Money management skills Addition & Subtraction Worksheets for Ages 3-7

3 filtered results

-

From - To

Enhance your child's financial literacy with our engaging Money Management Skills Addition & Subtraction Worksheets, tailored for ages 3-7. These interactive resources introduce basic math concepts while teaching young learners the fundamentals of money handling. Through fun exercises, children will practice adding and subtracting money amounts, fostering essential problem-solving skills. Our colorful and age-appropriate worksheets make learning enjoyable and effective, allowing students to relate mathematical concepts to everyday life. With these worksheets, kids will develop confidence in managing money, setting the foundation for responsible financial habits. Explore our diverse collection and watch your children excel in both math and money management skills!

Making Bracelets to Sell Worksheet

Smart Shopping: Trade Tens for a Hundred Worksheet

Selling the Bracelets Worksheet

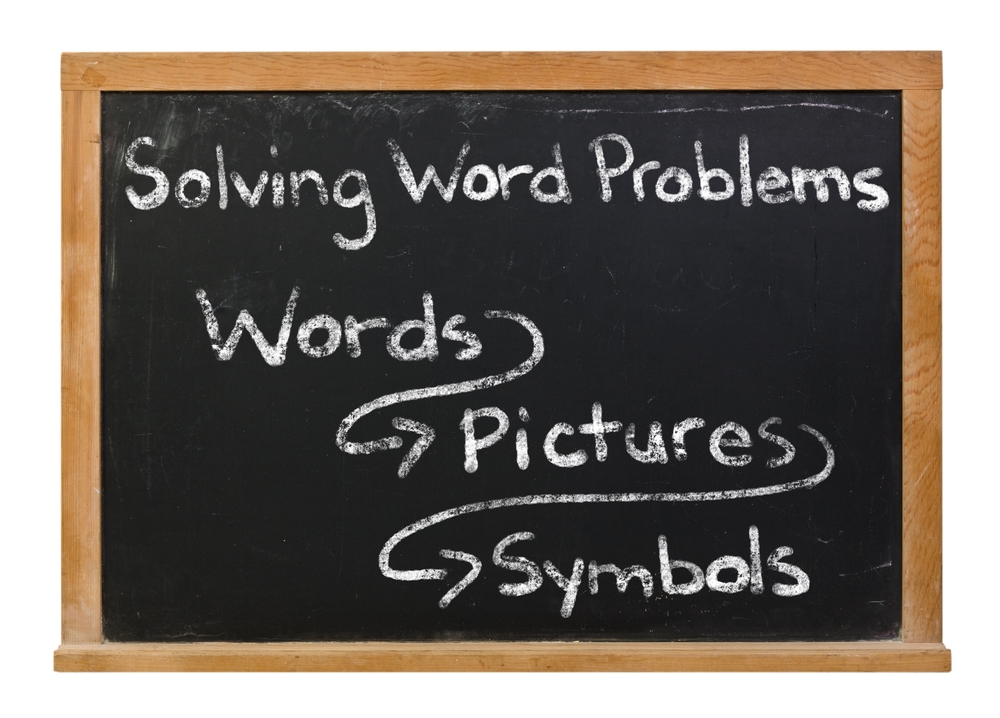

Money management skills, particularly basic addition and subtraction, are crucial for children aged 3 to 7 as foundational elements of lifelong learning. Understanding these concepts lays the groundwork for financial literacy and practical mathematics, which are essential in everyday life. At this age, children are naturally curious about the world around them, and introducing money concepts ignites that curiosity, making learning engaging and relevant.

Parents and teachers play a pivotal role in shaping a child's understanding of money management. By incorporating addition and subtraction through play and everyday activities, they can teach children how to handle quantities, understand value, and make simple transactions. This fosters critical thinking and problem-solving skills, preparing them for future financial decisions.

Moreover, early exposure to these skills helps build confidence. Children learn to differentiate between needs and wants, develop budgeting awareness, and comprehend the workings of saving and spending. It also promotes responsibility and decision-making, allowing them to understand the consequences of their choices.

In summary, nurturing money management skills through addition and subtraction helps create a solid foundation for children, equipping them with the knowledge and capabilities necessary to navigate future financial landscapes successfully. This investment in their education today can lead to informed and empowered choices tomorrow.

Assign to My Students

Assign to My Students