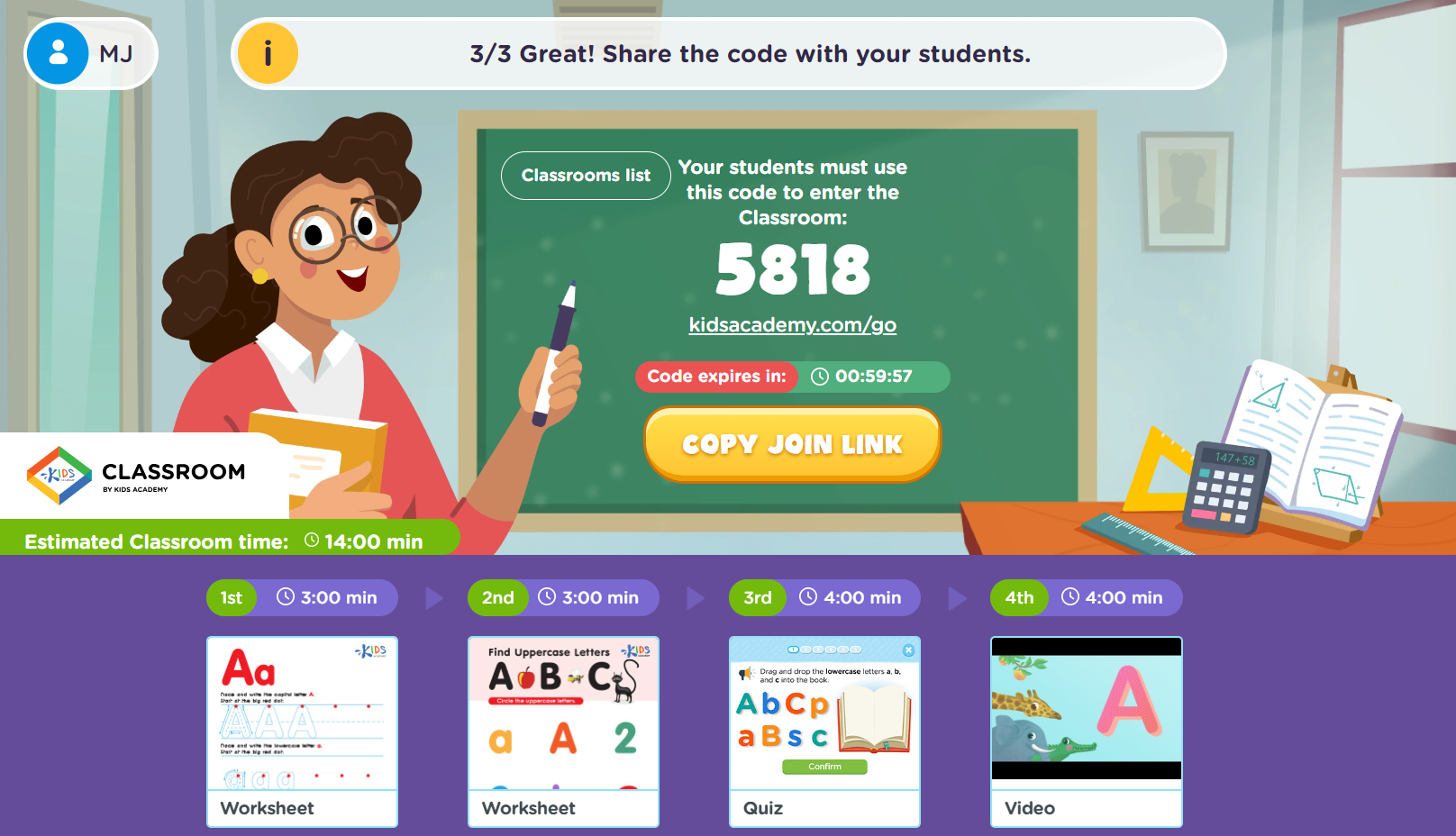

Assign to My Students

Assign to My Students