Money addition skills Worksheets for 5-Year-Olds

3 filtered results

-

From - To

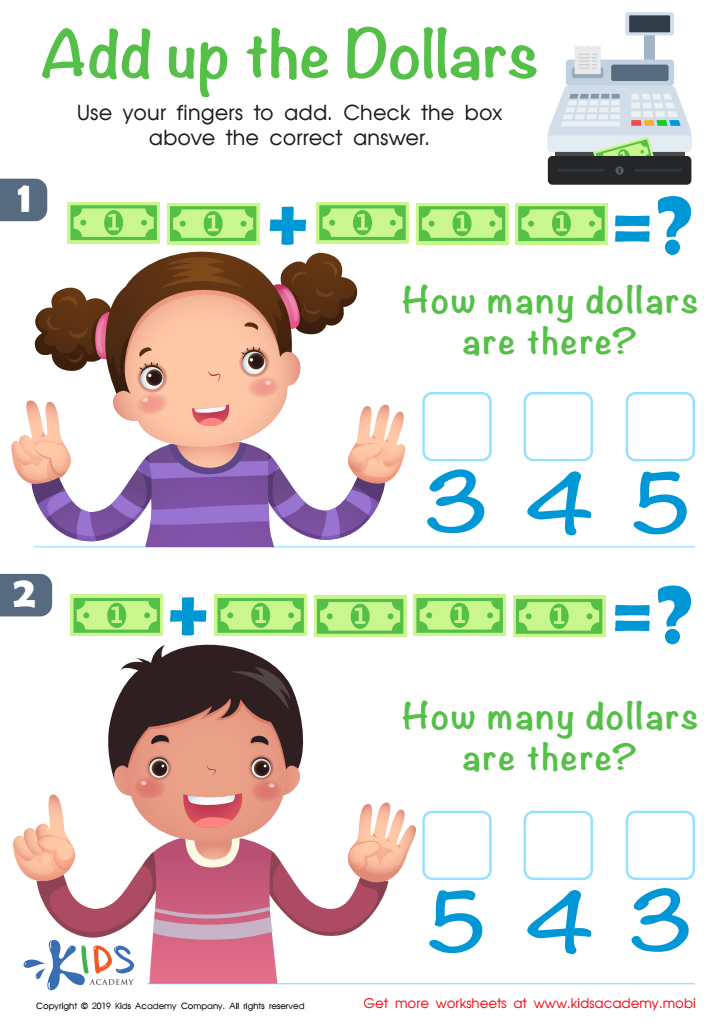

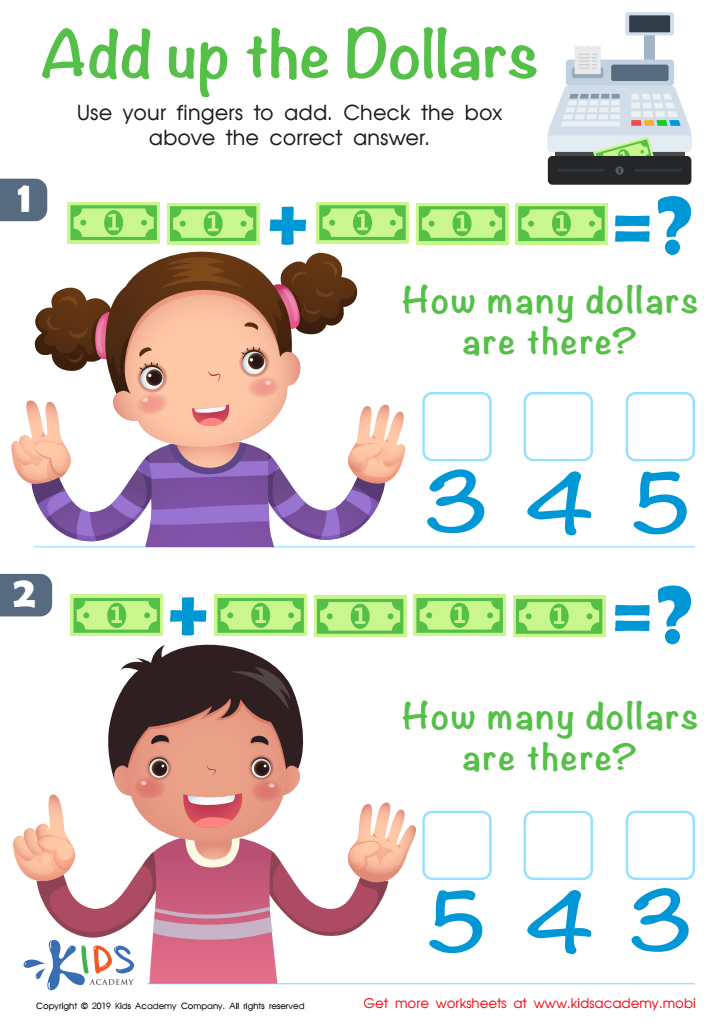

Our "Money Addition Skills Worksheets for 5-Year-Olds" are designed to make learning fun and engaging. Tailored for young learners, these worksheets introduce basic math concepts using real-life scenarios. Kids will practice adding different denominations of currency, enhancing their counting skills and understanding of money value. With colorful visuals and interactive activities, these worksheets not only support mathematical proficiency but also build essential life skills. Great for both classroom use and at-home practice, our worksheets ensure kids grasp the basics of adding money while enjoying the learning process. Start your child’s financial literacy journey today!

