Counting practice Money Worksheets

6 filtered results

-

From - To

Explore our engaging Counting Practice Money Worksheets designed to enhance young learners' math skills and financial literacy. These worksheets provide fun and interactive activities that teach children how to identify, count, and manage money effectively. By incorporating colorful visuals and relatable scenarios, kids can practice recognizing different denominations and solving practical coin-related problems. Perfect for reinforcing classroom lessons or for at-home learning, our worksheets cater to various learning styles and abilities. Help your child develop confidence in their counting skills and prepare them for real-world situations with our easy-to-use, printable resources today!

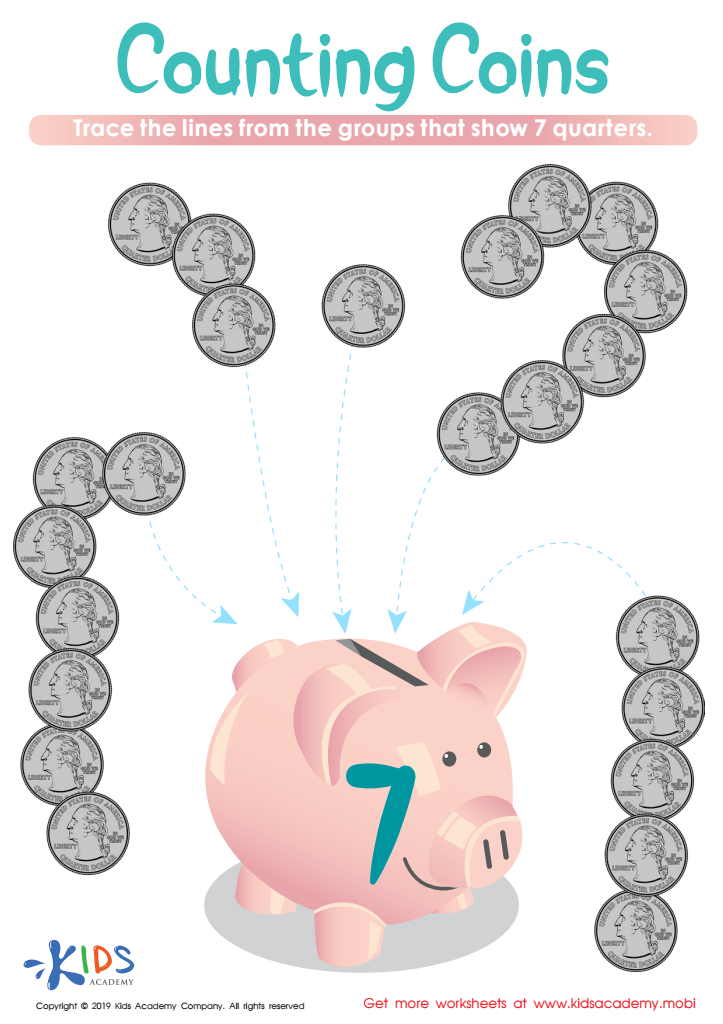

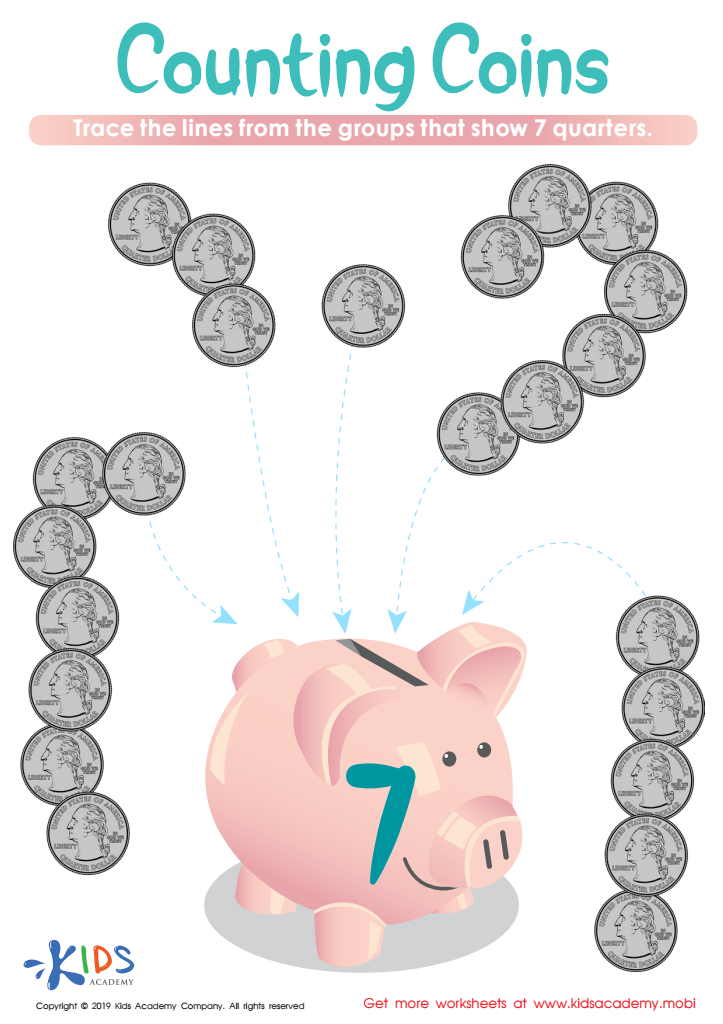

Counting Coins Worksheet

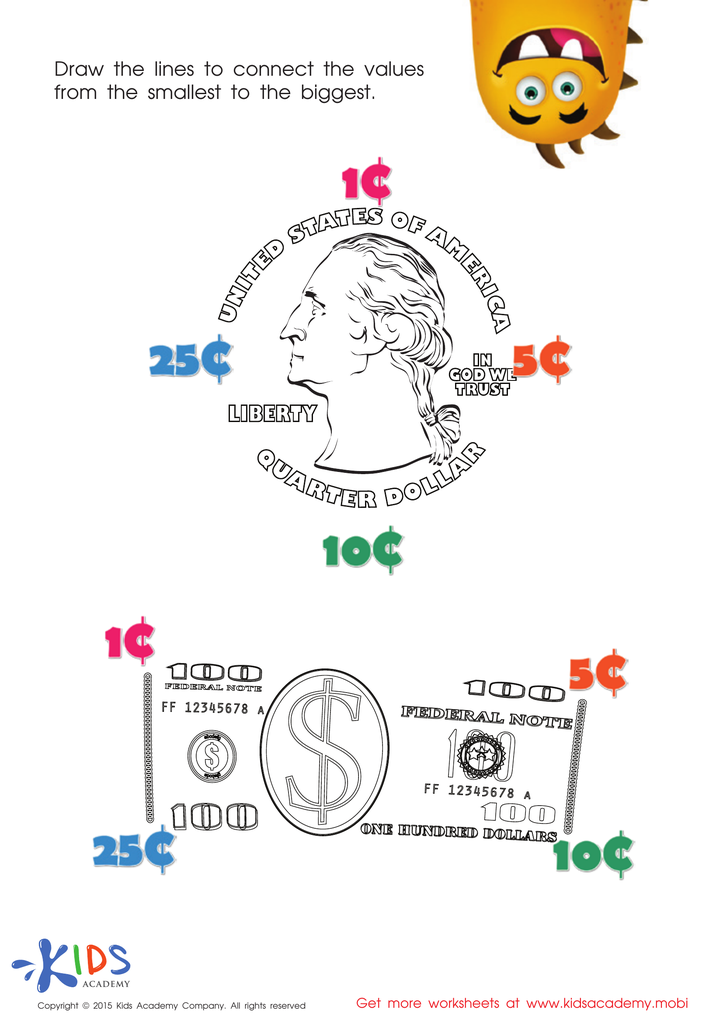

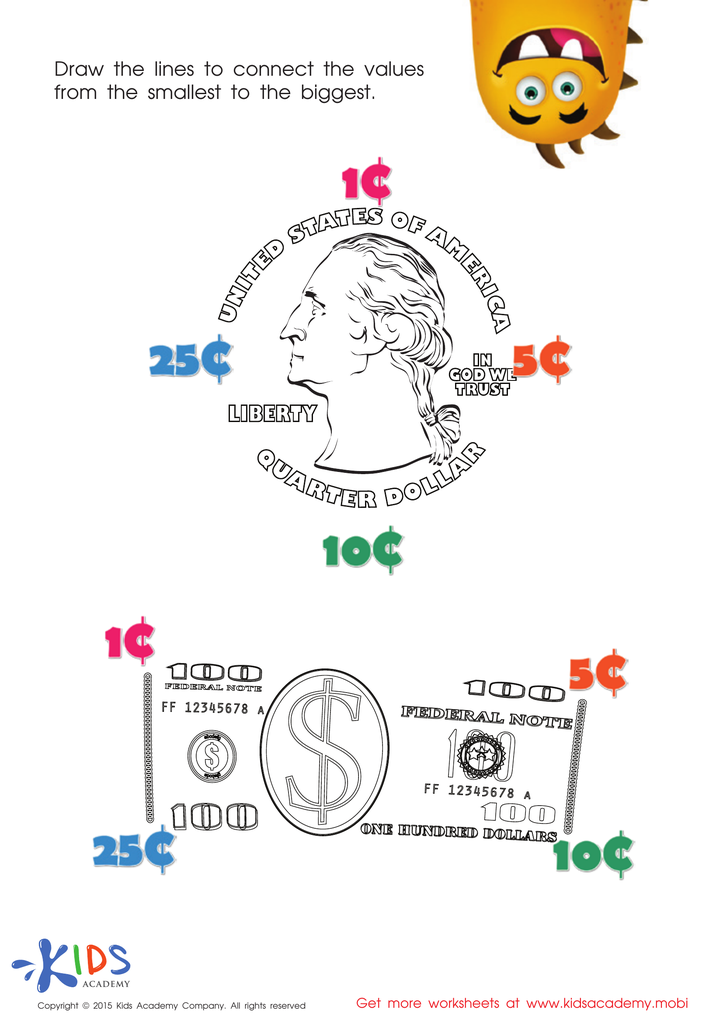

Connecting the Values Money Worksheet

How Many Coins Money Worksheet

Money: Coins Dollars Printable

Picking the Coins You Need Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Counting practice with money is a fundamental skill that benefits children in myriad ways and should be a priority for both parents and teachers. Firstly, money management is an essential life skill; learning to count money fosters an understanding of basic arithmetic, which is crucial for everyday transactions. This competency not only enhances mathematical skills but also promotes confidence in handling real-world financial situations, setting children up for future success.

Moreover, counting money helps develop critical reasoning and decision-making abilities. As children engage in activities that involve making change or budgeting for purchases, they learn to evaluate options, think strategically, and make informed choices. These skills translate beyond financial literacy and encourage thoughtful problem solving in various aspects of life.

Additionally, counting money provides opportunities for practical learning experiences. Parents and teachers can create engaging scenarios where children can practice counting coins or bills, reinforcing lessons in a fun and interactive manner. This hands-on approach makes abstract concepts tangible and memorable.

Ultimately, by prioritizing counting practice with money, parents and teachers nurture responsible, financially savvy individuals who are well-prepared to navigate the complexities of financial life. It’s about equipping the next generation with confidence and capability in managing their fiscal responsibilities.

Assign to My Students

Assign to My Students