Money recognition Money Worksheets for Ages 4-9

5 filtered results

-

From - To

Discover our engaging "Money Recognition Money Worksheets for Ages 4-9," expertly designed to help young learners understand the value and appearance of coins and bills. These fun and interactive printable worksheets provide kids with hands-on practice in identifying, sorting, and counting money, promoting essential early math and financial literacy skills. Perfect for home or classroom use, our educational resources support various learning styles and keep children motivated through colorful visuals and exercises. Equip your child with the foundational knowledge needed for real-world scenarios and boost their confidence with Kids Academy's reliable and age-appropriate materials.

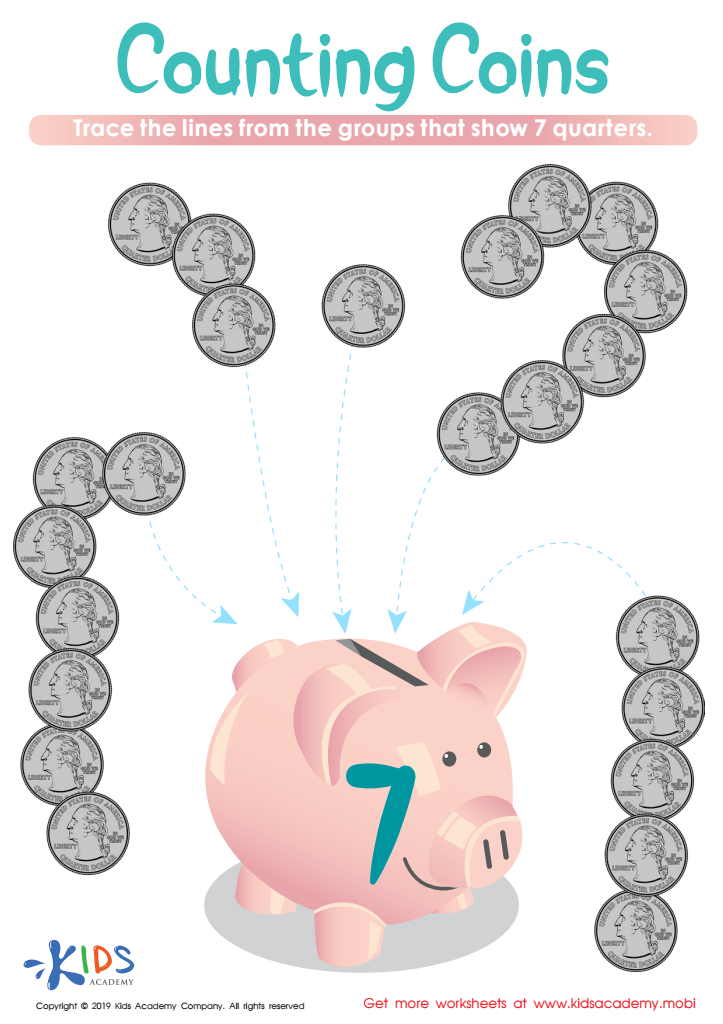

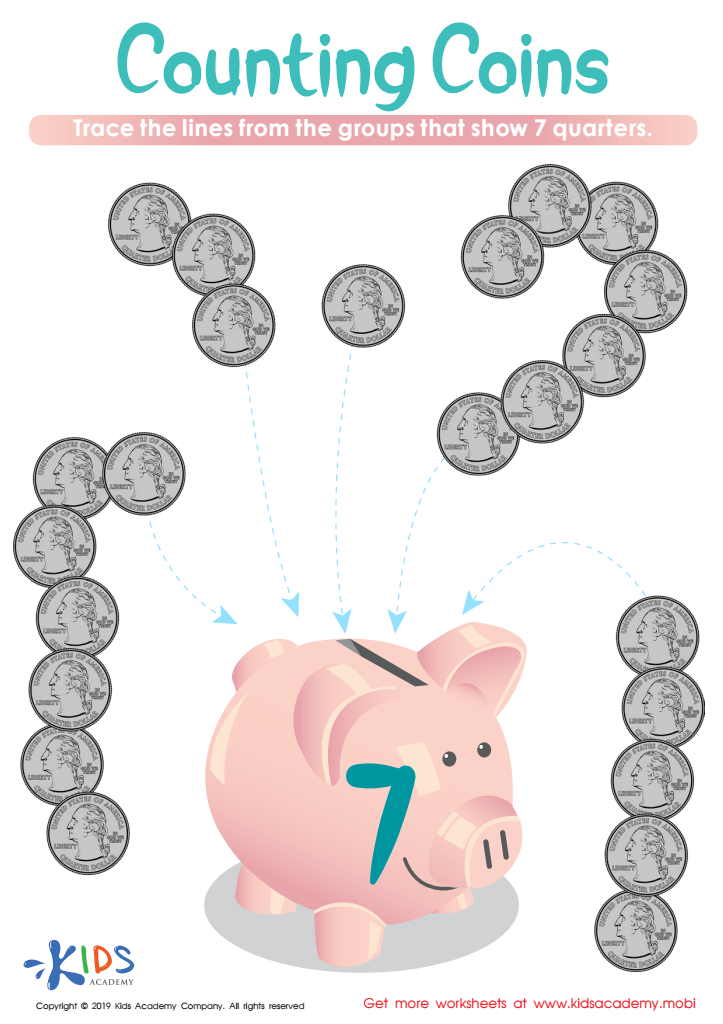

Counting Coins Worksheet

How Many Coins Money Worksheet

One Cent or the Penny Money Worksheet

Coin Names and Values Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Teaching money recognition to children ages 4-9 is vital as it lays the foundation for essential life skills. Early financial education helps kids understand the value of money, enhancing their abilities to make smart financial decisions in the future. Recognizing coins and bills introduces them to math concepts such as counting, addition, and subtraction in a real-world context, making abstract ideas more tangible and engaging.

Money recognition also promotes problem-solving skills and independence. When children learn that different items have different values and practice transactions through play, they develop a sense of autonomy. For example, paying for a toy with their own saved allowance can teach patience, goal-setting, and the importance of saving.

Moreover, early exposure to financial concepts fosters responsibility and strengthens critical thinking. Understanding the basics of money encourages children to differentiate between wants and needs, aiding them in setting priorities from a young age. This early education can also alleviate future financial stress by creating habits of budgeting and saving.

In summary, caring about money recognition for young children equips them with valuable mathematical, life, and social skills. By ensuring that children grasp these basic concepts early on, parents and teachers can help build a strong foundation for a financially literate and responsible adulthood.

Assign to My Students

Assign to My Students