Understanding money Addition & Subtraction Worksheets for 8-Year-Olds

4 filtered results

-

From - To

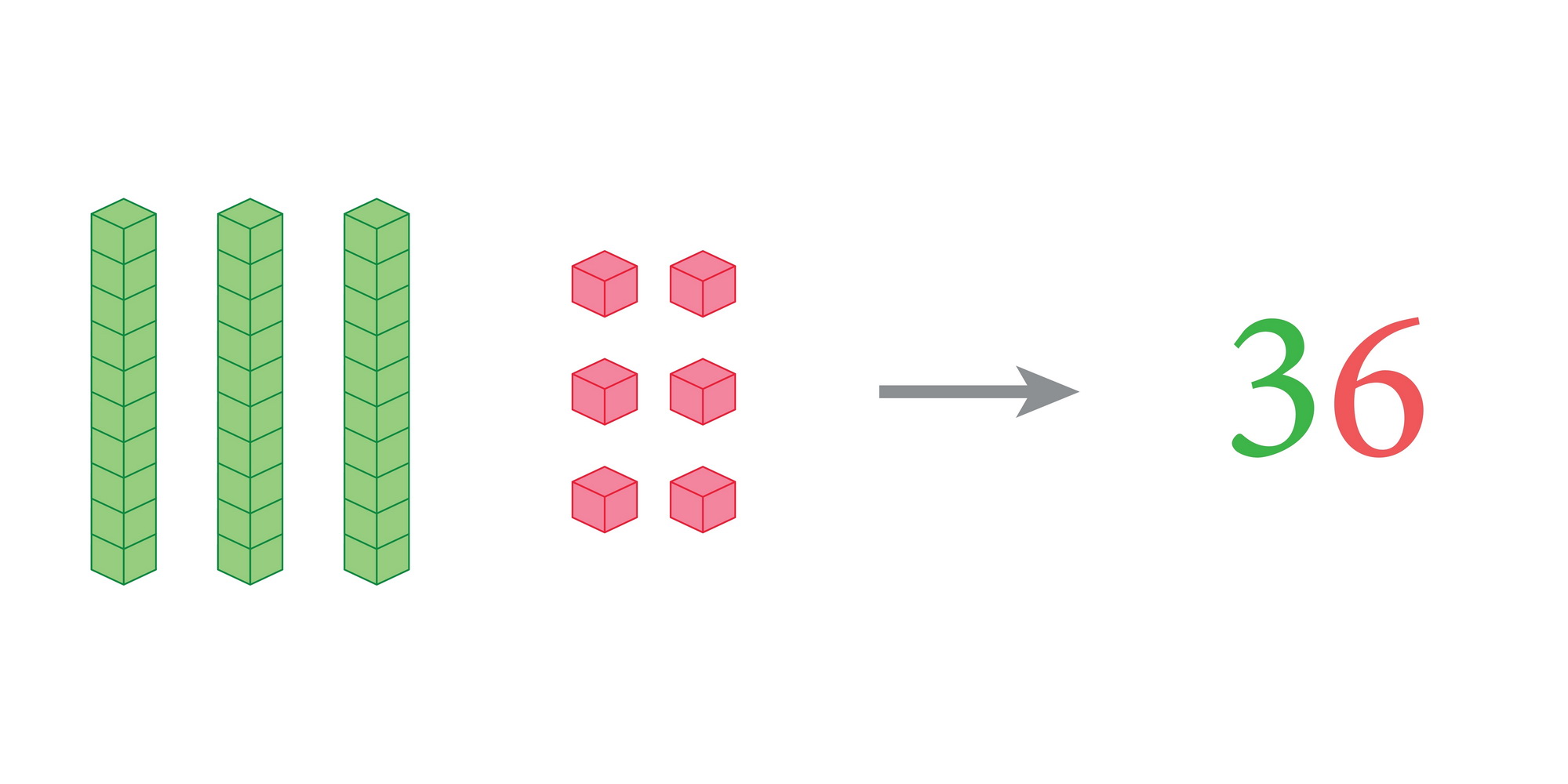

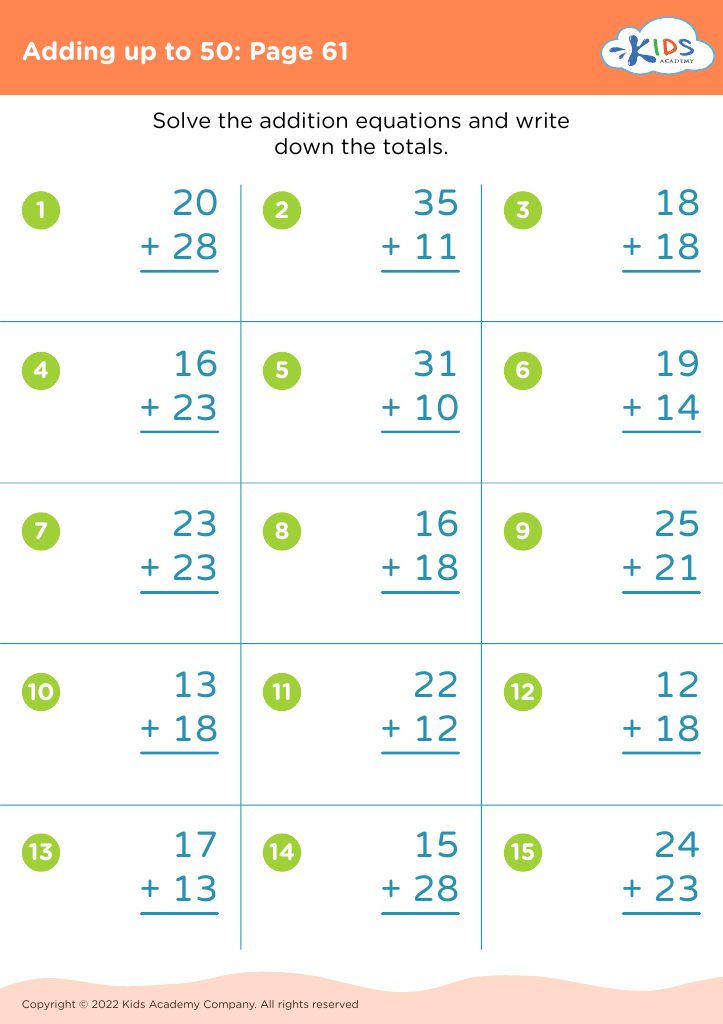

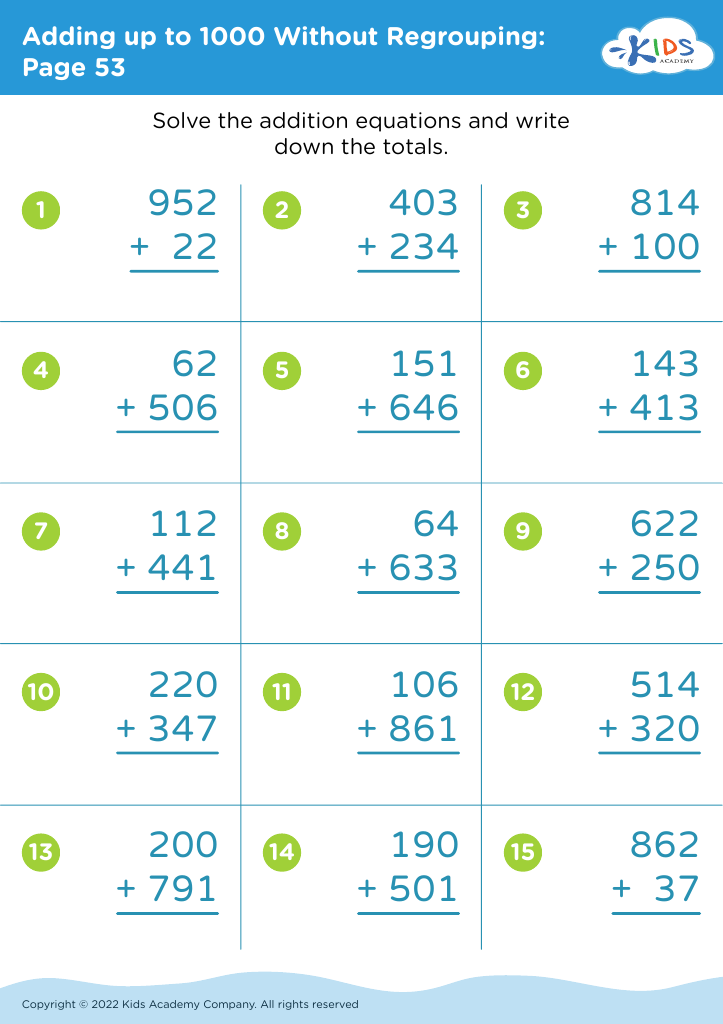

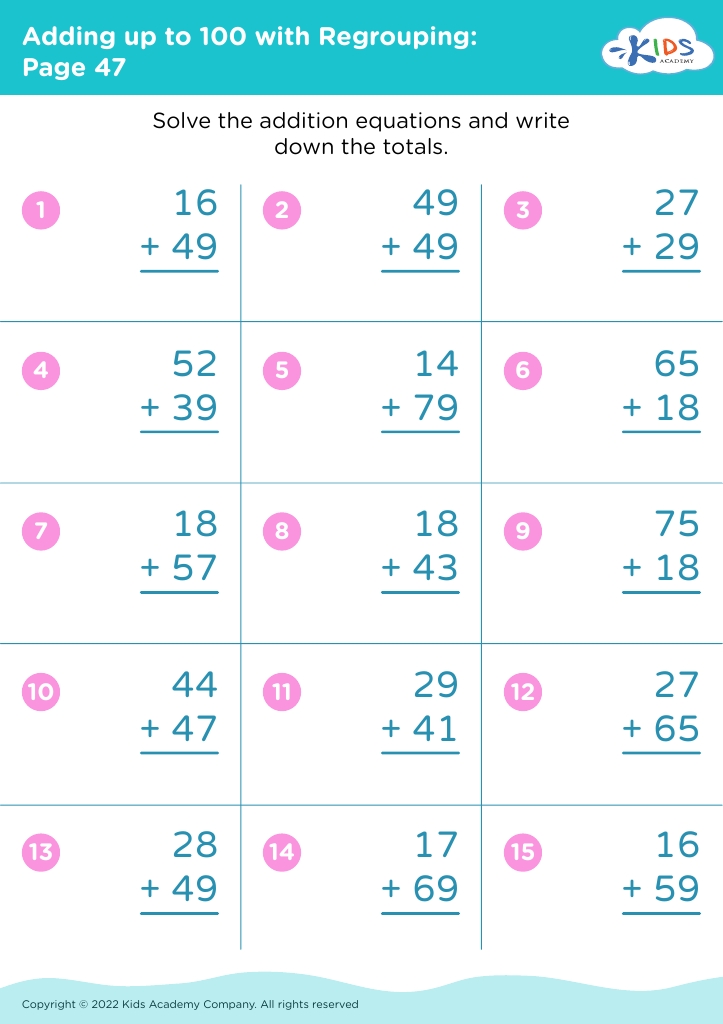

Discover our engaging "Understanding Money Addition & Subtraction Worksheets" designed specifically for 8-year-olds! These fun and interactive worksheets help young learners grasp essential math concepts while managing money. Children will enhance their addition and subtraction skills through practical scenarios like making purchases, counting change, and budgeting. Incorporating real-life examples helps students relate math to everyday situations, fostering a deeper understanding of financial literacy. Our worksheets are visually appealing and age-appropriate, ensuring that learning is both enjoyable and effective. Download now and empower your child with the confidence and skills needed to master money-related math challenges!

