Money management Worksheets for Ages 7-8

4 filtered results

-

From - To

Discover engaging and fun Money Management Worksheets for ages 7-8 designed by leading educational experts. These printable worksheets from Kids Academy help young learners understand the value of money, basic financial concepts, and critical thinking skills through interactive activities and vibrant illustrations. Tailored to grasp the fundamentals of earning, saving, spending, and budgeting, these resources make financial literacy enjoyable and approachable. Ideal for both classroom and home use, our worksheets encourage practical learning experiences, fostering responsible money habits from a young age. Equip your child with essential life skills through these thoughtfully curated money management activities.

Grocery Store Worksheet

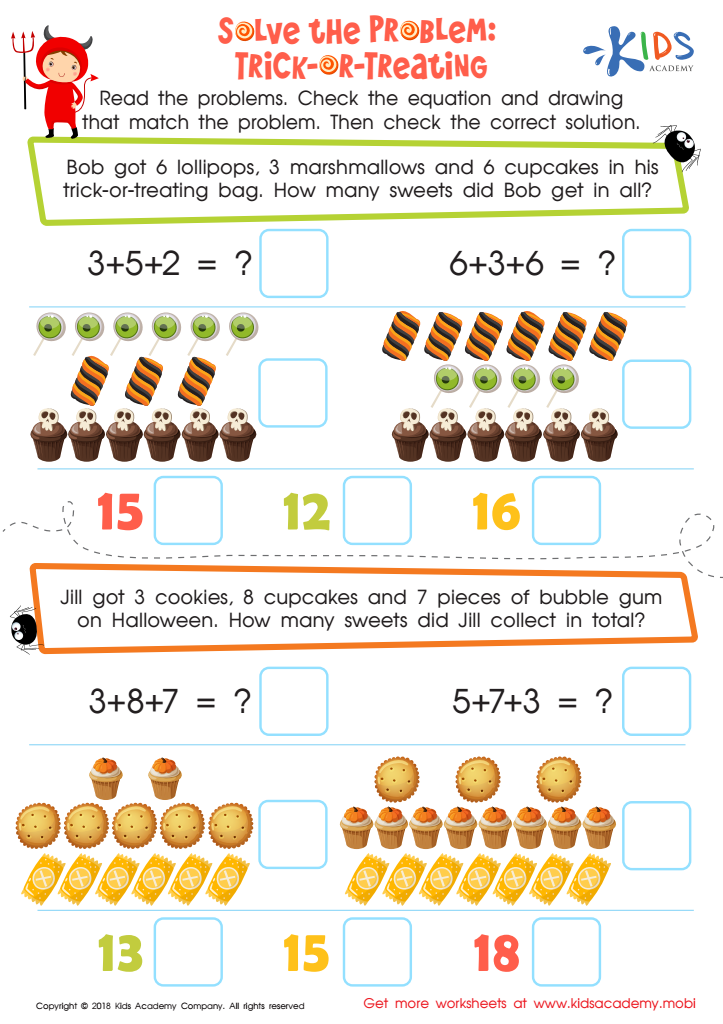

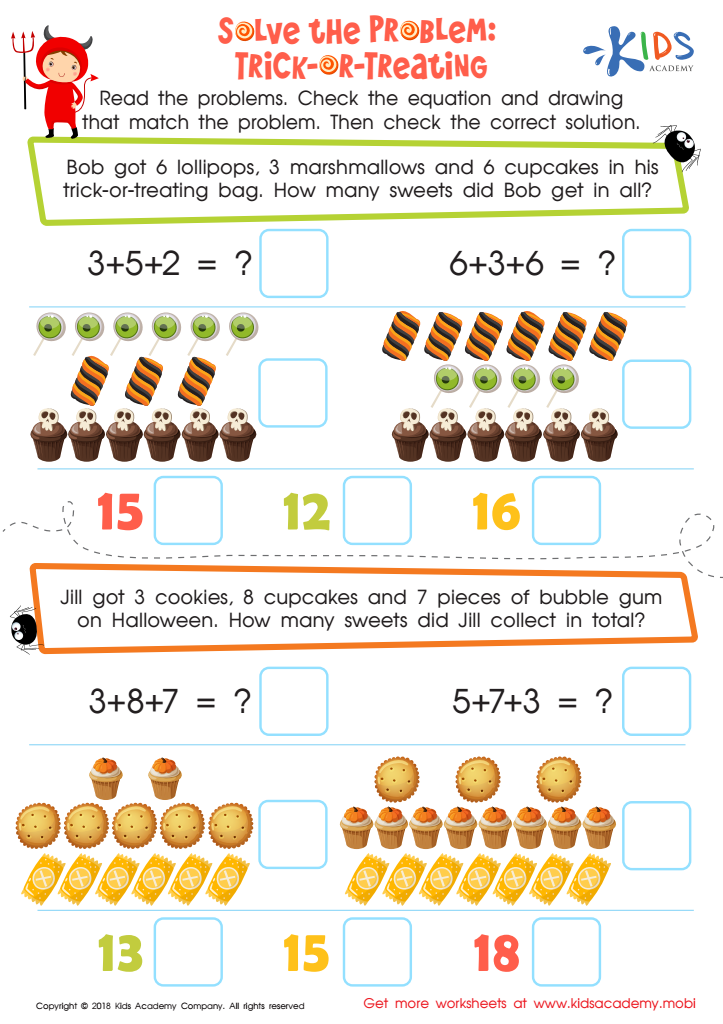

Solve the Problem: Trick–or–treating Worksheet

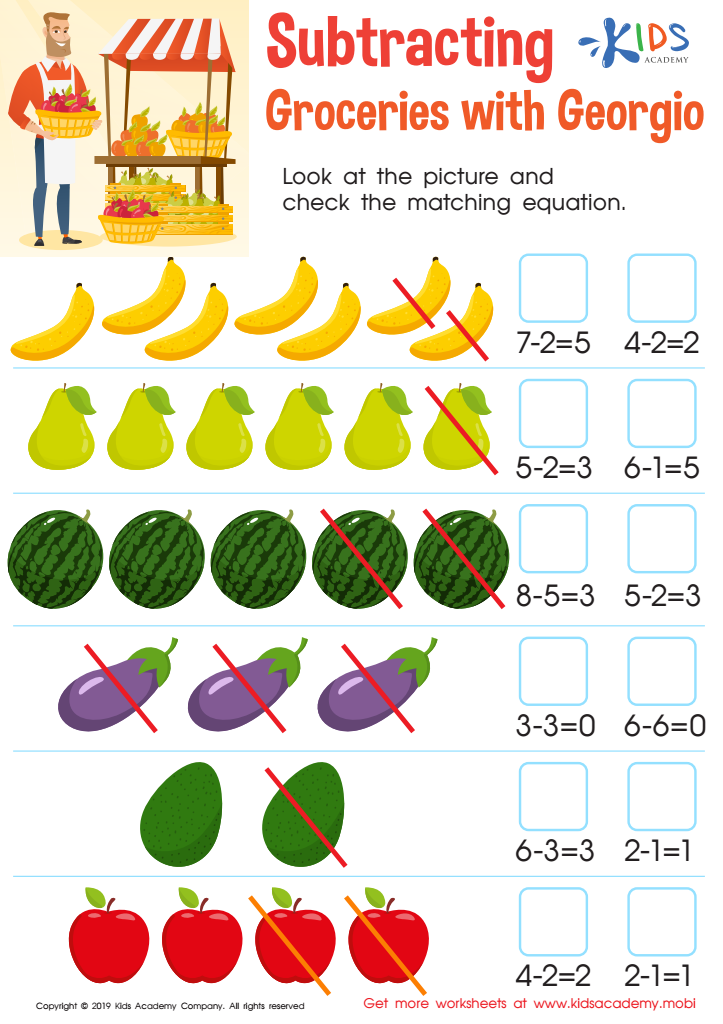

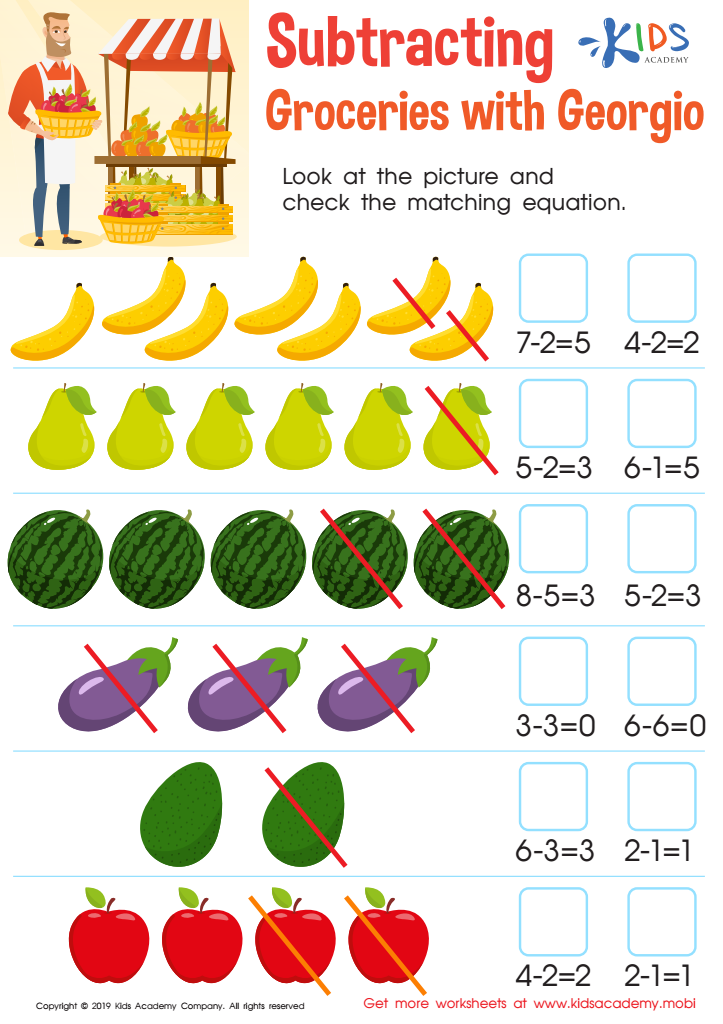

Subtracting: Groceries with Georgio Worksheet

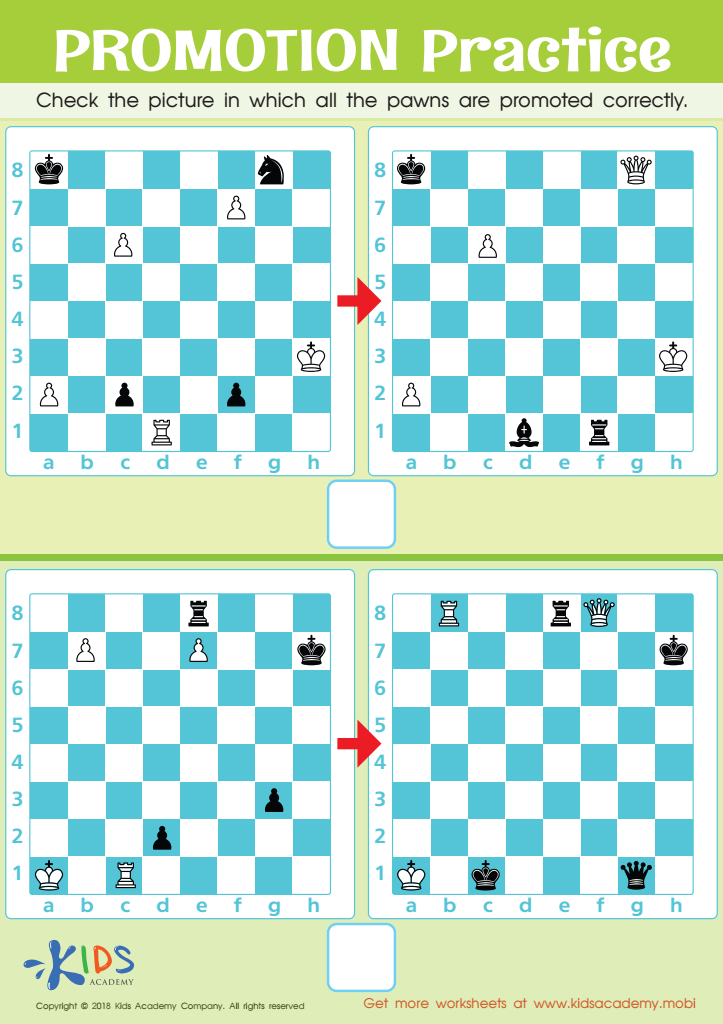

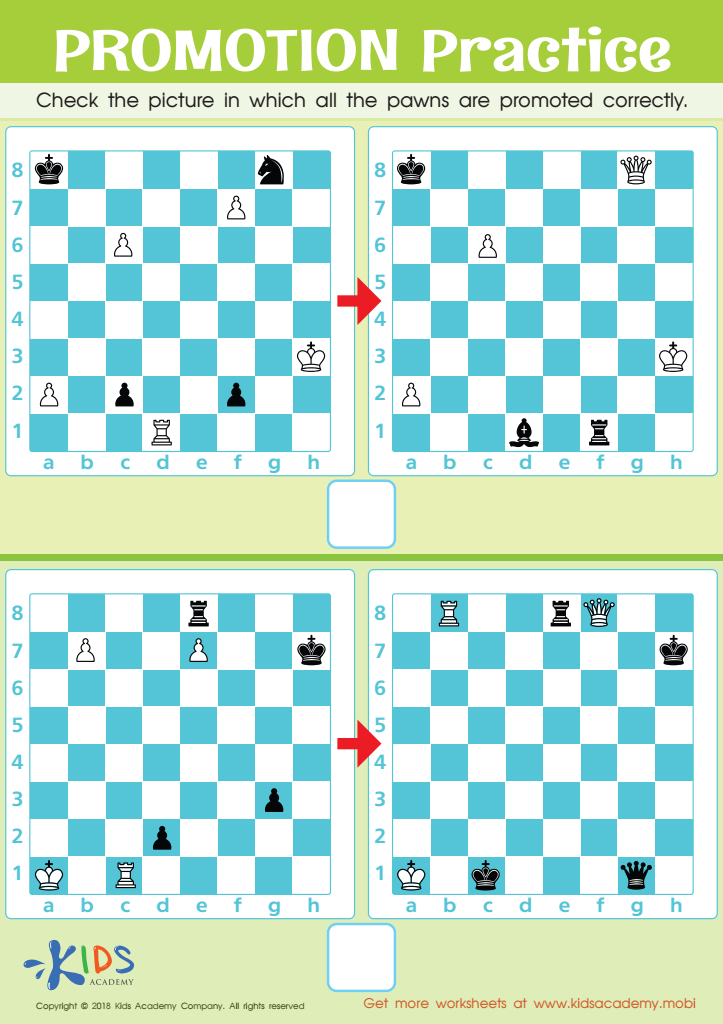

Promotion Practice Worksheet

Early financial education is crucial for children aged 7-8 because it sets the stage for lifelong financial responsibility and independence. At this impressionable age, kids are developing foundational skills and habits that they will carry into adulthood. Teaching money management helps children understand the value of money, the difference between needs and wants, and the importance of saving.

One key reason parents and teachers should care about money management for young children is to instill financial literacy early on. Understanding concepts such as budgeting, saving, and making informed spending decisions can help prevent future financial difficulties. With a basic knowledge of money, children are more likely to grow up with a mindset that prioritizes financial stability and informed decision-making.

Moreover, financial education promotes math skills. Activities like counting money, making change, and budgeting foster important numerical skills, supporting their academic growth in a practical and engaging manner.

Additionally, conversations about money can also introduce children to the concept of charity and sharing, teaching empathy and social responsibility.

By being actively involved in their children’s financial education, parents and teachers can not only provide essential life skills but also model good financial behavior, thus positively influencing their future financial wellbeing.

Assign to My Students

Assign to My Students