Counting skills Coins Worksheets for Ages 8-9

4 filtered results

-

From - To

Boost your child’s financial literacy with our engaging Counting Skills Coins Worksheets, designed for ages 8-9. These interactive worksheets help students master the essentials of counting coins, making math both fun and relatable. Through a variety of exercises, children will enhance their coin recognition, learn to add different denominations, and develop their money management skills. Each worksheet is thoughtfully crafted to align with educational standards, ensuring that learning feels seamless and enjoyable. Perfect for classroom use or at-home practice, these worksheets provide the ideal foundation for young learners to confidently handle everyday financial situations. Start counting coins with confidence today!

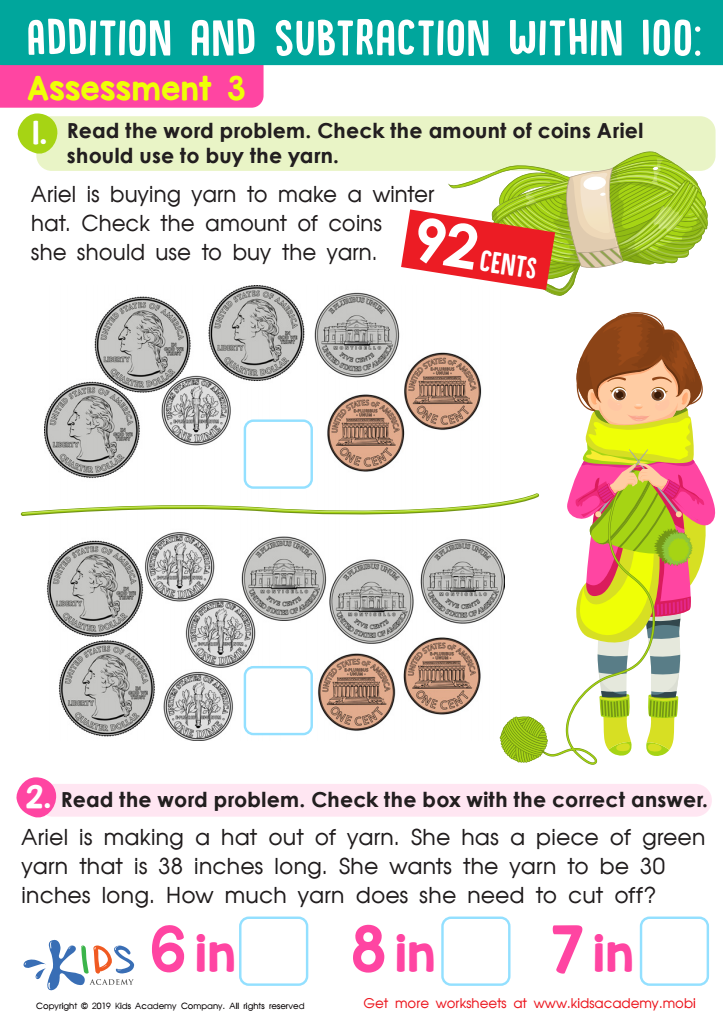

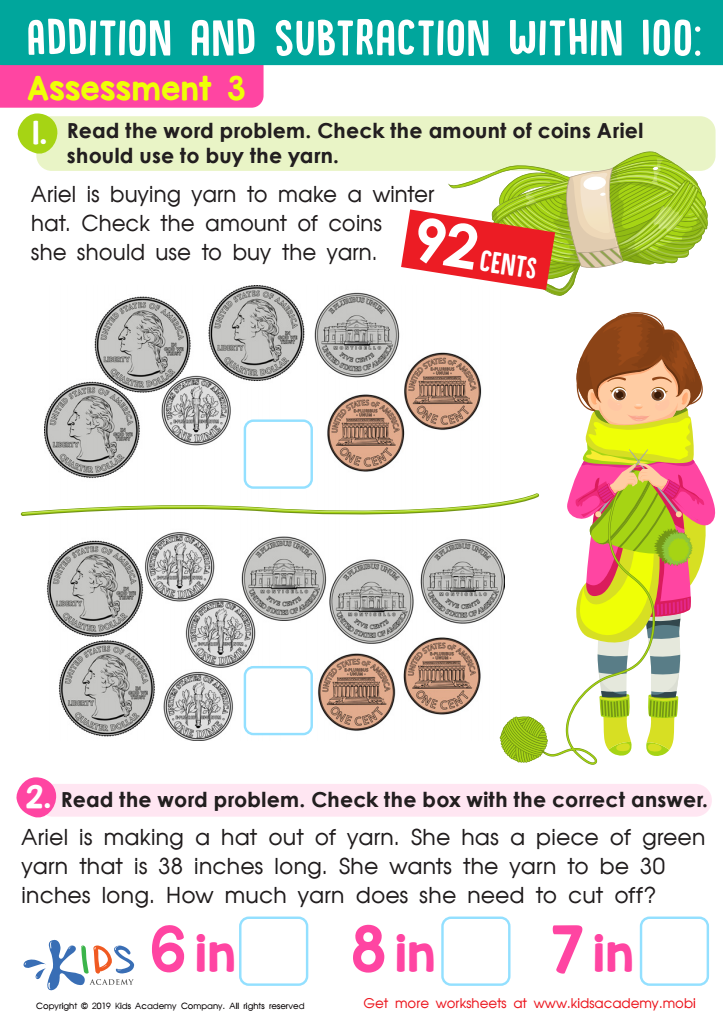

Assessment 3 Math Worksheet

One Cent or the Penny Money Worksheet

Five Cents or the Nickel Money Worksheet

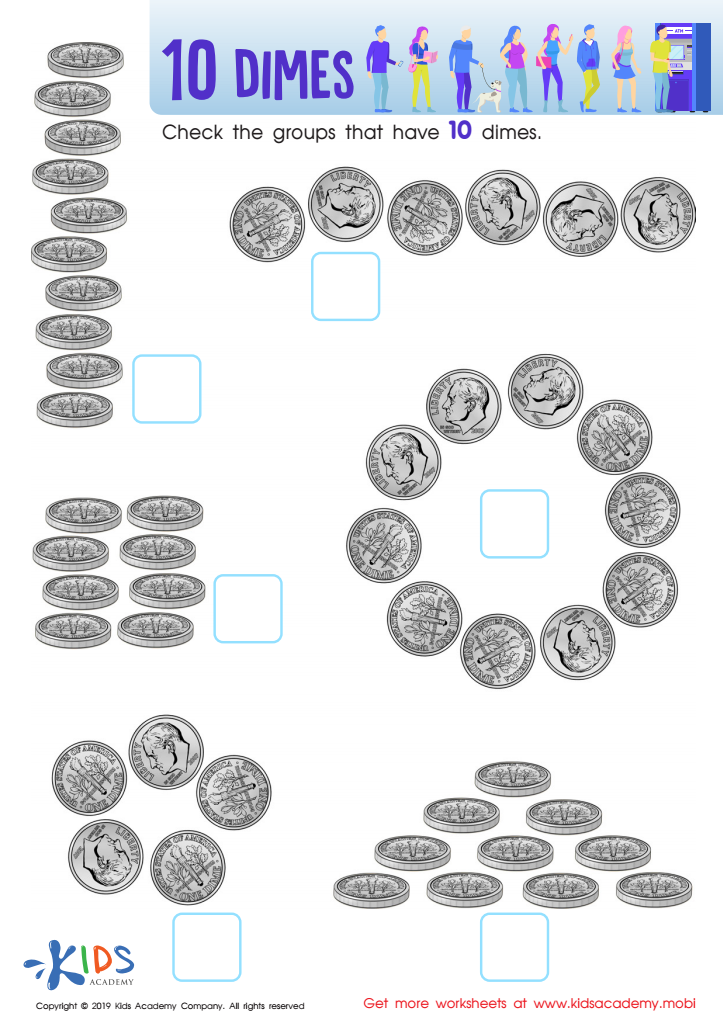

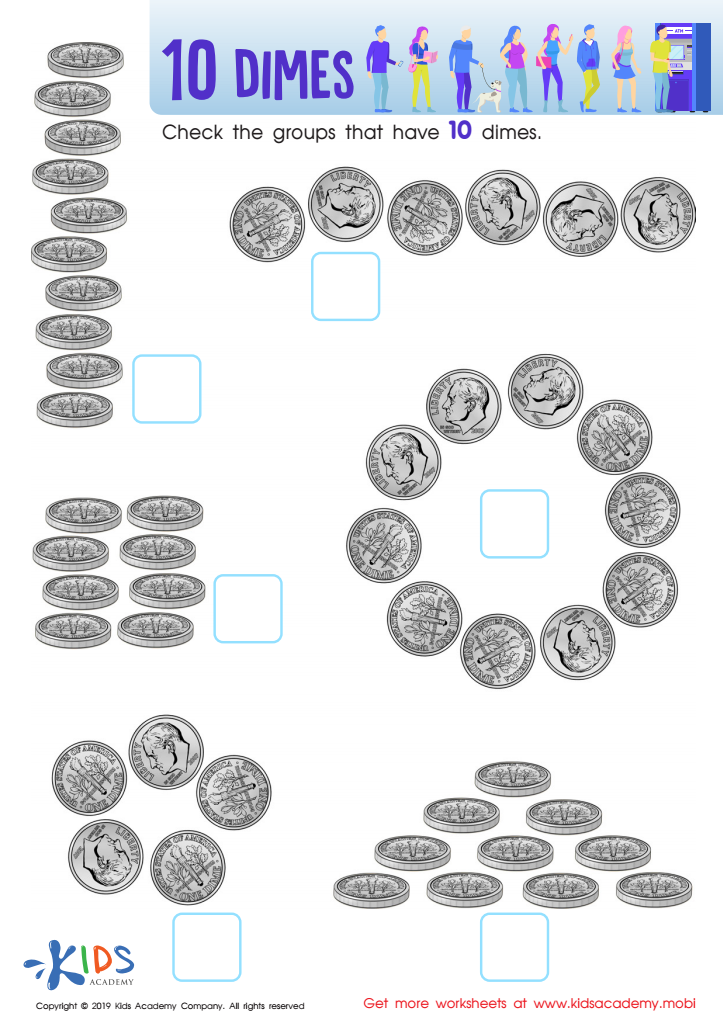

10 Dimes Worksheet

Counting skills, particularly when it comes to coins, are essential for children aged 8-9. This fundamental skill not only fosters mathematical proficiency but also prepares them for real-life financial interactions. At this age, children are developing critical thinking and problem-solving abilities, and learning to count money enhances these skills by requiring them to identify, group, and compute various coin denominations.

Moreover, understanding counting with coins promotes financial literacy, laying the groundwork for responsible money management as children grow older. It empowers them to make informed decisions about spending, saving, and budgeting. By engaging in hands-on activities like shopping games or pretend play, parents and teachers can make learning enjoyable while reinforcing these concepts.

Additionally, mastering coin counting supports broader educational goals, including enhancing concentration, boosting confidence in math, and fostering collaboration during group activities. This skill also serves as a stepping stone for more complex mathematical concepts, such as addition, subtraction, and multiplication with larger amounts. Ultimately, caring about these skills not only enriches the children’s mathematical experience but also equips them with crucial tools for everyday life, ensuring they become financially savvy individuals in the future.

Assign to My Students

Assign to My Students