Understanding currency Math Worksheets for Ages 4-7

4 filtered results

-

From - To

Discover our engaging "Understanding Currency" math worksheets designed specifically for children aged 4 to 7. These interactive resources help young learners grasp the concept of money through fun activities like counting coins, recognizing different denominations, and making simple transactions. Our worksheets encourage hands-on learning, making finance accessible and enjoyable for early learners. With colorful illustrations and age-appropriate challenges, children will develop essential math skills while building confidence in handling currency. Perfect for classroom settings or at-home practice, these worksheets provide a solid foundation for financial literacy. Explore our collection today and empower your child's understanding of money with creativity and play!

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

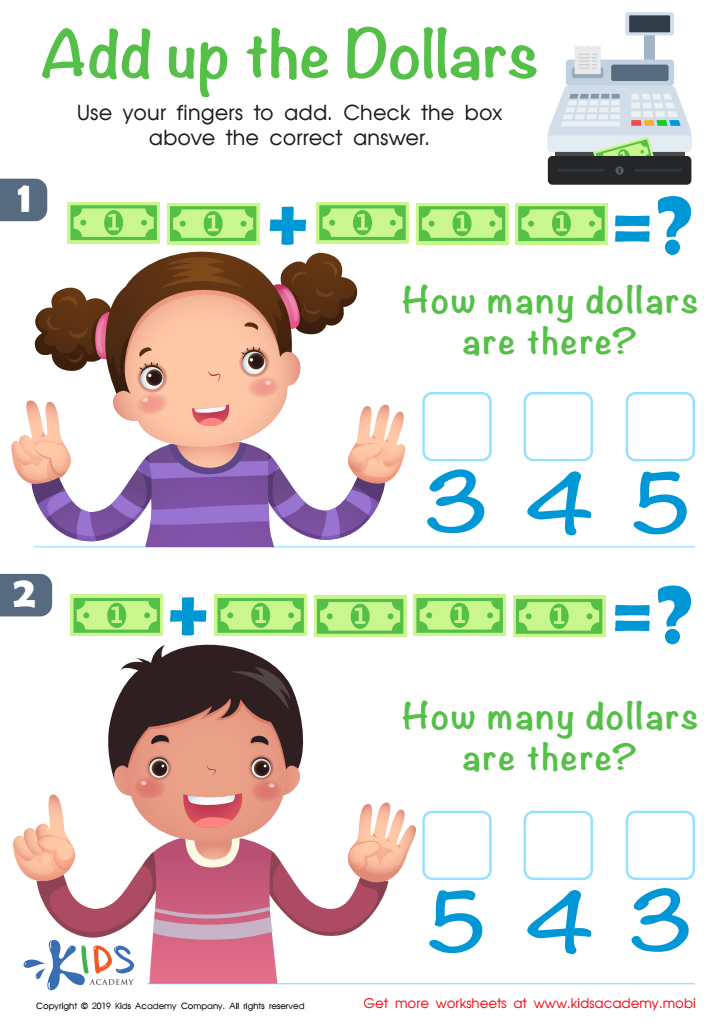

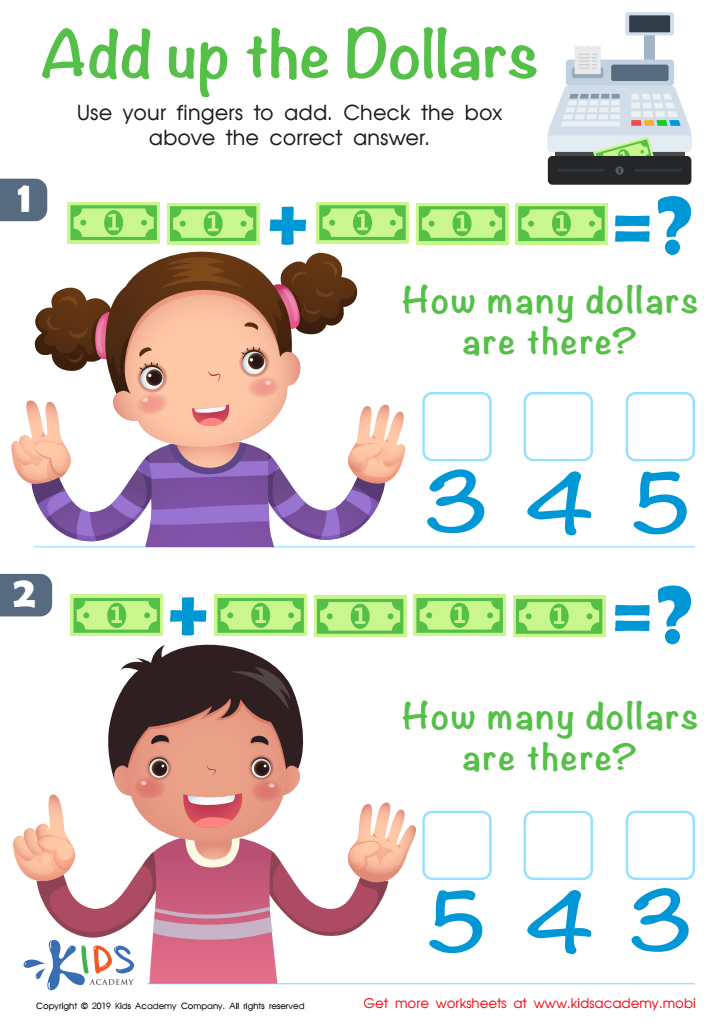

Add up the Dollars Worksheet

Understanding currency math is crucial for children aged 4-7, as it lays the foundation for essential life skills. During these formative years, children are naturally curious and eager to learn about the world around them. Introducing them to currency helps develop mathematical concepts such as counting, addition, and subtraction. As they play with coins and bills, they learn to recognize numbers and understand the value of money, fostering early numeracy skills.

Moreover, integrating currency math lessons encourages responsible financial habits from a young age. By grasping the basics of money management, children gain essential skills in budgeting, saving, and making informed choices. This knowledge is vital for their future, as it helps them navigate financial situations later in life.

For parents and teachers, focusing on currency math also promotes interactive learning experiences, enabling children to engage in hands-on activities. Utilizing real-life scenarios, such as grocery shopping or playing store, can make math fun and relevant. Additionally, these activities facilitate discussions about teamwork, sharing, and honesty. Ultimately, nurturing an understanding of currency math at an early age cultivates independent thinkers who are better prepared to manage their finances responsibly in adulthood.

Assign to My Students

Assign to My Students