Understanding money Math Worksheets for Ages 6-8

6 filtered results

-

From - To

Discover our engaging “Understanding Money” math worksheets designed specifically for children ages 6-8. These interactive activities help young learners master essential money concepts, including recognizing coins and bills, simple addition and subtraction, and calculating the total value of items. With a variety of exercises that incorporate real-life scenarios, students will enhance their financial literacy while developing critical math skills. Perfect for classroom use or at-home learning, our worksheets foster a fun and effective way to build confidence in handling money. Prepare your child for a brighter financial future with our carefully curated and easy-to-use resources!

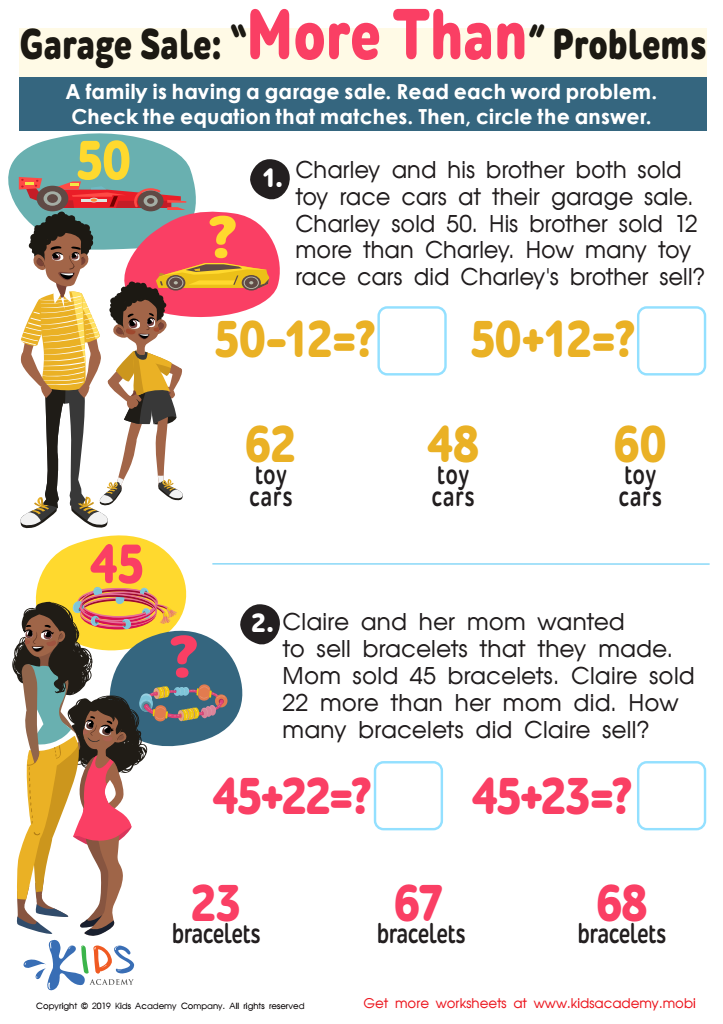

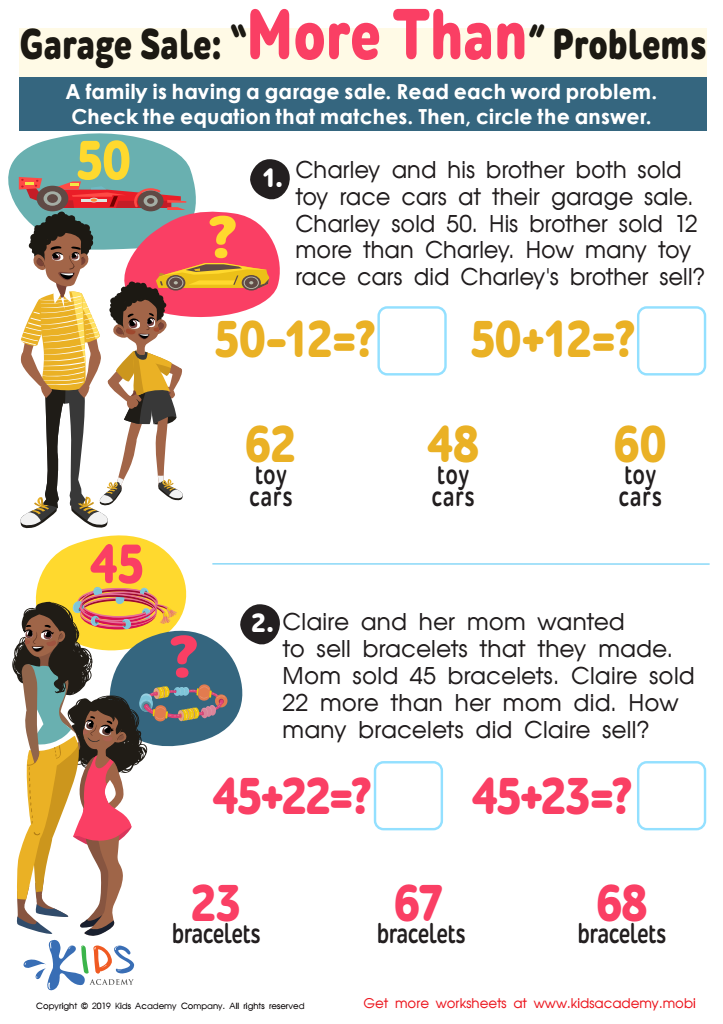

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

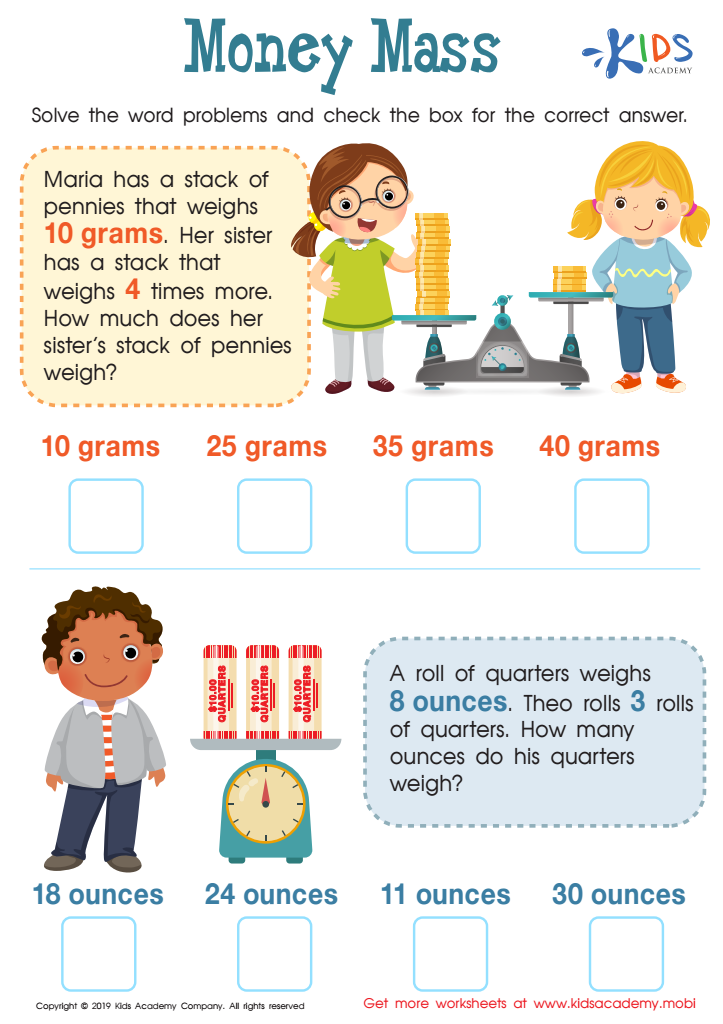

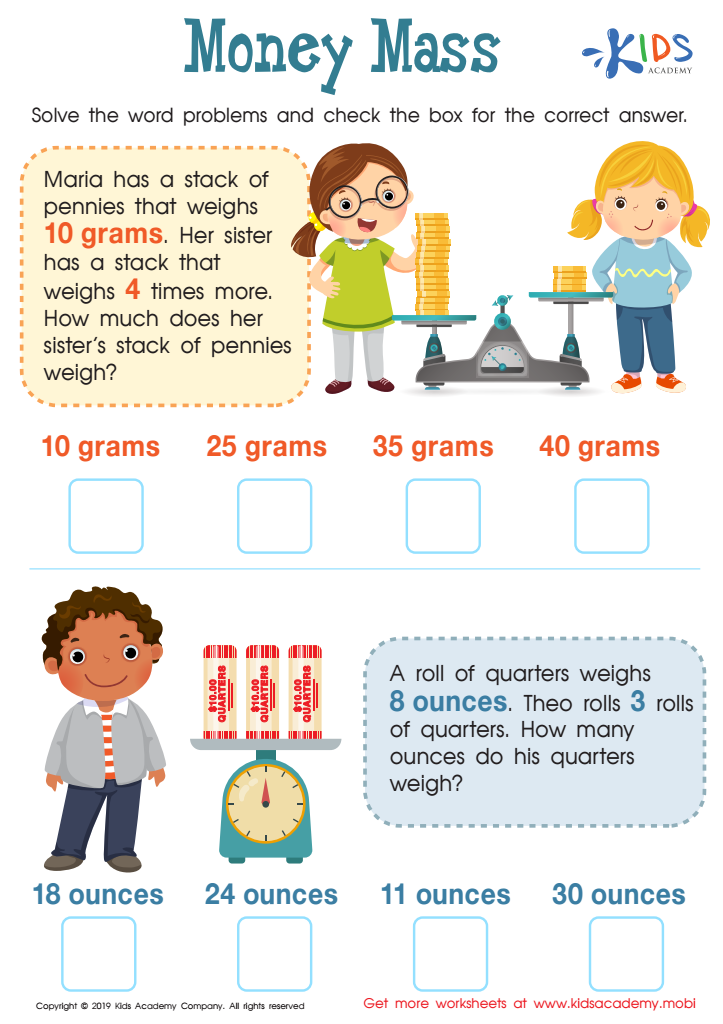

Money Mass Worksheet

Understanding money math is crucial for children aged 6-8 as it lays the foundation for important life skills. At this stage, children begin to grasp basic mathematical concepts, and incorporating money into their learning enhances their numerical fluency and problem-solving abilities. Teaching money math helps children understand the value of coins and bills, which develops their counting skills and reinforces their ability to make change, budget, and prioritize spending.

Moreover, understanding money promotes financial literacy, a necessary skill for responsible adulthood. By introducing concepts like saving, spending, and sharing from a young age, parents and teachers can instill a sense of responsibility and good financial habits early on. This knowledge empowers children to make informed decisions about money, setting the stage for better financial management in the future.

In a world where financial literacy is increasingly important, learning about money math equips children with the tools to navigate financial situations, fostering confidence in their ability to handle money wisely. Engaging with money-related activities also makes learning fun and relatable, turning abstract mathematical concepts into practical applications. Ultimately, parents and teachers should prioritize understanding money math to prepare children for future financial success and everyday decision-making.

Assign to My Students

Assign to My Students