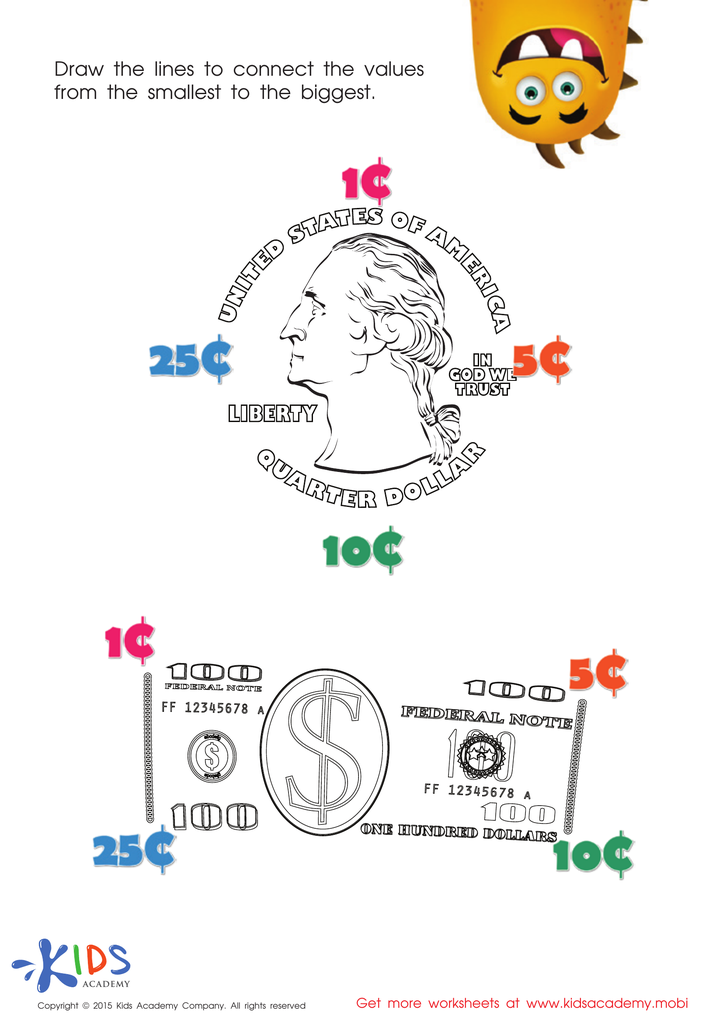

Connecting the Values Money Worksheet

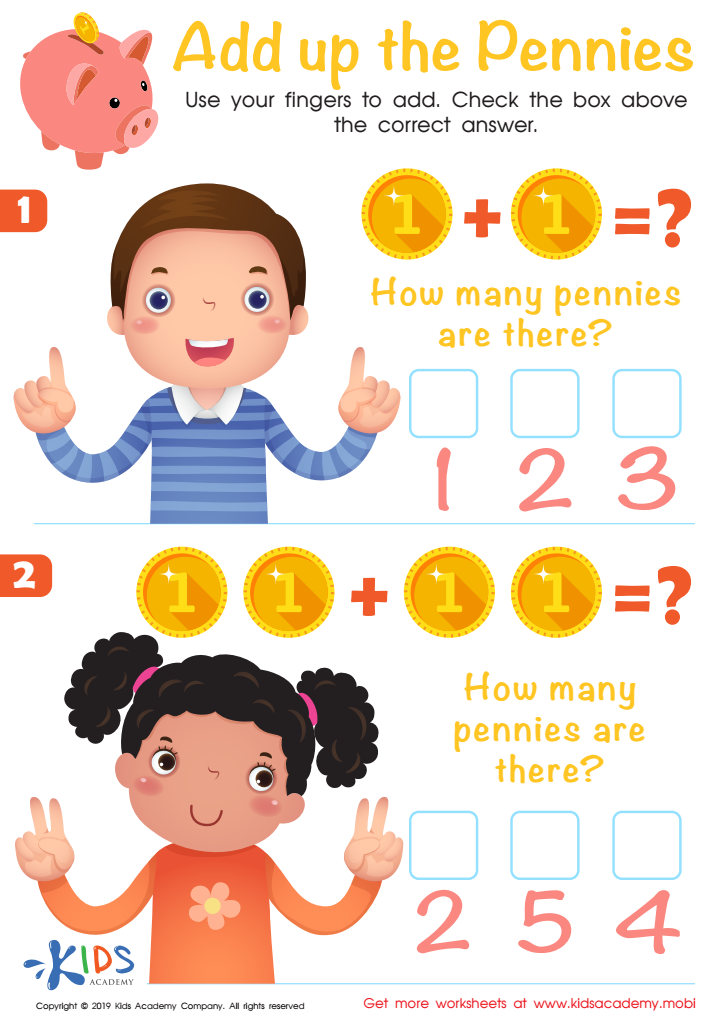

Add up the Pennies Worksheet

Add up the Dollars Worksheet

Teaching money addition skills to 5-year-olds is important for several reasons, crucial for both parents and teachers to consider. Firstly, early introduction to money concepts builds a foundation for future financial literacy. Helping young children understand the value of money and basic arithmetic reinforces important math skills that are essential for their overall academic success.

Secondly, learning about money helps to develop critical thinking and problem-solving abilities. Kids engage in exercises where they need to count coins, sum up prices, and make changes, which strengthens their cognitive skills and logical reasoning.

Moreover, imparting these skills encourages responsibility and practical life skills. Even in simple, playful scenarios such as pretend shopping with toy money, children learn the significance of saving, spending wisely, and budget management. These activities prepare them for real-life decisions.

For teachers and parents alike, fostering this early competency can also lead to increased confidence in a child's abilities. The sense of accomplishment they gain from correctly adding money can improve their self-esteem and motivate them to tackle more complex tasks in the future.

In summary, investing time in teaching money addition skills to young children equips them with essential mathematical, cognitive, and life skills, laying the groundwork for responsible and informed financial habits in adulthood.

Assign to My Students

Assign to My Students