Financial literacy Worksheets for Ages 6-7

6 filtered results

-

From - To

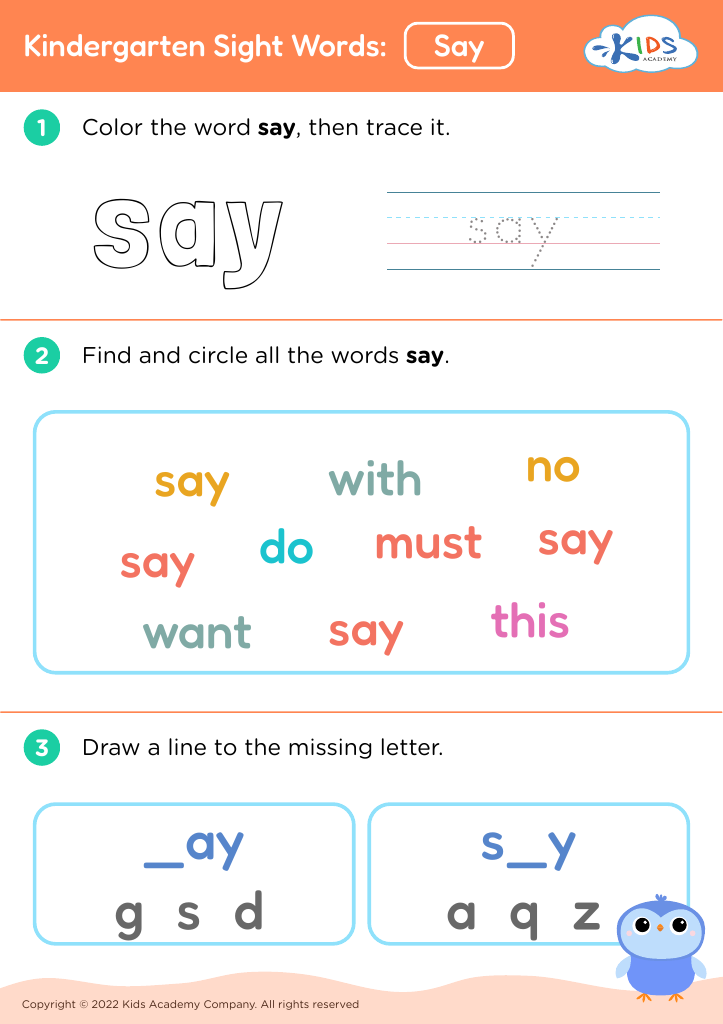

Our Financial Literacy Worksheets for Ages 6-7 introduce young learners to basic money concepts through engaging and interactive activities. Designed to build foundational skills, these worksheets cover topics such as identifying coins and bills, understanding their value, and simple budgeting exercises. Each worksheet combines learning with fun illustrations to keep children motivated and involved. Develop their math abilities and financial awareness early on with our expertly crafted resources. Perfect for both classroom and home use, these worksheets are an essential tool for teaching kids the importance of money management and financial responsibility from a young age.

Let's Go to the Store! Worksheet

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is an essential skill that equips children with the knowledge and confidence to make informed financial decisions. Introducing financial literacy at ages 6-7 can serve as a strong foundation for a lifetime of sound financial habits. At this young age, children are highly receptive and curious, making it an ideal period for teaching basic financial concepts in a fun and engaging way.

Children naturally observe financial behaviors from their parents and surroundings, and early education helps demystify concepts like saving, spending, and budgeting. By understanding these basics, they are better prepared to recognize the value of money, distinguish between needs and wants, and develop the habit of saving. These lessons empower them to make more responsible choices as they grow up, reducing the likelihood of financial struggles later in life.

For parents and teachers, embedding financial literacy into early education entails blending lessons into daily activities, such as setting up small savings jars for goals and incorporating math problems that involve money. Such practical applications not only reinforce math skills but also make learning relevant and engaging. By caring about financial literacy at an early age, parents and teachers ensure children are forming healthy relationships with money, paving the way to financially responsible adults who are better prepared to navigate an increasingly complex financial world.