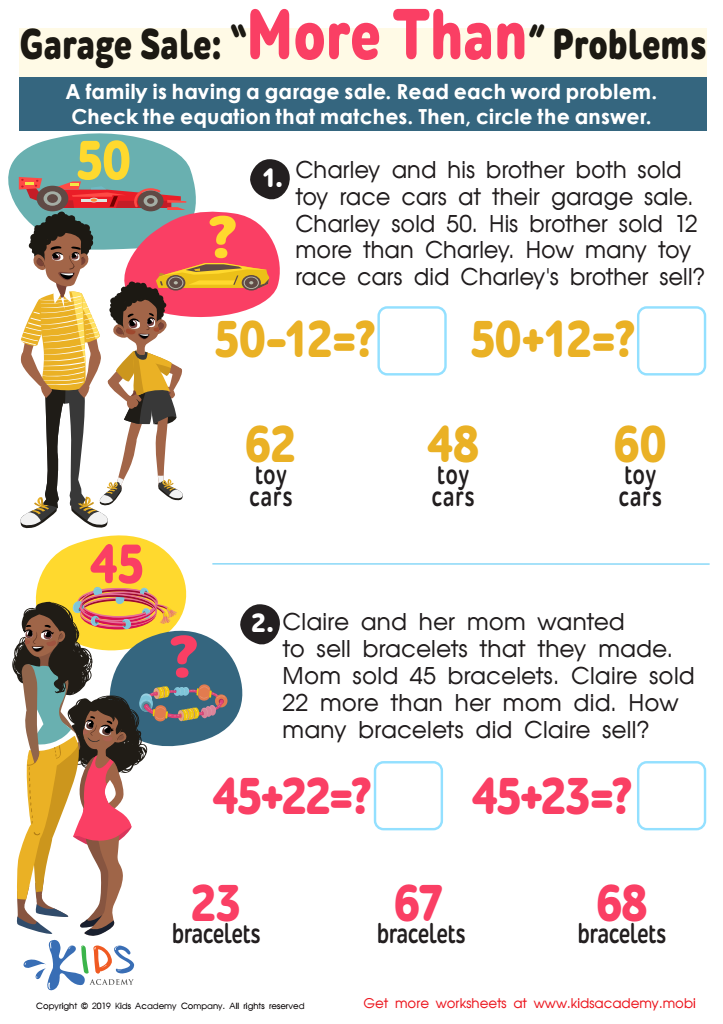

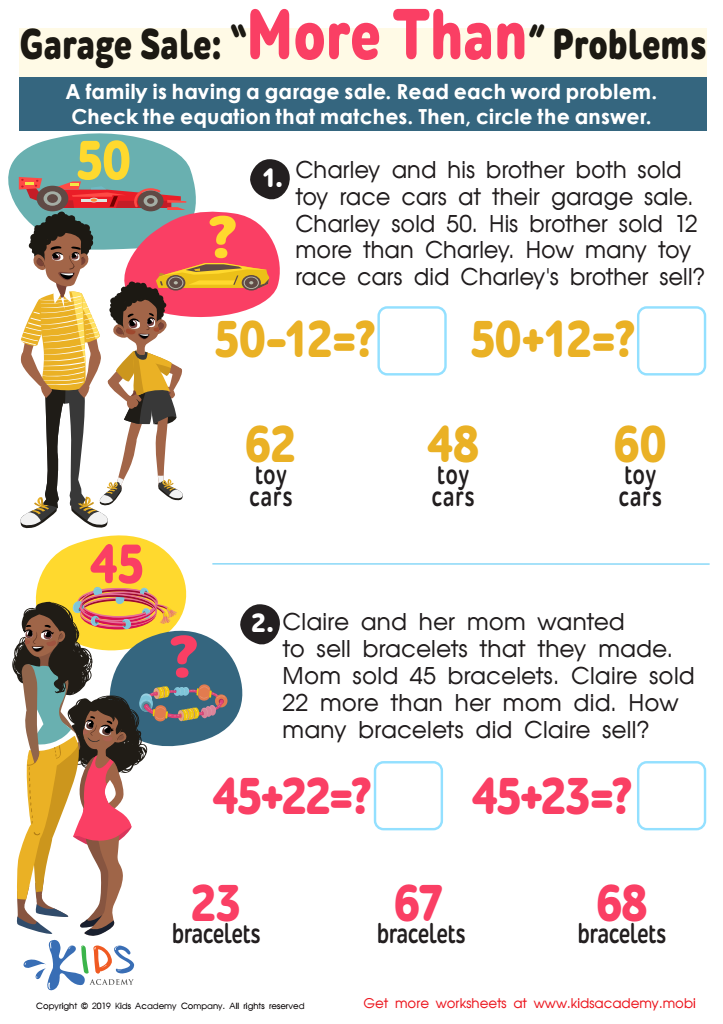

Garage Sale - More yhan Worksheet

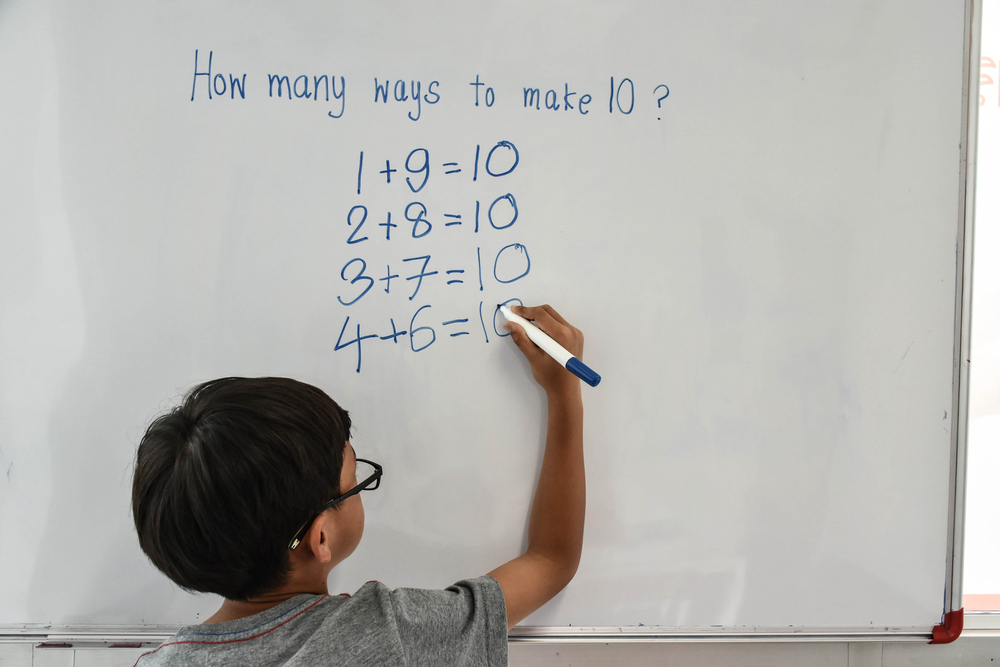

Understanding money, addition, and subtraction is crucial for 8-year-olds as it lays the foundation for their financial literacy and mathematical skills. At this age, children are beginning to interact with money through chores, allowances, and shopping with parents. Teaching them how to add and subtract money helps them make sense of transactions in real-life situations, fostering a practical understanding of budgeting and spending.

Additionally, mastering these concepts boosts their overall confidence in math. When children learn to manage money, they develop critical thinking skills as they navigate scenarios involving prices, change, and savings. This knowledge empowers them to make informed decisions, building a sense of responsibility that will benefit them in the future.

Moreover, money-related math can make learning more engaging and relevant. Children can relate to examples that involve their favorite toys or treats, reinforcing math skills in an enjoyable way. By focusing on these skills, parents and teachers not only enhance a child's academic performance but also prepare them for a financially responsible adulthood. Investing time in understanding money addition and subtraction empowers children to face everyday situations with confidence and skill, shaping them into financially savvy individuals.

Assign to My Students

Assign to My Students