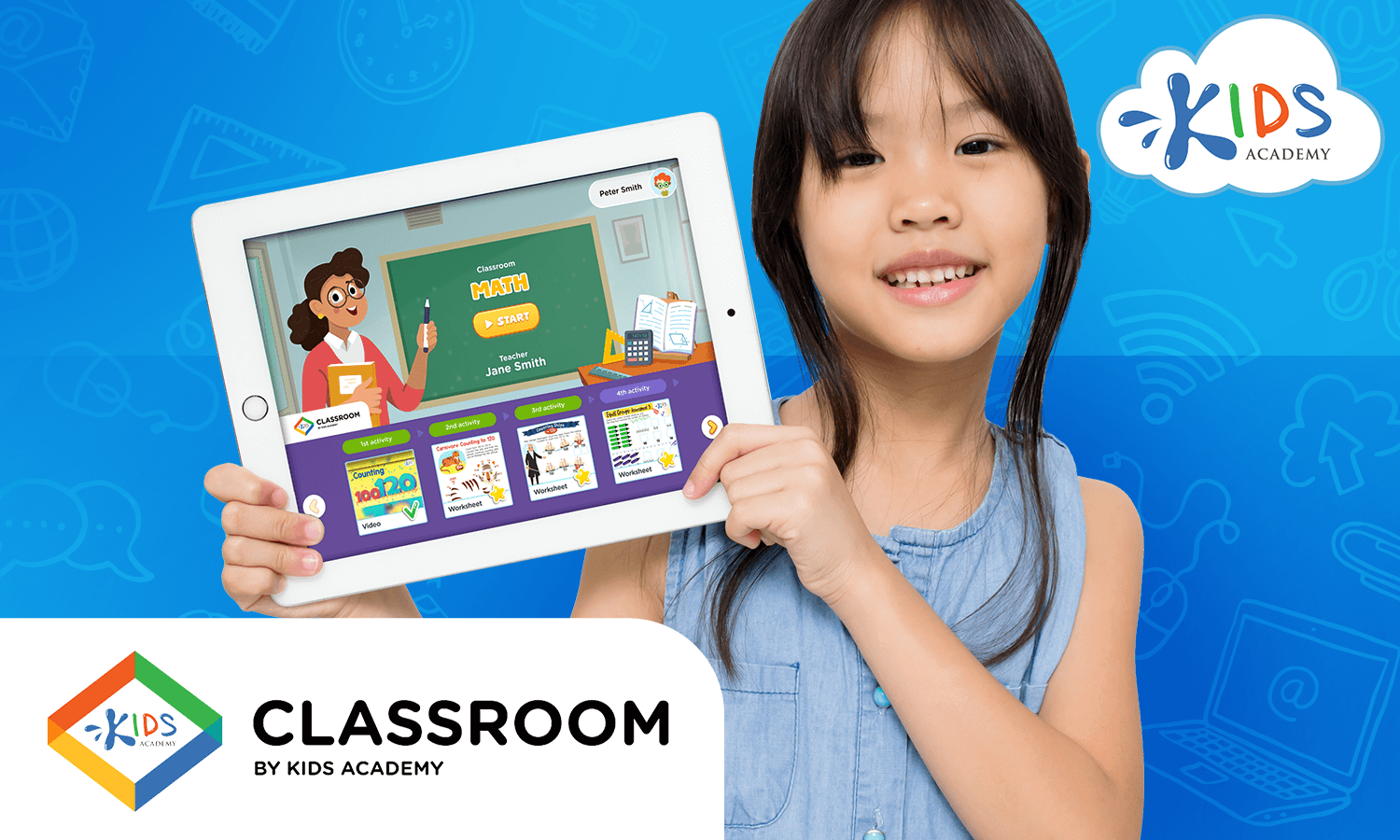

Assign to My Students

Assign to My Students